Definition and Meaning

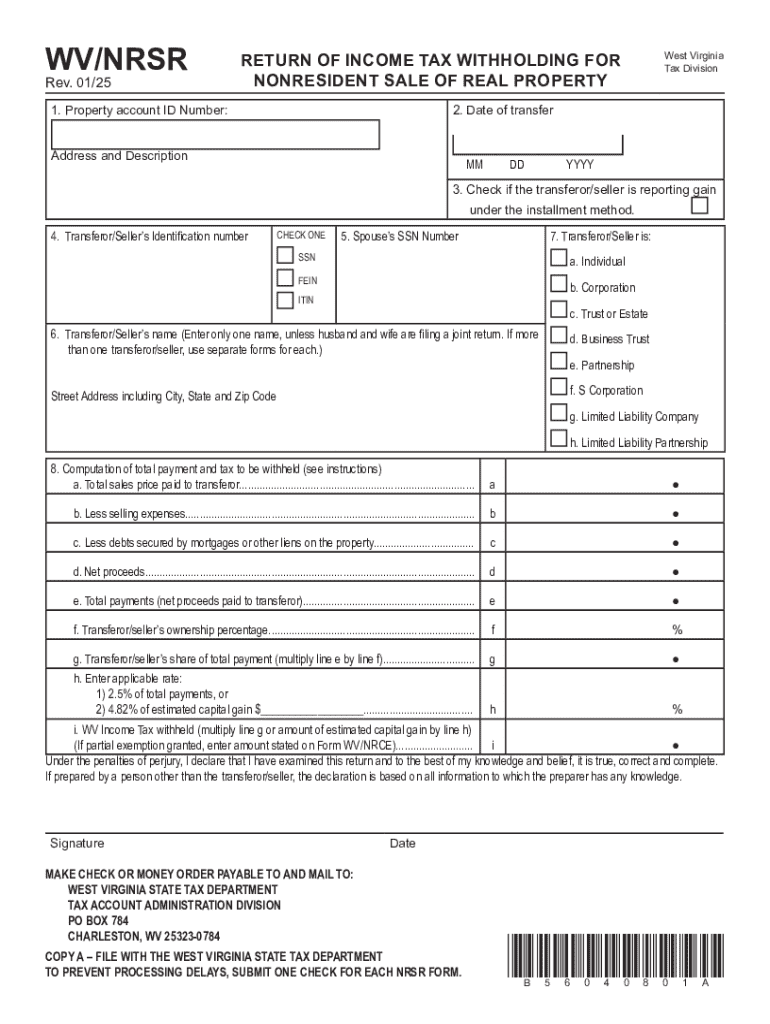

The "Return of Income Tax Withholding For" form is crucial for reporting and remitting taxes withheld from specific types of income. Often associated with real estate transactions involving nonresident sellers, this form ensures compliance with tax regulations by documenting the withheld amount from the sale proceeds, which will later be reported to the IRS.

Importance of Accuracy

- Tax Compliance: Accurate reporting on this form helps prevent legal issues and penalties associated with misreported taxes.

- Data Consistency: Ensures that the withheld amounts align with federal and state tax laws.

Practical Example

Consider a scenario where a nonresident sells property in the U.S.; they must complete this form as part of the transaction to report withholding accurately.

How to Use the Form

The usage of this form involves several steps, ensuring all required data is correctly captured and submitted.

Steps to Use

- Gather Required Information: Collect all relevant details, including the property account ID and transfer date.

- Fill Out Sections Clearly: Enter details such as the seller's and buyer's information and the tax withheld.

- Verification: Double-check all entered data for errors to ensure accuracy and completeness.

- Submission: Submit the form following the state's preferred method, which may vary between online, mail, or in-person submissions.

Detailed Example

When selling real property, the form must specify the date of transfer and account ID, ensuring all sections reflect accurate transactions.

How to Obtain the Form

Obtaining the "Return of Income Tax Withholding For" form is straightforward, yet varies based on jurisdiction.

Methods to Obtain

- Online: Many state tax division websites provide downloadable PDFs.

- In Person: Visit local tax offices to request a hard copy.

- Mail: Request a form via mail, but consider the response time varies based on location.

Online Access

Accessing the form online allows for quick downloading and filling, streamlining the preparation process.

Steps to Complete the Form

Completing the "Return of Income Tax Withholding For" form requires careful attention to detail.

Step-by-Step Process

- Identify the Property: Include the property account ID and description.

- Enter Transfer Details: Fill in the transfer date and corresponding details.

- Include Withholding Amounts: Precisely state the amount withheld.

- Sign and Date: The form must be signed by the responsible parties.

Important Reminders

Always ensure consistency in the information provided across all related tax documents to avoid discrepancies.

Key Elements of the Form

Understanding the essential sections of the form is crucial for accurate completion.

Critical Form Sections

- Property Information: Identification number, address, and description.

- Transfer Details: Accurate record of the transaction date and value.

- Withholding Information: Amount withheld, detailing the calculation method.

Detailed Breakdown

Each section demands specific details to ensure comprehensive reporting to tax authorities, making completeness vital.

IRS Guidelines

Adhering to IRS guidelines when completing and submitting this form is vital for tax compliance.

Relevant IRS Regulations

- Documentation: Maintain thorough records supporting the amounts reported.

- Submission Deadlines: Follow specific deadlines to avoid penalties.

Enforcement Example

Failure to comply with the IRS regulations concerning withholding may result in audits or penalties.

Filing Deadlines and Important Dates

Meeting deadlines is essential for the smooth submission of this form.

Deadlines to Consider

- Submission Deadline: Typically aligned with other tax reporting deadlines.

- Extension Options: In certain cases, extensions may be available but require proper justification and documentation.

Practical Deadlines

Ensure timely filing, particularly when coordinated with the end of the fiscal year or during real estate transactions.

Required Documents

Several documents are often required to accompany this form.

Essential Documents

- Proof of Withholding: Documentation from the withholding agent.

- Property Transfer Records: Legal documents proving the change in property ownership.

- Identification: Tax IDs for both parties involved.

Document Organization

Organizing these documents beforehand facilitates seamless form completion and submission, aligning with tax reporting requirements.

State-Specific Rules

Different states may have unique requirements for completing this form.

Variations Across States

- Withholding Rates: These can differ significantly by state.

- Additional Filings: Some states may require supplementary documentation.

Example of State Variation

In West Virginia, the specifics for nonresident real property sales might differ from those in another state like California, affecting withholding rates and processes.