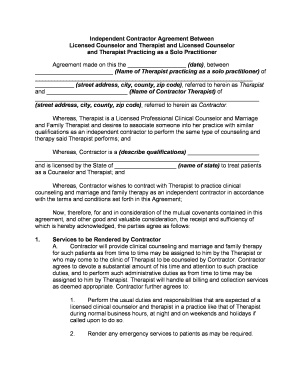

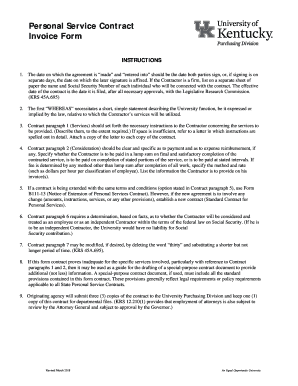

Simplify your common processes with Independent contractor agreement Canada Forms. Access, adjust, and share forms online with DocHub extensive document management features.

Your workflows always benefit when you can easily find all the forms and documents you may need at your fingertips. DocHub provides a a huge collection of forms to relieve your daily pains. Get hold of Independent contractor agreement Canada Forms category and quickly browse for your form.

Start working with Independent contractor agreement Canada Forms in a few clicks:

Enjoy effortless file managing with DocHub. Explore our Independent contractor agreement Canada Forms online library and discover your form today!