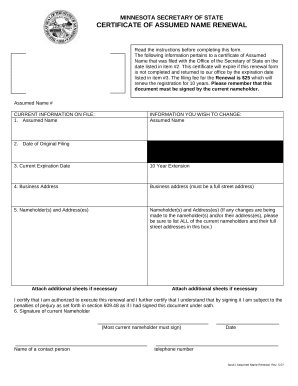

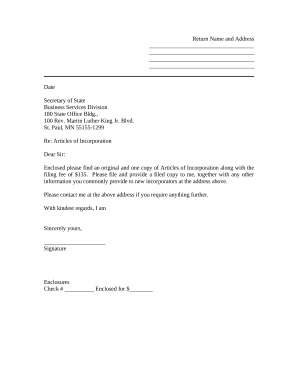

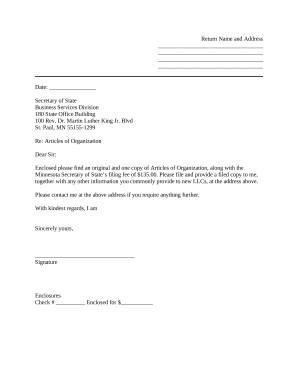

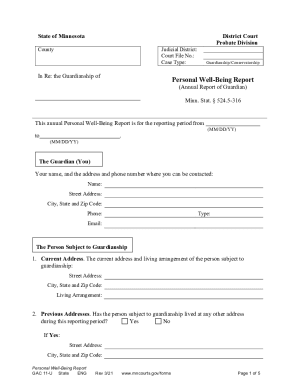

Select from a selection of ready-made Minnesota secretary of state Business Forms and keep the workflow on the right track. Ensure your forms and documents are professional and compliant with DocHub.

Improve your file management with our Minnesota secretary of state Business Forms collection with ready-made form templates that suit your requirements. Get the document template, modify it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively with the forms.

How to use our Minnesota secretary of state Business Forms:

Examine all the possibilities for your online document administration with our Minnesota secretary of state Business Forms. Get a totally free DocHub account right now!