Definition and Meaning

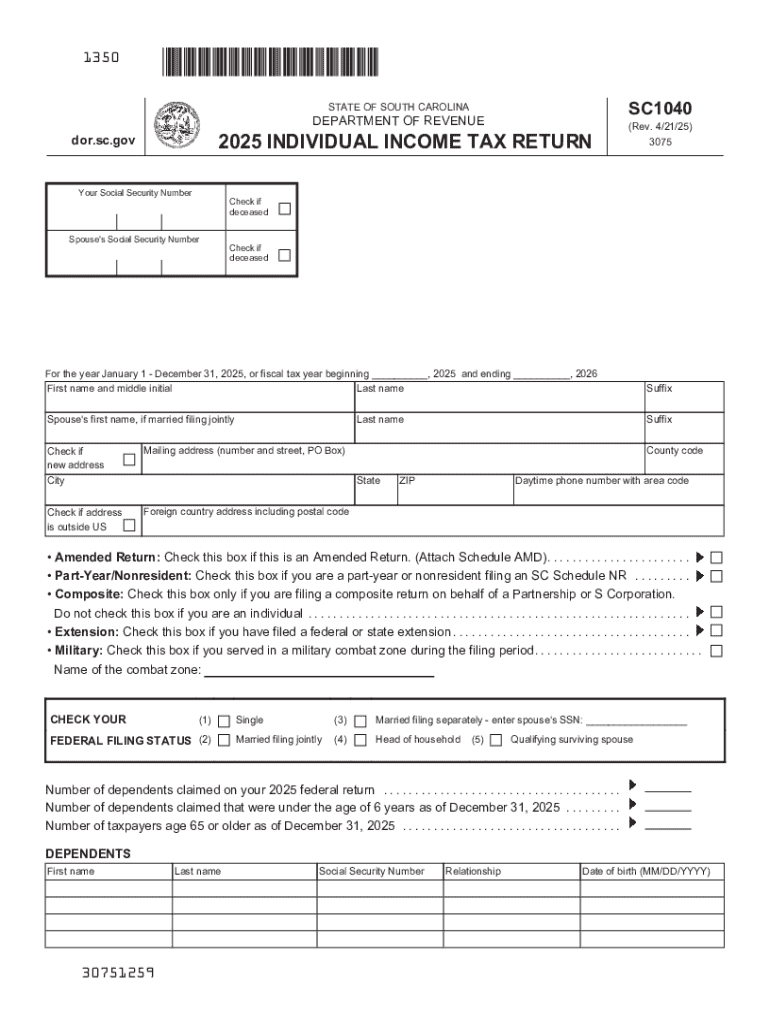

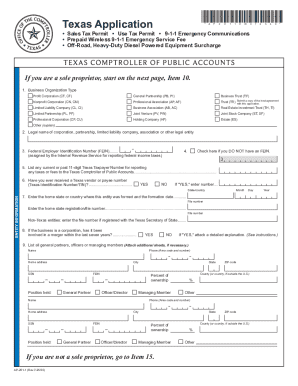

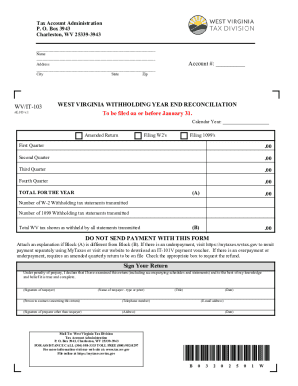

The "2025 Individual Income Tax Return" refers to the official tax form used by individuals in the United States to report their income, calculate their tax liability, and determine any refunds or payments due for the tax year 2025. This form is essential for the Internal Revenue Service (IRS) to assess the taxes individuals owe based on their income, deductions, credits, and filing status. This form typically includes sections for income sources, allowable deductions, and any eligible tax credits.

Key Components

- Income Reporting: This section requires the detailed listing of all sources of income, including wages, self-employed earnings, interest, dividends, and other income streams.

- Deductions and Credits: Filers can claim deductions and credits that may reduce their taxable income, such as the standard deduction, itemized deductions, or specific tax credits like the Child Tax Credit or Education Credits.

