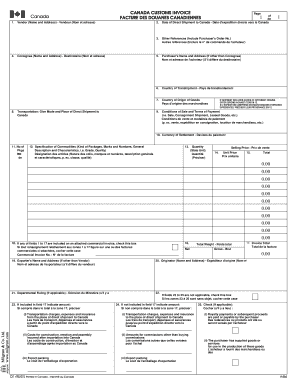

Get relevant Business invoice Canada Forms and effortlessly manage them according to your requirements. Edit, fill out, and firmly send your documents with local authorities.

Boost your file managing using our Business invoice Canada Forms online library with ready-made form templates that suit your requirements. Get your document template, edit it, fill it, and share it with your contributors without breaking a sweat. Start working more efficiently together with your forms.

The best way to use our Business invoice Canada Forms:

Explore all the possibilities for your online file administration with our Business invoice Canada Forms. Get your totally free DocHub profile right now!