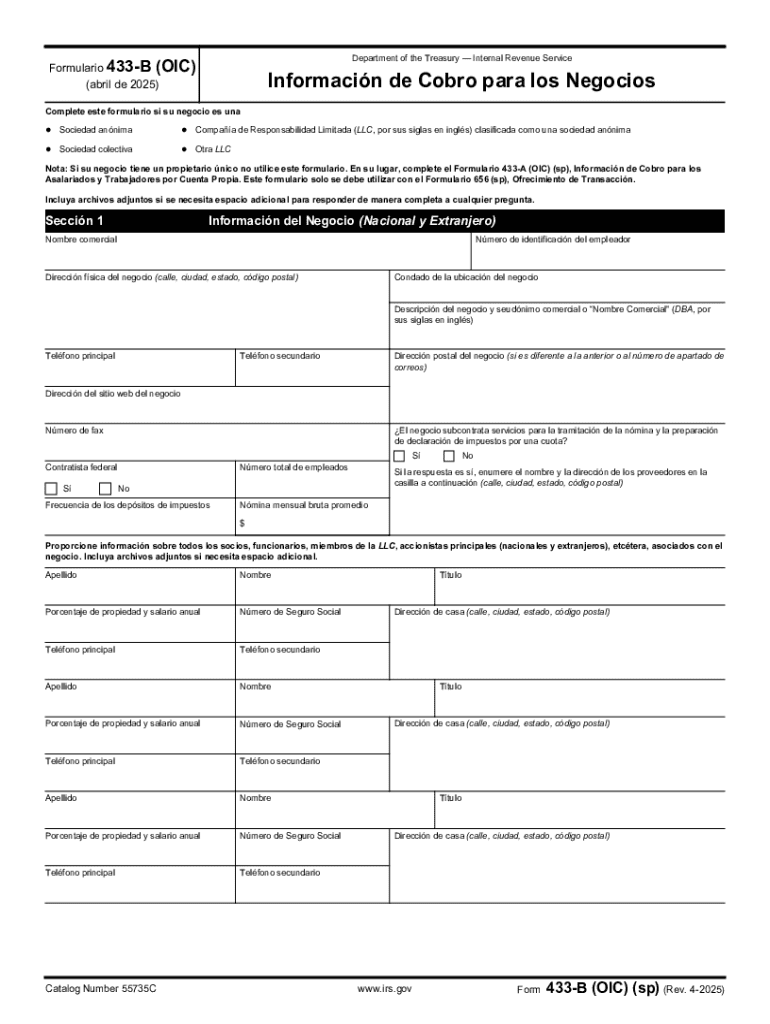

Definition & Purpose of IRS Form 433-B

IRS Form 433-B, also known as the "Collection Information Statement for Businesses," is a critical document used by businesses that owe tax debt to the Internal Revenue Service (IRS). This form provides a summary of the financial situation of a business, including assets, liabilities, income, and expenses. It assists the IRS in determining a company's ability to pay its tax liabilities, either in full or through a negotiated settlement like an installment agreement or offer in compromise. The form plays a pivotal role in documenting a business's capacity to meet its tax obligations while continuing operations.

How to Use Form 433-B Effectively

Successfully completing IRS Form 433-B requires a systematic approach:

-

Gather Financial Documents: Before beginning, gather all necessary financial and business records. This typically includes recent bank statements, details of assets, profit and loss statements, and documentation of any outstanding debts.

-

Complete the Form Sections:

- Section 1: Enter business identification information, including name, address, and Employer Identification Number (EIN).

- Section 2: Detail banking accounts and lines of credit, specifying balances and credit limits.

- Section 3: List all company assets, including accounts receivable and cash on hand.

- Section 4: Provide a comprehensive summary of business liabilities.

- Section 5: Document monthly income and expense analysis, showcasing the cash flow of the organization.

-

Review for Accuracy: Double-check all entries for accuracy to prevent delays or errors in processing.

-

Consult Professionals: It may be beneficial to consult with a tax professional or accountant to ensure thorough and accurate completion.

Steps to Obtain IRS Form 433-B

-

Download from IRS Website: The form is available on the IRS website, where it can be downloaded and printed. Look for the most recent version to ensure compliance.

-

Contact IRS Directly: Request the form through direct contact with the IRS. Their support line can provide guidance on obtaining the form.

-

Tax Professionals: Tax advisors or consultants often maintain copies of essential IRS forms, including Form 433-B, as part of their standard documentation toolkit.

Completion Process for IRS Form 433-B

-

Identify Sections: Begin by identifying each section's purpose and required information.

-

Organize Documentation: Arrange your financial documents in alignment with the form sections.

-

Input Data Accurately: Enter information in each section, ensuring clarity and precision.

-

Validate Entries: Confirm the accuracy of the data with corresponding documents.

-

Seek External Review: If possible, have a tax consultant review the form for completion errors and consistency.

-

Submit the Form: Mail to the designated IRS address provided in the form instructions, ensuring all supporting documentation is included.

Necessity of IRS Form 433-B

Completing IRS Form 433-B is crucial for businesses facing tax debt. It allows the IRS to assess a company’s financial condition and aids in negotiating terms that could lead to a more manageable payment plan. Additionally, it's essential for businesses seeking to avert severe collection actions, such as levies or liens, which could interrupt their operations.

Typical Users of IRS Form 433-B

The form is primarily used by businesses structured as corporations, partnerships, or limited liability companies (LLCs) facing IRS tax liabilities. These entities, due to their complex financial dealings, require this form to accurately reflect their financial standing.

Key Elements of IRS Form 433-B

- Business Information: Includes the business's identification and IRS account details.

- Financial Overview: In-depth analysis of the business's financial operations, addressing income, expenses, assets, and liabilities.

- Supporting Documentation: Requires accompanying documents to substantiate entries made within the form.

IRS Guidelines for IRS Form 433-B

- Intent: Used exclusively to assess financial capabilities of businesses with outstanding tax obligations.

- Submission Timing: Submit promptly to prevent enforced collection actions by the IRS.

- Privacy: Details remain confidential and are used solely for evaluating payment potential.

Filing Deadlines and Important Dates

- No Set Filing Date: Provides flexibility for businesses to gather comprehensive financial data but should be filed expediently to avoid IRS collection efforts.

- Respond Promptly: If requested by the IRS, adhere to any specified deadlines to avoid potential penalties or complications.

Required Documents for Submission

- Financial Statements: Recent balance sheets and income statements.

- Asset Documentation: Proof of business assets like vehicles, properties, and inventory.

- Liability Statements: Details of outstanding debts from creditors and lenders.

- Bank Statements: Reflecting transactions and cash flows over several months.

Form Submission Methods

- Mail: Traditional mailing to the IRS address specified in the form instructions.

- In-Person: Submission during an in-person meeting if a Revenue Officer is handling the case.

- Online Portal: While direct online submission is not typically available, related documentation and subsequent negotiations may be conducted electronically with IRS representatives.

Penalties and Compliance Requirements

Failing to complete IRS Form 433-B may lead to increased scrutiny from the IRS, additional penalties, or enforced collection measures. Maintaining compliance through timely and accurate submissions helps mitigate risks associated with tax debt scenarios.