- Filing Status: Individuals must select the applicable filing status, such as Single, Married Filing Jointly, or Head of Household, which can impact tax rates and eligible deductions.

How to Use the 2025 Individual Income Tax Return

Using the 2025 Individual Income Tax Return form involves gathering necessary documents, accurately filling out the required fields, and submitting it to the IRS by the deadline. Individuals must ensure all income and tax-exempt earnings are reported correctly.

Steps for Accurate Use

- Gather Documents: Collect income statements (W-2, 1099 forms), deduction receipts, and credit-related documentation.

- Complete Income Sections: Enter all relevant income details, ensuring accuracy to avoid discrepancies.

- Claim Deductions/Credits: Carefully evaluate and apply eligible deductions and credits to diminish taxable income.

- Verify Personal Data: Make sure personal information, including Social Security Number and filing status, is accurately entered.

- Review & Submit: Double-check all entries for correctness and submit the form before the filing deadline.

How to Obtain the 2025 Individual Income Tax Return

The 2025 Individual Income Tax Return can be obtained directly from the IRS website, local IRS offices, tax preparation software, or through licensed tax professionals. Ensure to choose the correct version for the filing year.

Methods to Acquire the Form

- Online: Access a downloadable PDF version from the IRS official website.

- Physical Copy: Visit an IRS office or order a copy through mail using the IRS's automated service lines.

- Software Packages: Most tax preparation software will include the latest tax forms and offer relevant guidance.

Steps to Complete the 2025 Individual Income Tax Return

Completing the tax return form involves a series of methodical steps to ensure all financial aspects are accurately reported.

Detailed Completion Process

- Personal Information: Start by filling in personal data, such as name, Social Security Number, and address.

- Filing Status Section: Indicate your filing status according to your personal circumstances.

- Income Details: List all forms of income and any non-taxable funds separately.

- Adjustments: Apply eligible adjustments to income before calculating the adjusted gross income.

- Deductions and Credits: Detail itemized or standard deductions and any credits you're eligible for.

- Calculate Tax Liability: Compute total taxes owed after applying deductions and credits.

- Sign and Date: After review, sign and date the form to validate the submission.

Why Use the 2025 Individual Income Tax Return

The 2025 Individual Income Tax Return is essential for fulfilling legal tax obligations, potentially maximizing deductions and credits, and ensuring compliance with IRS standards.

Benefits of Accurate Filing

- Legal Compliance: Complying with federal tax laws averts legal penalties or audits.

- Financial Health: Proper filing and claiming will help optimize tax refunds or minimize tax liabilities.

- Record Keeping: Maintaining a copy of the return serves as an essential record for future reference.

Important Terms Related to the 2025 Individual Income Tax Return

Understanding crucial terminology within the form aids in accurate completion.

Terms Explained

- Adjusted Gross Income (AGI): Total income minus specific deductions, influencing tax liability.

- Standard Deduction: A fixed dollar amount subtracted from income, varying by filing status.

- Tax Credit: A dollar-for-dollar reduction in tax liability, directly affecting the amount owed to the IRS.

Taxpayer Scenarios for the 2025 Individual Income Tax Return

Different taxpayer scenarios can arise depending on individual economic situations, such as employment status or retirement.

Example Situations

- Self-Employed: Must report income through self-employment schedules and estimate quarterly taxes.

- Retired Individuals: Report distributions from retirement accounts and consider unique deductions.

- Students: Can claim education credits and possibly income from part-time work.

Filing Deadlines and Important Dates

Awareness of tax deadlines is crucial for timely submission to avoid penalties.

Key Deadlines

- Annual Filing Deadline: Typically due on April 15, 2026, unless extended by circumstances or natural disasters.

- Extension Request: Filing for an extension gives until October 15, 2026, to submit the return, though taxes owed still need to be paid by the original deadline.

By understanding and following the structured path in filing the 2025 Individual Income Tax Return, taxpayers can efficiently navigate their tax obligations and benefit from due credits and deductions.