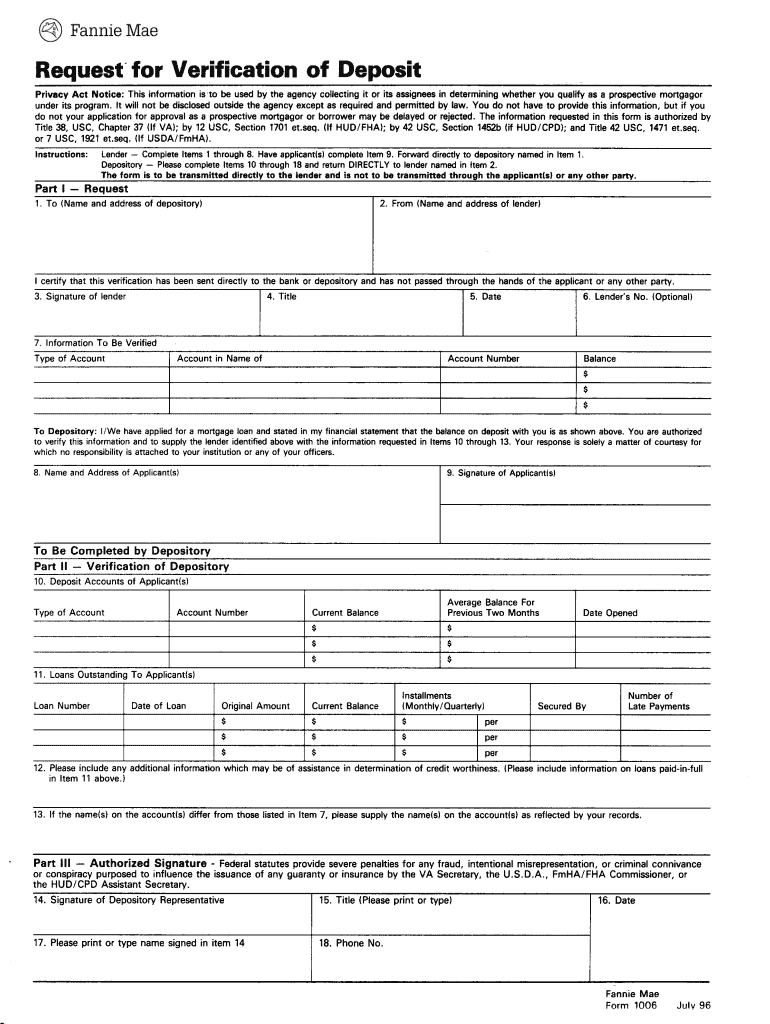

Definition & Meaning

The verification of deposit form is a document utilized primarily by financial institutions and lenders to confirm the legitimacy and accuracy of a borrower's bank deposits. This form serves as a proof of deposit, typically requested during loan applications, especially for mortgages, where creditors seek to verify the financial standing of the applicant. It outlines the account type, balance, and transaction history, granting lenders a clear picture of the applicant's financial health. Accurate completion of this form is crucial, as it can influence loan approval and terms.

The verification of deposit form is often specific to individual lenders or institutions and can vary in format. However, its purpose remains consistent: to provide reliable and verifiable financial information. This is essential for mitigating risk for lenders and ensuring borrowers are financially capable of maintaining loan obligations.

Key Elements of the Verification of Deposit Form

Understanding the vital components of the verification of deposit form is essential for both lenders and borrowers. The following elements are commonly included:

-

Account Information:

- This section typically contains the account holder's name, account number, and type of account (checking, savings).

-

Deposit Details:

- The form will detail current balances and the length of time the account has been held.

-

Transaction History:

- A brief overview of recent transactions may be included to provide insight into cash flow patterns and spending habits.

-

Lender Information:

- Details of the requesting lender, including their name and contact information, to facilitate direct communication.

-

Signature and Authorization:

- A section for the account holder's signature authorizing the institution to release the requested financial information to the lender.

These elements must be accurately completed to ensure the integrity of the verification process.

Steps to Complete the Verification of Deposit Form

Completing the verification of deposit form requires careful attention to detail. Here are the sequential steps typically involved:

-

Identify the Lender:

- Obtain the specific form or template required by your lender as formats may differ.

-

Gather Required Information:

- Collect necessary details about your bank account, including the account number and current balance.

-

Fill in Your Information:

- Accurately input your full name, address, and contact details along with the requested account information.

-

Review Deposit History:

- Provide a snapshot of recent transactions if necessary, focusing on stability and regular deposits.

-

Sign and Date the Form:

- Ensure to sign and date the document as required, thereby allowing the bank to process your request.

-

Submit the Form:

- Send the completed verification of deposit form to your bank, which will then process and return it to the requesting lender.

By following these steps, borrowers can streamline the process and help ensure a positive response from their lender.

Who Typically Uses the Verification of Deposit Form

The verification of deposit form is commonly used in various financial contexts to assist multiple stakeholders, including:

-

Lenders:

- Banks and mortgage companies use this form to verify the financial status of borrowers during the application process.

-

Borrowers:

- Individuals seeking loans or mortgages need to submit this form as part of their documentation to prove financial stability.

-

Account Holders:

- Those who require an official statement of their deposits for personal or business matters may request the completion of this form from their bank.

-

Financial Advisors and Accountants:

- Professionals may utilize the form to assess the financial standing of their clients and provide guidance on creditworthiness.

The wide utilization of this form underscores its importance in the lending and banking industries.

Why You Should Use the Verification of Deposit Form

Utilizing the verification of deposit form brings numerous benefits to both lenders and borrowers, including:

-

Enhanced Credibility:

- This form establishes trust between the lender and the borrower by providing verified financial data.

-

Streamlined Loan Applications:

- Having a completed verification of deposit form can expedite the loan approval process, reducing delays.

-

Financial Transparency:

- By disclosing relevant financial details, it enables lenders to make informed decisions and helps borrowers demonstrate their financial responsibility.

-

Protection Against Fraud:

- Verification processes ensure that the information provided by borrowers is authentic, minimizing risks associated with lending.

Recognizing the importance of this form can empower borrowers during the lending experience while protecting lenders from financial pitfalls.