Definition & Meaning

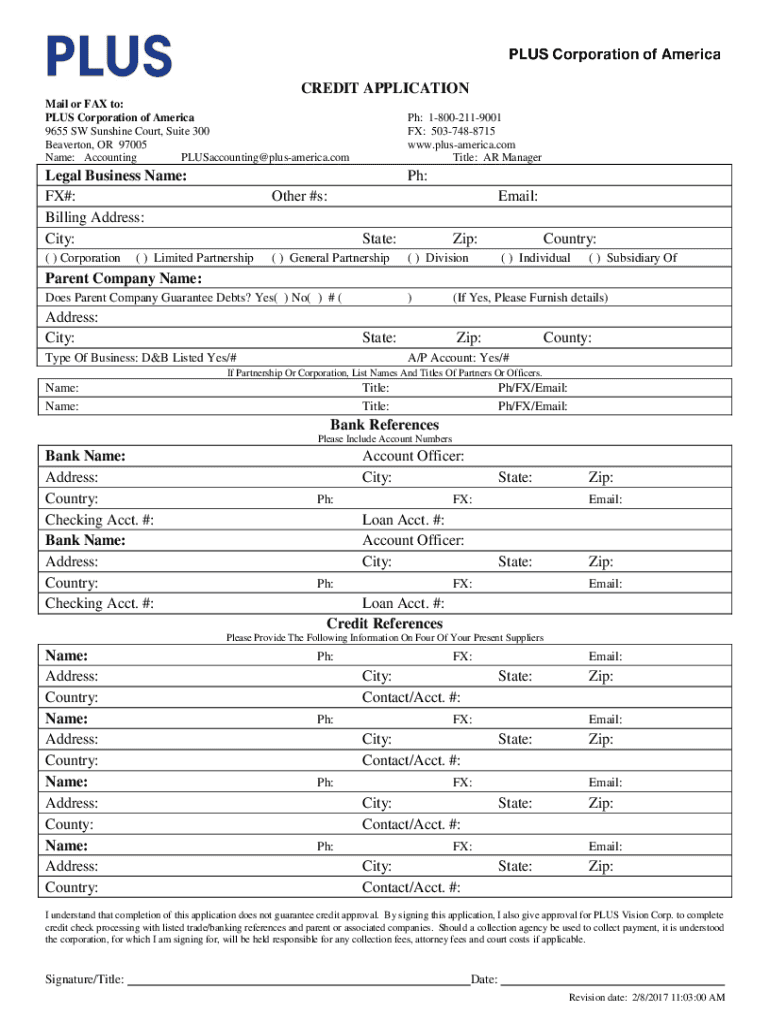

A credit application form is an essential document used by businesses to assess the creditworthiness of potential customers who wish to obtain goods or services on credit. Typically, this form collects detailed information about the applicant’s financial history, personal details, and employment status. Its primary function is to provide lenders and service providers with critical data to make informed lending decisions. In a business context, this form helps manage risk by evaluating the potential of non-repayment from borrowers or clients.

Key Elements of the Credit Application Credit Application Form

Personal Information

- Name and Contact Details: Full name, address, phone number, and email of the applicant.

- Identification Numbers: Social Security number or other relevant identifiers for credit checks.

Financial Information

- Income Details: Regular income sources, monthly/annual income, and additional earnings.

- Banking Information: Current bank account details, including branch and account number.

Credit History

- Credit References: List of current creditors, outstanding loans, and repayment history.

- Credit Score Consent: Permission for the lender to access the applicant’s credit score and report for assessment.

How to Obtain the Credit Application Credit Application Form

The credit application form can typically be obtained directly from the business or financial institution offering credit. It may be available:

- Online: Many establishments offer downloadable forms from their official websites.

- In-Person: Forms may be procured by visiting the physical location of the lender or business.

- Email Request: Upon request, some businesses may email the form in a PDF or other editable formats for convenience.

Steps to Complete the Credit Application Credit Application Form

- Gather Necessary Information: Ensure you have all required documentation and details, including personal identification and financial data.

- Fill Out Personal Details: Provide accurate and up-to-date personal information as requested.

- Provide Financial Details: Input all required financial information and income details as accurately as possible.

- Sign the Authorization: Agree to any consent terms for credit checks and data verification.

Common Errors to Avoid

- Incomplete Information: Ensure all fields are filled correctly to avoid delays in processing.

- Inaccuracies: Double-check all information for accuracy before submission.

Why Should You Use the Credit Application Credit Application Form

A well-structured credit application form can be beneficial for both parties involved:

- For Lenders: It helps in assessing credit risk and determining credit limits.

- For Applicants: It can facilitate faster credit approval by providing all necessary information efficiently.

Important Terms Related to Credit Application Credit Application Form

- Credit Limit: The maximum amount of credit a lender is willing to extend to a borrower.

- Collateral: An asset pledged by the borrower to secure the credit, ensuring repayment.

- Net Terms: Specific payment timelines offered by the lender, such as net 30 or net 60 days.

Legal Use of the Credit Application Credit Application Form

When using a credit application form, it is crucial to comply with relevant privacy laws and regulations, especially regarding the handling and protection of personal data:

- Fair Credit Reporting Act (FCRA): Governs how credit information can be collected and used.

- Equal Credit Opportunity Act (ECOA): Ensures non-discriminatory practices in credit approval processes.

Who Typically Uses the Credit Application Credit Application Form

- Businesses: To evaluate potential credit customers and set credit terms.

- Individuals: Seeking loans or credit lines with a banking institution.

- Financial Institutions: As part of the loan application process for personal and business loans.