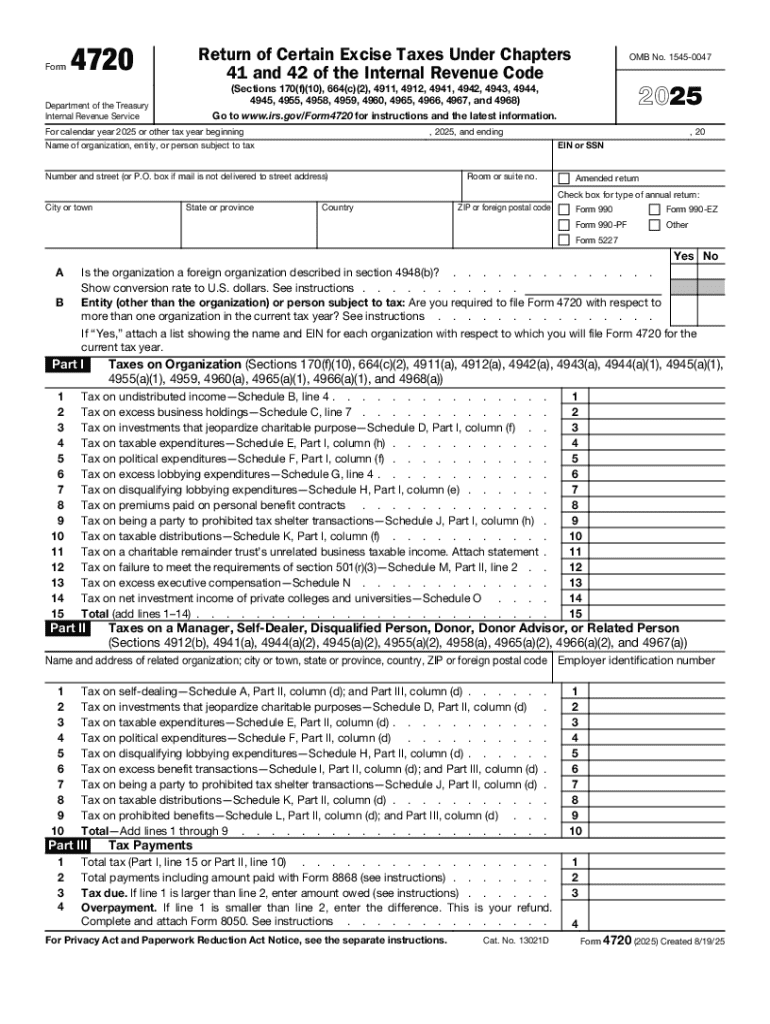

Definition and Purpose of 2025 Form 4720

The 2025 Form 4720, known officially as the "Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code," is essential for identifying and reporting excise taxes imposed on specified activities by organizations and individuals in accordance with the Internal Revenue Code. This form primarily addresses taxes related to specific provisions such as private foundation transactions, excess contributions to public charities, and political expenditures. It ensures compliance with IRS regulations by enforcing tax obligations for certain organizational decisions and transactions.

Key Excise Taxes Covered

- Private Foundation Excise Taxes: Includes taxes on self-dealing, failure to distribute income, excess business holdings, jeopardy investments, and taxable expenditures.

- Political Expenditures: Imposes taxes on political contributions made by tax-exempt organizations.

- Public Charity Excess Contributions: Applies excise taxes on excess contributions carried forward that surpass donor limits.

Steps to Complete the 2025 Form 4720

Completing the 2025 Form 4720 requires meticulous attention to detail to ensure compliance with IRS mandates. Below are the fundamental steps involved:

- Gather necessary documents: Collect all relevant documents related to the excise taxes reported, such as financial records and organizational documents.

- Identify applicable sections: Determine which specific taxes apply to your scenario using the instructions provided with the form.

- Fill out personal and organizational information: Enter your identifying details, including name, address, and Employer Identification Number (EIN).

