Definition & Meaning

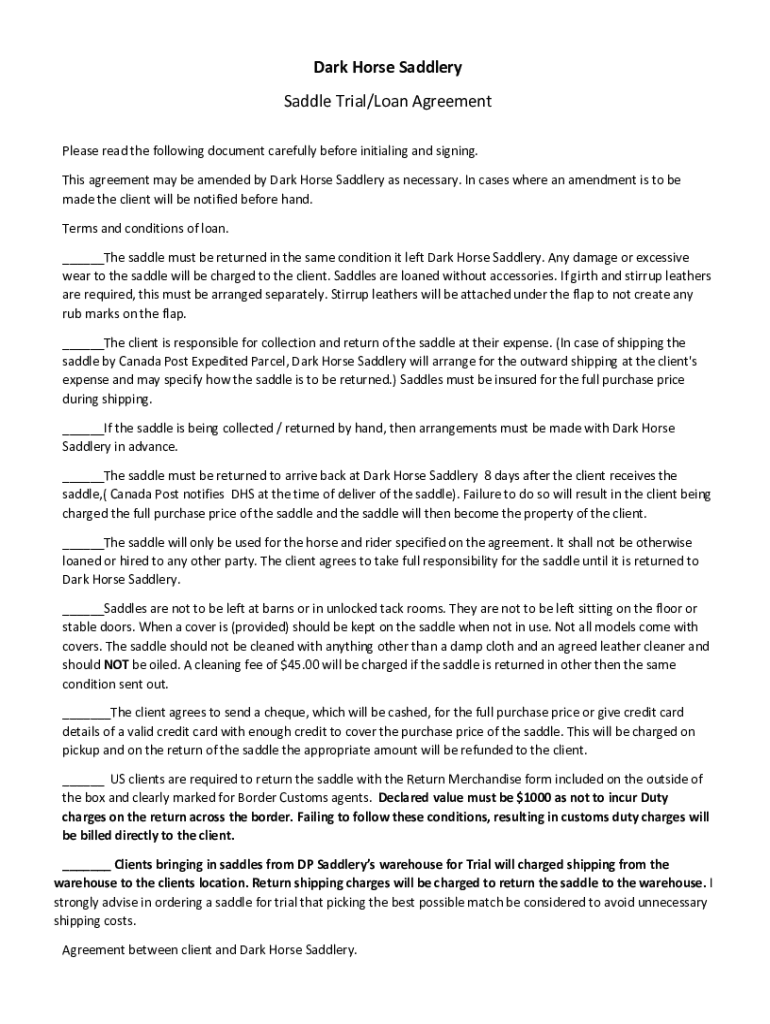

The "Saddle Trial Loan Agreement - Dark Horse Saddlery" is a specialized document facilitating the temporary use of saddles provided by Dark Horse Saddlery. This agreement outlines the responsibilities and obligations of the borrower concerning the trial and eventual return of the saddle. Designed to ensure that both parties understand their rights and duties, this document serves as a legal foundation that supports a smooth transaction between Dark Horse Saddlery and the borrowing party.

How to Use the Saddle Trial Loan Agreement

To use the Saddle Trial Loan Agreement effectively, both the lender and borrower should ensure that all sections of the document are thoroughly completed and understood before initialing and signing. This includes specifying trial duration, care guidelines, and the condition in which the saddle should be returned. Borrowers should clear any doubts with Dark Horse Saddlery representatives to confirm agreement terms are mutually agreeable and clearly understood.

Practical Usage Steps

- Read Carefully: Review every section of the agreement for clarity.

- Initial and Sign: Initial each page and sign where necessary.

- Communicate with Representatives: Contact Dark Horse Saddlery for any uncertainties or necessary amendments.

How to Obtain the Saddle Trial Loan Agreement

The Saddle Trial Loan Agreement can be acquired directly from Dark Horse Saddlery, either through their physical store or through an online request via their official website. Individuals interested in this agreement should prepare to provide identification and any information required by the saddlery to initiate the loan process.

Acquisition Methods

- In-Person: Visit the Dark Horse Saddlery location to request and collect the agreement.

- Online Request: Send a request through the official website, if available.

Important Terms Related to Saddle Trial Loan Agreements

Understanding key terms in the Saddle Trial Loan Agreement is crucial for all parties involved. These terms define the use, maintenance, and responsibilities during the saddle trial period, including liability for damages, rental fees, and the return process.

Key Terms

- Trial Period: The duration for which the saddle is loaned.

- Liability: Responsibility for damage during the trial.

- Deposit: Any upfront fee required.

- Return Condition: Required state of the saddle upon return.

Key Elements of the Saddle Trial Loan Agreement

The agreement typically encompasses several critical components that ensure a comprehensive understanding between the involved parties. These elements include the trial period, conditions of use, security deposits, and penalty fees if applicable.

Critical Components

- Trial Duration: Clearly stated start and end dates.

- Usage Guidelines: Instructions provided for saddle care.

- Financial Obligations: Any costs involved like deposits or rental fees.

- Return Policies: Defined procedures and conditions for returning the saddle.

Steps to Complete the Saddle Trial Loan Agreement

Completing the Saddle Trial Loan Agreement involves structured steps that must be followed to ensure validity and enforceability. These steps include filling out personal details, understanding terms and conditions, and confirming acceptance of all stipulations.

Completion Steps

- Fill Personal and Contact Information: Provide accurate borrower details.

- Understand All Terms: Both parties must read and agree to the conditions.

- Signatures and Initials: Add initials where required, and sign the agreement.

- Provide Any Necessary Deposits: Follow payment instructions for any deposit.

Legal Use of the Saddle Trial Loan Agreement

The legal use of the Saddle Trial Loan Agreement ensures both parties comply with stipulated terms, offering protection and recourse in cases of disputes. This document is often used in legal proceedings to delineate agreed-upon terms in the case of non-compliance or violation by one of the parties.

Legal Compliance

- Contract Validity: Ensure all parties are of legal age and mentally competent.

- Terms Adherence: Both parties must follow all outlined terms.

- Breach of Contract: Defines consequences of non-compliance, including possible penalties.

Penalties for Non-Compliance

The agreement ensures protection against misuse or breach through stipulated penalties. These can range from financial reparations to legal action, depending on the severity of the non-compliance.

Types of Penalties

- Monetary Fines: For damage or breach of return conditions.

- Legal Action: Potential court actions following agreement violations.

- Forfeiture of Deposit: Retention of deposit in cases of non-compliance.

Digital vs. Paper Version of the Agreement

Dark Horse Saddlery may offer both digital and paper versions of the Saddle Trial Loan Agreement to accommodate borrower preferences. Each version has specific benefits, including ease of distribution and storage for digital, and tangibility and signature authenticity for paper.

Features of Each Version

- Digital: Easily accessible and shareable, with electronic signature options.

- Paper: Traditional and physically verifiable, allowing handwritten signatures.

Examples of Using the Saddle Trial Loan Agreement

Real-world usage of the Saddle Trial Loan Agreement often involves a client borrowing a saddle for events, competitions, or personal trial periods, ensuring the saddle meets their needs before purchase.

Use Case Scenarios

- Event Trials: Borrowing a saddle for a competitive event.

- Personal Fit Testing: Trying different saddle options to determine the best fit.

- Short-Term Use: Temporary use for unique riding conditions.