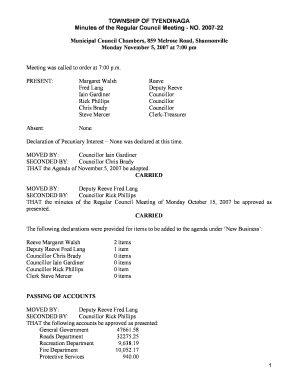

Definition & Meaning

A checking account reconciliation form is a document used to ensure that your checking account balance matches your bank statement. Reconciliation helps you identify discrepancies between your records and the bank's records. This form is essential for maintaining accurate financial management and ensuring no funds are missing due to errors or unauthorized transactions.

In practice, reconciliation involves comparing your check register, deposit slips, and canceled checks to your bank statement. Any inconsistencies need to be addressed, whether it's a forgotten transaction, a banking error, or unauthorized charges. By regularly using a reconciliation form, individuals and businesses can maintain financial accuracy and catch errors promptly.

Key Elements of the Checking Account Reconciliation Form

The checking account reconciliation form includes several critical elements designed to facilitate the reconciliation process:

- Beginning Balance: The starting balance from your previous statement.

- Checks Outstanding: List all checks issued but not yet cleared by the bank.

- Deposits Not Credited: Record deposits made after the bank statement was issued.

- Service Charges: Include any fees charged by the bank that are not in your register.

- Interest Earned: Note any interest credited to your account which may not be reflected in your records.

- Ending Balance: After making all adjustments, this balance should match the statement provided by the bank.

Each section of the form serves a specific purpose, providing a comprehensive snapshot of your financial transactions to ensure accuracy in your financial records.

Steps to Complete the Checking Account Reconciliation Form

-

Gather Necessary Documents: Collect your bank statement, check register, and any receipts for outstanding deposits.

-

Verify Beginning Balance: Ensure the starting balance on the form matches the ending balance from your last reconciliation.

-

List Outstanding Checks: Include all checks written but not yet cleared by the bank. Double-check against your check register for accuracy.

-

Account for Deposits Not Credited: Enter any bank deposits listed in your records that do not appear on the statement.

-

Adjust for Bank Fees and Interest: Record any service charges or interest accrued within the statement period.

-

Calculate Adjusted Balance: Add/subtract outstanding checks, deposits, service charges, and interest to calculate the adjusted balance. Compare it with the bank's reported balance.

Adjust any errors found during this review and ensure the process is repeated regularly, ideally monthly, to maintain financial accuracy.

Why Should You Use a Checking Account Reconciliation Form?

Regular use of a checking account reconciliation form promotes financial accuracy and accountability. It helps individuals detect fraudulent activities or bank errors early before they escalate into larger financial problems. Businesses, in particular, benefit from the consistent financial audits the form provides, ensuring that internal controls are enforced, and operational transparency is maintained.

Reconciliation can also improve budgeting by ensuring that your records reflect true financial conditions. When you know precisely how much money you have and how it's being used, you can make more informed financial decisions.

Who Typically Uses the Checking Account Reconciliation Form?

The checking account reconciliation form is primarily used by individuals, small business owners, and accountants. For individuals, it helps manage household finances, detect unauthorized activities, and avoid overdraft fees. Small businesses rely on the form to ensure accuracy in financial statements, detect discrepancies, and maintain robust fiscal management for tax purposes.

Accountants use reconciliation processes as part of larger audit functions, ensuring that the financial records they manage are accurate and reflective of client assets and liabilities.

Important Terms Related to the Checking Account Reconciliation Form

Understanding certain key terms is essential for effective use of the checking account reconciliation form:

- Cleared Transaction: Any transaction, such as a check or withdrawal, that has been processed by the bank.

- Outstanding Check: A check that has been written but not yet cleared by the bank.

- Adjusted Balance: The balance calculated after considering outstanding checks and deposits.

- Service Charge: Fees imposed by the bank for maintaining your account.

- Endorsement: The signature on the back of a bank instrument (like a check) signifying agreement to the contents.

These terms form the basis of accurate reconciliation and must be understood by anyone regularly using the form.

Examples of Using the Checking Account Reconciliation Form

Imagine a small business that issues monthly payments to suppliers via check. Throughout the month, several payments are made, but not all checks are cashed or recorded by the bank immediately. At the end of the month, using the reconciliation form, the business compares bank statements with its records to pinpoint checks issued but not yet cleared.

By identifying these discrepancies, the business can adjust its financial records to reflect an accurate cash balance, ensuring they do not overspend or misreport their financial position.

Legal Use of the Checking Account Reconciliation Form

In the United States, maintaining accurate financial records through reconciliation is critical for legal and tax purposes. Businesses must ensure that their financial statements accurately reflect their fiscal situation to comply with audit requirements and tax filings.

The reconciliation form acts as a financial audit tool, helping businesses verify the accuracy and completeness of their financial records. Using this form regularly can also help prevent legal issues by ensuring compliance with various financial regulations and standards, providing a clear audit trail for all financial transactions.