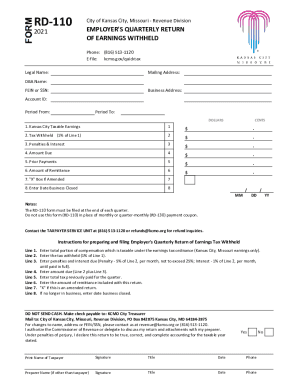

Locate industry-specific Pay stub with calculator Canada Forms and stay compliant with local and international regulations. Modify, complete, and safely store your forms without switching between profiles.

Your workflows always benefit when you can obtain all the forms and files you may need on hand. DocHub offers a huge selection of forms to relieve your daily pains. Get a hold of Pay stub with calculator Canada Forms category and quickly find your form.

Begin working with Pay stub with calculator Canada Forms in several clicks:

Enjoy seamless document managing with DocHub. Explore our Pay stub with calculator Canada Forms collection and get your form right now!