Definition and Purpose of BIR Form 2316

BIR Form 2316, officially known as the Certificate of Compensation Payment/Tax Withheld, is a document issued by employers in the Philippines. It serves multiple purposes, primarily acting as proof of the compensation received by an employee and the corresponding taxes withheld throughout a specific fiscal year. This form consolidates crucial information related to an employee's income and tax deductions, providing transparency and clarity regarding their financial standing with the Bureau of Internal Revenue (BIR).

- Tax Compliance: BIR Form 2316 contributes to ensuring that employees comply with local tax laws, particularly during tax season. It summarizes all income received from employment and the taxes that have been withheld, which is vital for accurately filing annual income tax returns.

- Documentation for Employees: Employees often use this form when filing their Income Tax Returns (ITR), as it provides official confirmation of the compensation they received and the taxes deducted by their employer.

Understanding the significance of this form is essential for employees and employers, especially when verifying income or preparing for financial transactions that necessitate a clear illustration of compensation and tax withholdings.

How to Obtain BIR Form 2316

Acquiring BIR Form 2316 can be straightforward for employees. Here are steps for obtaining it:

- Contact Your Employer: The primary method to obtain the BIR Form 2316 is to request it directly from your employer's human resources or payroll department. It is typically provided at the end of the fiscal year or upon termination of employment.

- Online Access: Some employers may provide access to BIR Form 2316 through their employee portals or websites. It's advisable to check these digital resources for instant access.

- Regular Mail: Employers are required to issue the form to their employees via postal mail if electronic means are not available.

Additional Ways to Access the Form Online

For those who may need earlier versions of the form or require a blank copy, the BIR's official website often allows for downloads:

- BIR Official Website: Use the search feature to find BIR Form 2316 in PDF or downloadable formats.

- Tax Preparation Software: Certain software programs that support tax preparation may include templates for BIR Form 2316, facilitating completion.

Required Information on BIR Form 2316

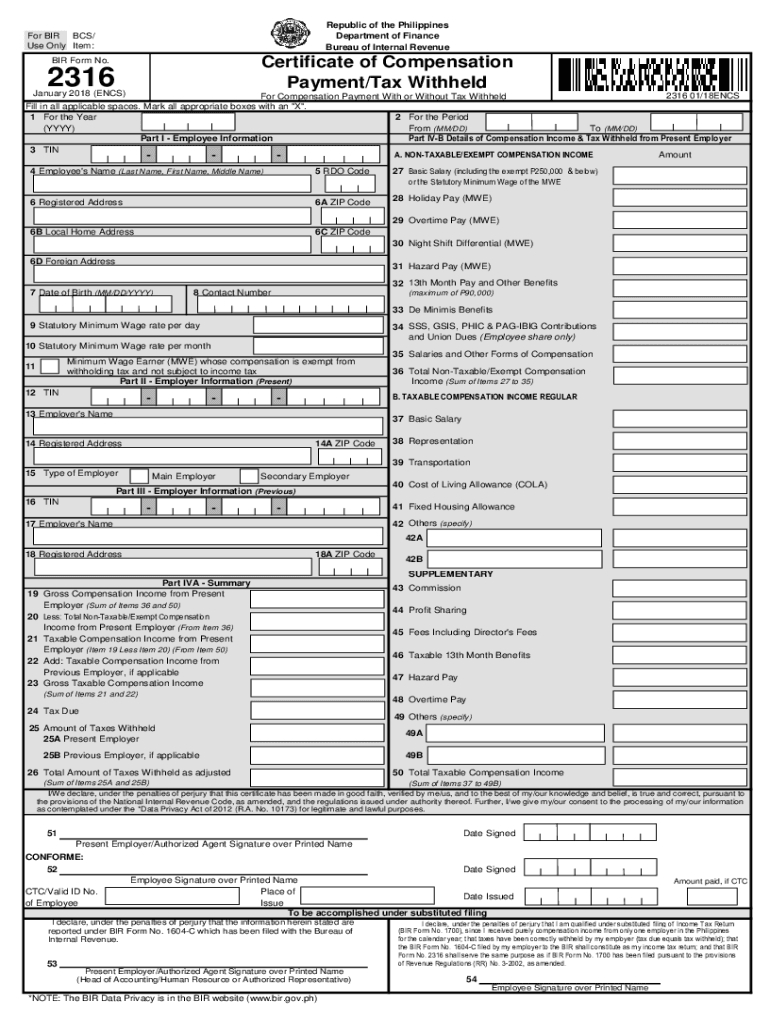

BIR Form 2316 contains essential details regarding the employee's compensation and tax information. The sections of the form typically include:

- Employee Information: This includes the employee's name, Tax Identification Number (TIN), and other personal details necessary to identify the individual.

- Employer Information: The name, TIN, and address of the employer or business entity must be clearly indicated, ensuring accountability and clear documentation of the employment relationship.

- Compensation Details: The total amount of compensation the employee received during the year, categorized as taxable and non-taxable income, must be detailed.

- Tax Withheld: A separate section outlines the total amount of tax withheld throughout the year, which is essential for tax returns.

This comprehensive layout ensures that both employees and employers maintain accurate records for tax purposes.

Important Deadlines and Filing Obligations

Timeliness is essential when dealing with BIR Form 2316. The following deadlines and obligations should be noted:

- Submission Deadline: Employers are required to issue BIR Form 2316 to their employees by the end of January for the previous tax year.

- Filing Tax Returns: Employees must incorporate the information from BIR Form 2316 when filing their annual Income Tax Returns, with the deadline typically falling on April 15 of the following year.

- Retaining Copies: Both employers and employees should retain copies of BIR Form 2316 for their records, which may be necessary in case of audits or reviews by the BIR.

Staying aware of these deadlines helps ensure compliance with Philippine tax regulations and minimizes the risk of penalties associated with late submissions.

Consequences of Non-Compliance

Understanding the penalties associated with BIR Form 2316 is crucial for both employers and employees:

- For Employers: Failure to issue BIR Form 2316 can result in fines, and employers may be held liable for any unpaid taxes withheld from employee salaries. This non-compliance may also affect the employer's credibility and standing with tax authorities.

- For Employees: Employees who do not receive their BIR Form 2316 for properly filed returns may face challenges when submitting their ITR. This could result in penalties for incorrect filings or disputes regarding tax obligations.

Awareness of these consequences emphasizes the importance of compliance and maintaining accurate documentation.

Potential Variants of BIR Form 2316

BIR Form 2316 has variants primarily based on the nature of employment or changes in tax regulation:

- Revised Versions: The BIR occasionally updates Form 2316 to comply with new tax laws or regulations. Employees should ensure they have the latest version when filing.

- Specific Employer Variants: Some organizations may issue customized versions of BIR Form 2316 for employees, particularly in unique contractual arrangements or employment types.

Understanding these variants can help both employers and employees navigate occasional discrepancies in forms and tax obligations.