Definition & Meaning

Apprenticeship Training Tax Credits are financial incentives offered by some governments to businesses that employ apprentices. These credits are designed to encourage employers to provide training and job opportunities for apprentices, thereby supporting workforce development and skill-building. The credits can reduce the overall tax liability of a business, making it more financially feasible to engage in apprenticeship programs.

Importance of Understanding

- Financial Benefits: Helps businesses reduce taxes.

- Workforce Development: Encourages businesses to train and retain skilled staff.

- Economic Growth: Contributes to a more skilled and competitive labor market.

How to Use the Apprenticeship Training Tax Credits

Businesses can utilize these tax credits by incorporating apprenticeships into their workforce training programs. It's crucial for businesses to document their participation in apprenticeship programs and ensure compliance with any relevant regulations or requirements.

Documenting Participation

- Record Keeping: Maintain thorough records of apprentice employment terms and training progress.

- Compliance: Ensure all participation criteria are met to qualify for credits.

How to Obtain the Apprenticeship Training Tax Credits

Acquiring these credits involves several steps, including identifying eligible apprenticeship programs and following the application process set by relevant authorities.

Steps to Acquire

- Enroll in an Eligible Program: Select a recognized apprenticeship program relevant to your industry.

- Document Accordingly: Keep accurate employment records and training details of apprentices.

- Submit Application: File for credits through designated tax forms or online portals.

- Approval Process: Await confirmation, which may require additional documentation or verification.

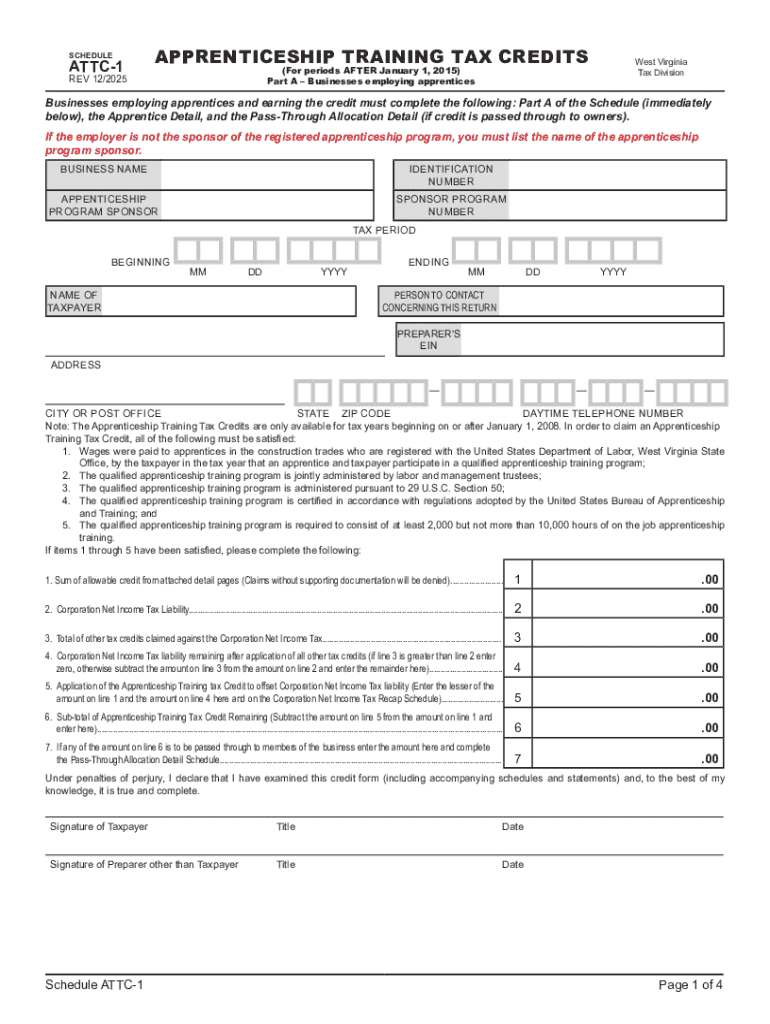

Steps to Complete the Apprenticeship Training Tax Credits

Detailed Application Steps

- Identify Eligibility: Determine if your business meets the state's criteria for employing apprentices.

- Gather Necessary Documentation: Collect employment and training records for each apprentice.

- Complete Relevant Tax Forms: Fill out specific sections related to apprenticeship credits on your business tax returns.

- File On Time: Submit forms by the designated deadline to avoid missing out on credits.

Why Should You Use Apprenticeship Training Tax Credits

These credits offer multiple advantages to businesses and the economy by supporting skill acquisition and reducing tax burdens.

Benefits Overview

- Cost Reduction: Lowers business tax liabilities.

- Skill Enhancement: Improves workforce expertise and capabilities.

- Economic Impact: Supports future growth and innovation through skilled labor.

Who Typically Uses the Apprenticeship Training Tax Credits

Various businesses across industries benefit from these tax credits, particularly those invested in workforce development and apprenticeship programs.

Common Users

- Manufacturers: Often use this to train skilled tradespeople.

- Technological Firms: Leverage credits to build a skilled tech workforce.

- Construction Companies: Use credits to train new craftsmen and builders.

Important Terms Related to Apprenticeship Training Tax Credits

Understanding key terminology is essential when discussing these tax credits to ensure compliance and proper utilization.

Key Terminology

- Apprentice: An individual in a formal training program combining work experience with classroom instruction.

- Eligible Program: An apprenticeship that qualifies for tax incentives under state or federal guidelines.

- Tax Liability: The total amount of tax a business is required to pay.

Legal Use of the Apprenticeship Training Tax Credits

It's important for businesses to adhere to legal standards when claiming tax credits to avoid penalties or loss of eligibility.

Legal Considerations

- Regulatory Compliance: Follow all government regulations related to staffing apprentices.

- Documentation: Properly maintain records proving apprenticeship status and training modules.

- Filing Integrity: Ensure all claims are filed accurately and truthfully to avoid legal repercussions.

Key Elements of the Apprenticeship Training Tax Credits

Successful utilization of these credits involves understanding their main components and how they relate to business operations.

Main Components

- Eligibility Criteria: Standards a business or apprenticeship program must meet.

- Application Process: The formal procedure for claiming credits.

- Tax Impact: The potential savings on business taxes when using the credits.

By deeply understanding these aspects, businesses can optimize the benefits offered by Apprenticeship Training Tax Credits.