Definition & Meaning

A Personal Financial Statement is a document that provides a detailed breakdown of an individual's financial status. It typically includes a comprehensive list of assets, liabilities, income, and expenses. Vantage Bank Texas uses this form to assess an individual's financial health when evaluating credit applications or considering loans. Understanding the definition of this form is crucial for individuals to accurately present their financial conditions to the bank.

The primary goal of the Personal Financial Statement is to present a clear picture of an individual's financial standing. This includes all financial obligations, assets owned, and income streams. By completing this form, individuals can provide Vantage Bank Texas with the necessary information to make informed decisions regarding financial products and services.

How to Use the Personal Financial Statement - Vantage Bank Texas

Using the Personal Financial Statement from Vantage Bank Texas involves accurately filling out each section of the form. Begin by gathering all relevant financial information, such as bank statements, loan documents, and income records. The form typically requires details on:

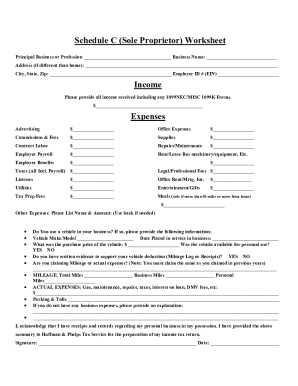

- Assets: List all assets, including real estate, vehicles, bank accounts, investments, and personal property.

- Liabilities: Note down all debts, including mortgages, credit card balances, loans, and any other financial obligations.

- Income: Provide details on all sources of income, including salary, bonuses, rental income, and investments.

- Expenses: Document monthly expenses, including utilities, groceries, transportation, and other regular outgoings.

Once all information is collected, fill out the form carefully, ensuring all entries are accurate and up-to-date. This thoroughness is crucial for providing a truthful representation of one’s financial situation.

How to Obtain the Personal Financial Statement - Vantage Bank Texas

Individuals can obtain the Personal Financial Statement form directly from Vantage Bank Texas. This can be done by visiting a local branch, calling customer service, or downloading the form from the bank’s official website. It may also be available through online banking portals for existing customers. Ensuring you have the most current version of the form is essential as forms are updated periodically.

There are instances where financial advisors or loan officers at Vantage Bank Texas can assist in obtaining the necessary form. They can provide guidance and clarity on any questions regarding the form’s requirements.

Steps to Complete the Personal Financial Statement - Vantage Bank Texas

-

Download or acquire the form: Ensure you have the most recent version of the Personal Financial Statement form from Vantage Bank Texas.

-

Gather financial documents: Collect all required documents and statements related to your financial assets and liabilities.

-

Fill out personal information: Start with entering your personal details, including name, address, and contact information.

-

Detail assets and liabilities: Accurately fill in the sections detailing all assets owned and liabilities owed. Provide breakdowns where necessary.

-

Input income and expenses: Record all sources of income and regular monthly expenses to give a complete financial overview.

-

Review and double-check entries: Before submitting, verify all entered information for accuracy to prevent errors that could affect assessments.

-

Submit the completed form: Send the form to Vantage Bank Texas using the submission methods provided, which might include mail, in-person delivery, or online submission.

Who Typically Uses the Personal Financial Statement - Vantage Bank Texas

The Personal Financial Statement is predominantly used by individuals applying for personal loans, mortgages, or credit lines with Vantage Bank Texas. It is essential for potential borrowers who need to provide a comprehensive view of their financial health. Business owners seeking loans or lines of credit may also use this form, especially if personal financial standing impacts business credit assessments.

Individuals engaged in financial planning may also use this form to understand their financial situation better, even if not actively applying for credit or loans at the time.

Important Terms Related to Personal Financial Statement - Vantage Bank Texas

Understanding certain terms within the Personal Financial Statement can aid in accurately completing the form:

- Assets: Items of value owned by an individual, including cash, stocks, real estate, and personal property.

- Liabilities: Financial obligations or debts owed, such as loans, credit card debt, and mortgages.

- Net Worth: The difference between total assets and total liabilities.

- Fixed Expenses: Regular, unchanging monthly payments, like rent or mortgage.

- Variable Expenses: Payments that fluctuate monthly, such as groceries and utilities.

These terms help clarify the information required, ensuring an accurate reflection of one's financial status.

Required Documents

Filling out the Personal Financial Statement requires supporting documentation to verify the information provided. Essential documents typically include:

- Recent bank statements for all accounts.

- Mortgage, loan, and credit card statements showing outstanding balances.

- Tax returns for recent years to confirm income details.

- Documents related to investments, stocks, or bonds.

- Any existing financial agreements or contracts.

Having these documents on hand ensures all entered details are current and accurate, providing Vantage Bank Texas with a precise financial picture.

Form Submission Methods

Individuals can submit the Personal Financial Statement to Vantage Bank Texas in several ways:

- Online Submission: Some platforms allow for the completion and submission of forms electronically, which is convenient and immediate.

- Mail: Physical forms can be mailed directly to Vantage Bank Texas, ensuring all documents are included.

- In-Person: Visiting a local branch to submit the form can provide an opportunity for immediate feedback or inquiry assistance from bank staff.

Choosing a preferred submission method based on convenience and immediate needs is crucial for a smooth process.