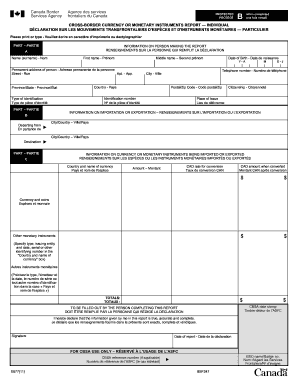

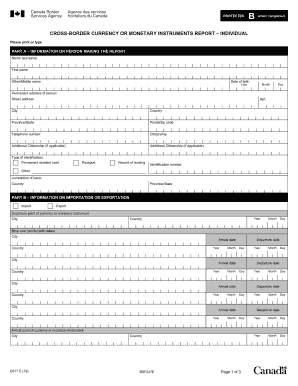

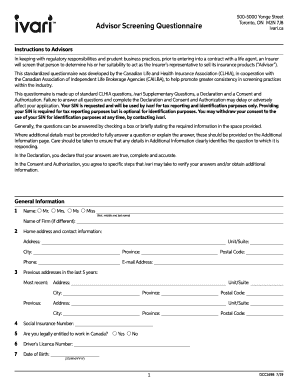

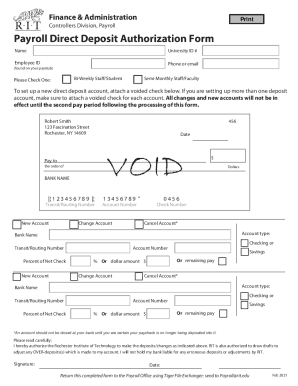

Obtain up-to-date Cheque Canada Forms and effortlessly manage them according to your requirements. Adjust, complete, and safely share your documents with local authorities.

Your workflows always benefit when you can easily find all the forms and documents you may need at your fingertips. DocHub gives a a large collection document templates to ease your day-to-day pains. Get hold of Cheque Canada Forms category and quickly browse for your form.

Begin working with Cheque Canada Forms in several clicks:

Enjoy smooth file administration with DocHub. Check out our Cheque Canada Forms collection and locate your form right now!