- Calculate potential excise taxes: Use the form’s worksheets to compute the taxes for applicable excise tax categories.

- Review your calculations: Ensure accuracy by double-checking figures and ensuring calculations align with supporting documents.

- Sign and date the form: The form must be signed by an authorized individual to validate the information provided.

Common Errors to Avoid

- Misreporting amounts or miscalculating taxes due

- Failing to attach required schedules or documentation

- Overlooking applicable sections relevant to your organizational activities

Who Typically Uses the 2025 Form 4720

The 2025 Form 4720 is primarily used by private foundations, nonprofit organizations, and certain individuals who may become liable for excise taxes under chapters 41 and 42 of the Internal Revenue Code. This includes organizations such as:

- Private foundations: Required to report taxes on self-dealing or failing to distribute income adequately.

- Public charities: That must address taxes related to excess contributions.

- Political organizations: Subject to excise taxes for specific political expenditures.

In addition, individuals associated with these organizations, such as trustees or managers, might also need to report personal liabilities related to these taxes.

Important Terms Related to 2025 Form 4720

Understanding the terminology related to the Form 4720 is crucial for accurately completing the form. Below are key terms often encountered:

- Self-dealing: Involves transactions between a private foundation and its substantial contributors or key insiders that might incur excise taxes.

- Excess business holdings: Relates to ownership percentages exceeding allowed limits for private foundations in business enterprises.

- Jeopardy investment: Refers to investments that risk the charity’s exempt purpose and can lead to excise taxes.

Examples in Context

- A private foundation enters into a loan agreement with a disqualified person, potentially triggering self-dealing excise taxes.

- Donations exceeding donor limits over a specified period in a public charity result in excess contributions that are taxable.

Filing Deadlines and Important Dates

Meeting filing deadlines for the 2025 Form 4720 is crucial to avoid penalties and interest. Typically, the form must be filed by the 15th day of the fifth month following the end of the organization’s fiscal year.

Extensions and Penalties

- Extensions: Organizations may file Form 8868 to request an extension, delaying the due date by an additional six months.

- Penalties: Fines may be imposed for late filing and failure to include required financial documentation. Ensuring compliance with deadlines is key to avoiding these repercussions.

Digital vs. Paper Version

The 2025 Form 4720 is available in both digital and paper formats, offering flexibility depending on user preference and capacity:

- Digital Filing: Preferred for faster processing and ease of service. It accommodates online submissions along with real-time acknowledgment of receipt.

- Paper Filing: Suitable for entities without reliable access to digital resources, though it involves longer processing times and manual notification of submission.

Software Compatibility

The digital version is compatible with various tax software programs, such as TurboTax and QuickBooks, facilitating efficient data entry and electronic filing. This compatibility enhances accuracy by integrating directly with your financial systems.

Penalties for Non-Compliance

Failure to comply with the 2025 Form 4720 requirements can result in multiple penalties, stressing the importance of adherence:

- Late Filing Penalties: Imposed on organizations that miss filing deadlines, these penalties accrue over time.

- Underpayment or Misreporting: Incorrectly reporting excise taxes can result in fines and interest; organizations must ensure reporting accuracy.

- Fraudulent Filing: Severe penalties, including criminal charges, may be applied where intentional misrepresentation is discovered.

IRS Guidelines

The IRS provides specific guidelines and instructions for accurately completing the 2025 Form 4720. Key considerations include:

- Accuracy of Information: Double-check all entries for precision and completeness.

- Required Attachments: Include all necessary schedules and supplemental documents as specified.

- Compliance with Other Forms: Ensure that related forms are also completed when applicable to the taxpayer's situation.

Additional Resources

- IRS Publication 557 provides a comprehensive overview of tax-exempt organizations, including excise tax obligations.

- Consult an IRS representative or a tax professional for guidance tailored to your specific situation and organization.