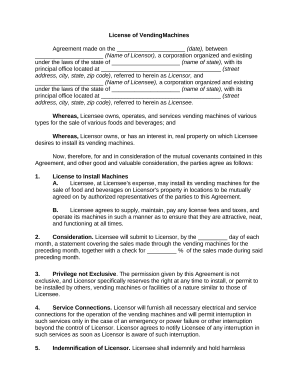

Navigate and locate the needed Vending Business Forms. Safely adjust, distribute, and cooperate with your team for a more streamlined document management process.

Your workflows always benefit when you can easily locate all the forms and documents you will need on hand. DocHub delivers a huge selection of documents to ease your everyday pains. Get hold of Vending Business Forms category and quickly find your document.

Start working with Vending Business Forms in several clicks:

Enjoy effortless record administration with DocHub. Explore our Vending Business Forms online library and discover your form right now!