Definition & Meaning

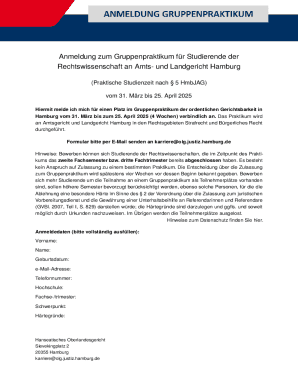

The "Antrag auf Zahlungserleichterung - bgedersdorfbbatb" is a form used to request relief in financial obligations, typically by individuals or businesses facing difficulties meeting payment commitments. This document is often leveraged to propose adjustments to payment schedules, reduce payment amounts, or apply for temporary suspensions. The form's primary intent is to provide a structured way for applicants to communicate their financial situations and request an easing of payment terms, ensuring transparency and detailed record-keeping.

How to Use the Antrag auf Zahlungserleichterung - bgedersdorfbbatb

To effectively use the form, applicants should first gather all pertinent financial information, including current financial statements, income, expenses, and any supporting documentation that justifies the request for payment relief. Next, fill out the form with accurate and comprehensive details. Be clear about the type of relief being requested, such as extended payment terms or a temporary payment suspension. It's also prudent to include a proposal for how the payment terms might be adjusted to fit the circumstances.

Step-by-Step Process:

- Collect Financial Documents: Gather proof of your financial status, including bank statements and income proof.

- Understand Your Needs: Determine the specific payment relief you are seeking.

- Fill Out the Form: Enter all required information accurately.

- Attach Documentation: Include any relevant documents that support your request.

- Review and Submit: Double-check the filled form for accuracy before submission.

Steps to Complete the Antrag auf Zahlungserleichterung - bgedersdorfbbatb

Completing this form requires attention to detail to ensure all necessary information is included for proper evaluation. Start by identifying all personal or business details that are mandatory to complete the form, such as your name, contact information, and account details relevant to the payment obligation. Proposed payment arrangements should be clear and reasonable, taking into account the financial entity's policies regarding payment adjustments.

Detailed Instructions:

- Start with Personal Details: Include your legal name, address, and contact information.

- Specify the Payment Account: Detail accounts or obligations that require adjustment.

- Outline Financial Details: Provide a comprehensive view of your financial situation, including current income levels and outstanding debts.

- Propose Payment Adjustments: Clearly specify the type of payment relief you're requesting.

- Support with Documentation: Attach all necessary financial documents and justification letters.

Required Documents

Applicants need to submit various documents to support their request for payment relief effectively. This documentation should include, but isn't limited to, financial statements, evidence of income decrease, or unexpected expenses that have impacted financial stability. Moreover, correspondence from financial advisors or any previous agreements regarding payments can provide valuable context and support to the application.

- Financial Statements: Recent bank statements and cash flow analyses.

- Income Proof: Latest pay stubs or revenue reports for businesses.

- Expense Documentation: Bills or receipts showcasing necessary expenditures.

- Official Correspondence: Letters from financial advisors or previous payment agreements.

Application Process & Approval Time

The application process begins with the completion and submission of the form, followed by a review period. Once submitted, the review process can vary in length depending on the organization or government entity managing the payment relief. Applicants should expect a period of evaluation where submitted documentation and proposed adjustments are considered for feasibility and compliance.

- Submission Methods: Forms may be submitted online, via mail, or in-person depending on institutional protocols.

- Typical Review Period: Expect a range from two to six weeks for processing.

- Notification of Decision: Applicants will be informed of the decision via email or mail.

Legal Use of the Antrag auf Zahlungserleichterung - bgedersdorfbbatb

The form is a legal document that supports the applicant's request within the boundaries of financial regulations and laws. It serves as formal documentation of intent and agreement for payment alterations requested by the applicant. Ensuring all information is accurate and truthful is essential to comply with legal requirements and avoid potential accusations of fraud or misrepresentation.

Key Legal Considerations:

- Accuracy and Truthfulness: All provided information must be truthful.

- Compliance with Regulations: Ensure the terms of relief comply with financial laws.

- Documentation Retention: Maintain copies of all submitted documents and relevant correspondence.

Who Issues the Form

This specific form is typically issued by financial institutions, government agencies, or other entities responsible for managing payments that require facilitation of payment easing requests. Understanding which organization issues the form can help applicants navigate the submission process more effectively and ensure compliance with all stipulations.

Main Issuers Include:

- Government Fiscal Agencies: For tax-related payment relief.

- Financial Institutions: Banks or credit lenders offering payment restructuring.

- Corporate Entities: Companies managing business-to-business financial obligations.

Form Submission Methods (Online / Mail / In-Person)

Submitting the "Antrag auf Zahlungserleichterung - bgedersdorfbbatb" can be done through various channels, each with its procedures and requirements. Deciding the best submission method depends on the applicant’s preference and the issuer's capabilities.

- Online Submission: Typically involves filling out a digital form and uploading necessary documents for direct submission.

- Mail Submission: Prepare physical copies of the form and necessary documents to send via postal services.

- In-Person Submission: This method involves visiting the issuing body’s office to submit the forms and documents directly.

Eligibility Criteria

Determining eligibility is crucial to ensure that the time and effort placed into filling out the form are justified. The criteria generally include financial hardship, unexpected changes in economic conditions, or specific circumstances outlined by the issuing body. Understanding these criteria beforehand can help applicants determine their likelihood of success.

- Financial Hardship: Demonstrated via documented income drops or unforeseen expenses.

- Compliance History: Previously maintaining good standing or adherence to payment terms.

- Significant Economic Changes: Impacts due to changes like employment status or market downturns.

Penalties for Non-Compliance

Failing to adhere to the stipulations of the restructured payment plan—or providing false information during the application process—can result in penalties. These penalties can vary based on the issuing organization and may include reverting terms to the original agreement, additional fees, or more severe legal consequences.

Possible Penalties:

- Reversion of Terms: Returning to the original payment schedule.

- Additional Fees: Accumulation of fines due to non-compliance.

- Legal Action: Potential for legal proceedings if fraud is detected.

Quick Facts

- Primary Purpose: Request relief in payment obligations due to financial hardships.

- Document Type: Legal form requiring full accuracy in details and proposals.

- Submission Options: Available through online, mail, or in-person methods.

- Review Timeline: Typically processed between two to six weeks, with notification of results.

- Eligibility Necessity: Demonstrated financial need and compliance history are crucial.

By understanding and adhering to the detailed requirements and procedural guidelines, applicants can effectively navigate the process of requesting payment relief through the "Antrag auf Zahlungserleichterung - bgedersdorfbbatb," ensuring thorough compliance and enhancing the potential for a favorable outcome.