Definition and Purpose

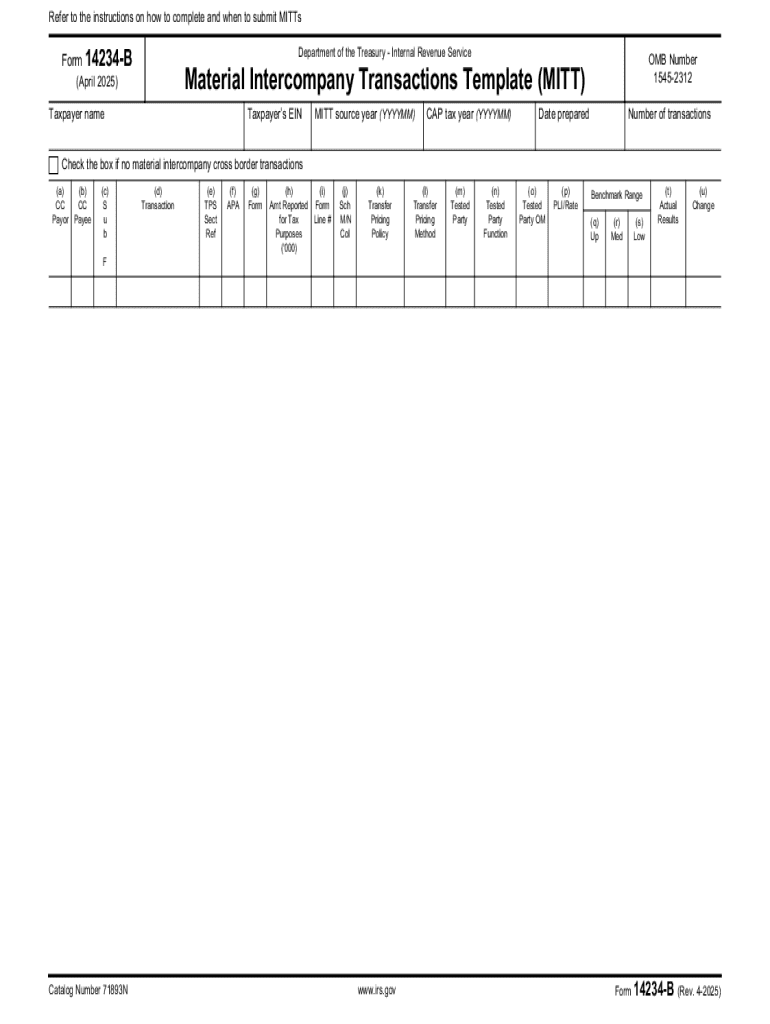

IRS Form 14234-B, also known as the Material Intercompany Transactions Template (MITT), plays a critical role in documenting and reporting intercompany transactions within multinational enterprises. This form is a vital compliance measure, ensuring that transactions between related parties are conducted at arm's length. It serves to mitigate potential tax avoidance through transfer pricing by requiring detailed documentation of all material intercompany transactions. This form is essential for businesses operating across multiple jurisdictions to comply with IRS guidelines on transfer pricing and maintain transparency in financial dealings.

How to Use IRS Form 14234-B

Using IRS Form 14234-B involves a systematic approach to capturing data relevant to intercompany transactions. Businesses must:

- Identify Transactions: Determine all material transactions between related entities.

- Document Details: Include comprehensive information about the nature, value, and terms of each transaction.

- Transfer Pricing: Demonstrate that the transactions meet arm’s length standards based on comparable market data.

Providing detailed documentation is mandatory, as it is used for taxpayer evaluations under the IRS Transfer Pricing Examination Process.

Obtaining IRS Form 14234-B

The IRS Form 14234-B can be acquired via the IRS website. Business entities should download the latest version to ensure compliance with any recent updates or changes. Alternatively, authorized third-party software with IRS form support may offer this document as part of their digital filing suite, allowing for an integrated approach to managing tax compliance.

Steps to Complete IRS Form 14234-B

- Prepare Required Information: Gather all necessary details regarding material transactions, including financial data and transfer pricing methodologies.

- Complete Sections: Fill in each section of the form with accurate and complete transaction data.

- Verify Compliance: Ensure all entries comply with IRS guidelines, particularly focusing on the arm’s length principle in transfer pricing.

- Submit Form: Submit the completed form through the designated IRS submission method, either electronically or via mail, ensuring timely filing.

Who Typically Uses IRS Form 14234-B

This form is predominantly used by multinational corporations and large business entities engaging in cross-border transactions. It is particularly relevant for industries with complex intercompany dealings, such as technology, manufacturing, and finance sectors. Tax professionals and financial officers within these organizations are generally responsible for the accurate completion and submission of the form.

Key Elements of IRS Form 14234-B

- Transaction Identifiers: Details such as transaction type, counterparties involved, and transaction years are fundamental.

- Financial Data: Revenue, expenses, and profits related to intercompany transactions must be reported.

- Comparable Data: Documentation supporting transfer pricing methods, including market comparisons and analysis.

Filing Deadlines and Important Dates

Form 14234-B must be filed in accordance with the standard IRS filing deadlines for corporate tax returns. It is crucial to stay informed of any changes to filing deadlines due to legislative updates or IRS announcements to avoid penalties for late submission.

Penalties for Non-Compliance

Failing to properly document and report intercompany transactions using Form 14234-B may result in significant penalties. The IRS imposes fines for inadequate transfer pricing documentation and adjustments for any tax discrepancies discovered. Maintaining accurate records and timely submissions is essential to avoid these financial repercussions.

Software Compatibility

Form 14234-B can be integrated with various tax preparation software like QuickBooks or TurboTax, which can handle complex intercompany transactions with appropriate modules. Leveraging these tools can enhance accuracy, streamline the completion process, and ensure compliance with IRS requirements.