Definition & Meaning of the Sales Tax Exempt Certificate

A sales tax exempt certificate is a formal document that allows qualifying buyers to make purchases without paying sales tax. This certificate is typically utilized by organizations or individuals who purchase goods or services for resale or certain exempt purposes. Each state in the U.S. has its own regulations governing the use and issuance of these certificates, which can differ in format and terminology.

This certificate serves as proof that the buyer is exempt from sales tax—common examples include non-profit organizations, governmental agencies, and certain educational institutions. When a vendor receives an exemption certificate from a buyer, they are permitted to refrain from charging sales tax on the transaction, thus facilitating the resale process.

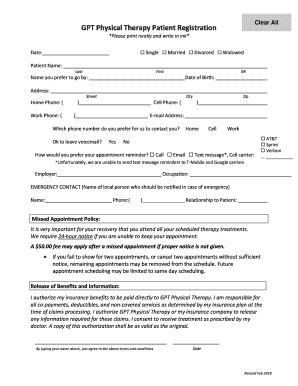

How to Use the Sales Tax Exempt Certificate

Using a sales tax exempt certificate involves several key steps to ensure that the transaction qualifies for exemption.

- Present the Certificate: Buyers must provide the sales tax exempt certificate to the vendor at the time of purchase. This document must be properly filled out and signed to validate the tax-exempt status.

- Keep Records: Vendors should keep a copy of the certificate on file, which provides documentation in case of an audit.

- Specify Exempt Purchases: The buyer should indicate the specific items or services that qualify for exemption. This clarity ensures compliance with state laws and minimizes any potential disputes.

For example, a non-profit organization purchasing a computer for educational purposes would present a sales tax exempt certificate issued by their state. This allows the organization to buy the computer without incurring sales tax.

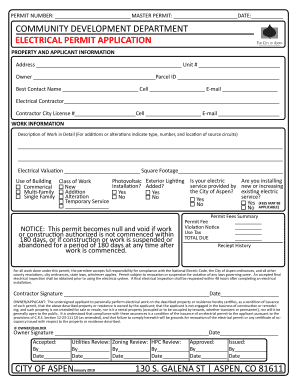

Steps to Complete the Sales Tax Exempt Certificate

Completing a sales tax exempt certificate requires attention to detail to ensure accuracy and compliance with state regulations.

- Obtain the Correct Form: Identify the appropriate certificate of exemption form as dictated by the state in which the purchase is being made.

- Fill Out Buyer Information: Include the purchaser’s name, address, and tax identification number, which is often a requisite for completing the form.

- Declare Exempt Status: The buyer must specify the reason for tax exemption, such as a non-profit status or reselling goods.

- List Exempt Items: Clearly outline the goods or services being purchased that qualify for tax exemption.

- Sign and Date the Certificate: Ensure that the certificate is signed by an authorized representative of the buying entity to validate its use.

These steps form the basis of correctly completing a sales tax exempt certificate. For instance, in the construction industry, a contractor purchasing materials for a tax-exempt project would complete the form with relevant information before presenting it to the supplier.

Legal Use of the Sales Tax Exempt Certificate

Understanding the legal usage of a sales tax exempt certificate is essential for both buyers and sellers to avoid unwanted tax liabilities.

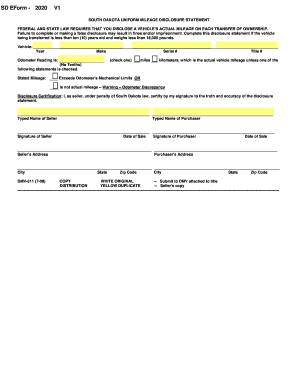

- Validity of the Certificate: The certificate must be valid under state law, including being properly completed with up-to-date information.

- Permissible Purchases: The items or services purchased under the certificate must align with the exemption qualifications outlined by the state.

- Proper Documentation: Businesses should ensure adequate record-keeping practices are followed. This documentation can serve as evidence during audits and help defend against non-compliance claims.

Improper use of a sales tax exempt certificate—such as using it for ineligible purchases—can lead to penalties, including fines or back taxes owed. For example, if a non-profit organization incorrectly uses the certificate to purchase office supplies not related to their exempt purpose, they could be held liable for sales tax on that purchase.

Examples of Using the Sales Tax Exempt Certificate

Sales tax exempt certificates find application across various industries and scenarios, highlighting their versatility and importance in transactions.

- Non-Profit Organizations: A charity purchasing furniture for their office can use a sales tax exempt certificate to save on costs associated with sales tax.

- Wholesalers and Retailers: A retailer sourcing products from a wholesaler for resale would present a sales tax exempt certificate, thus avoiding tax on those goods.

- Government Purchases: Local government agencies purchasing vehicles or equipment for public use can use the certificate to avoid unnecessary tax expenses.

These examples illustrate how using a sales tax exempt certificate can lead to substantial savings for qualifying entities while ensuring compliance with relevant tax laws.

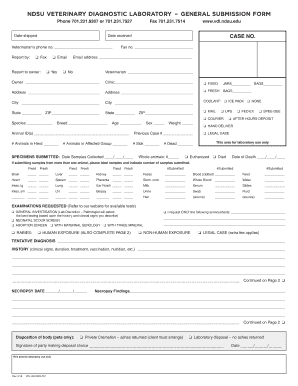

Important Terms Related to Sales Tax Exempt Certificate

Understanding the terminology surrounding sales tax exempt certificates is vital for accurately navigating the tax landscape.

- Certificate of Exemption Form: A standardized document that verifies a buyer's tax-exempt status for specific purchases.

- Sales Tax Liability: The obligation to pay sales tax on taxable purchases, which can be avoided when using a valid exempt certificate.

- Vendor Responsibility: The requirement for vendors to collect and remit sales taxes — unless a valid exemption certificate is presented by the buyer.

- Exempt Use Certificate: A specific type of sales tax exempt certificate that confirms items purchased will be used in a manner qualifying for exemption.

Awareness of these terms can aid stakeholders in properly leveraging sales tax exemptions while remaining compliant with state requirements. For example, understanding vendor responsibility is crucial for businesses to avoid unexpected tax liabilities when failing to collect taxes on exempt sales.