Definition and Meaning

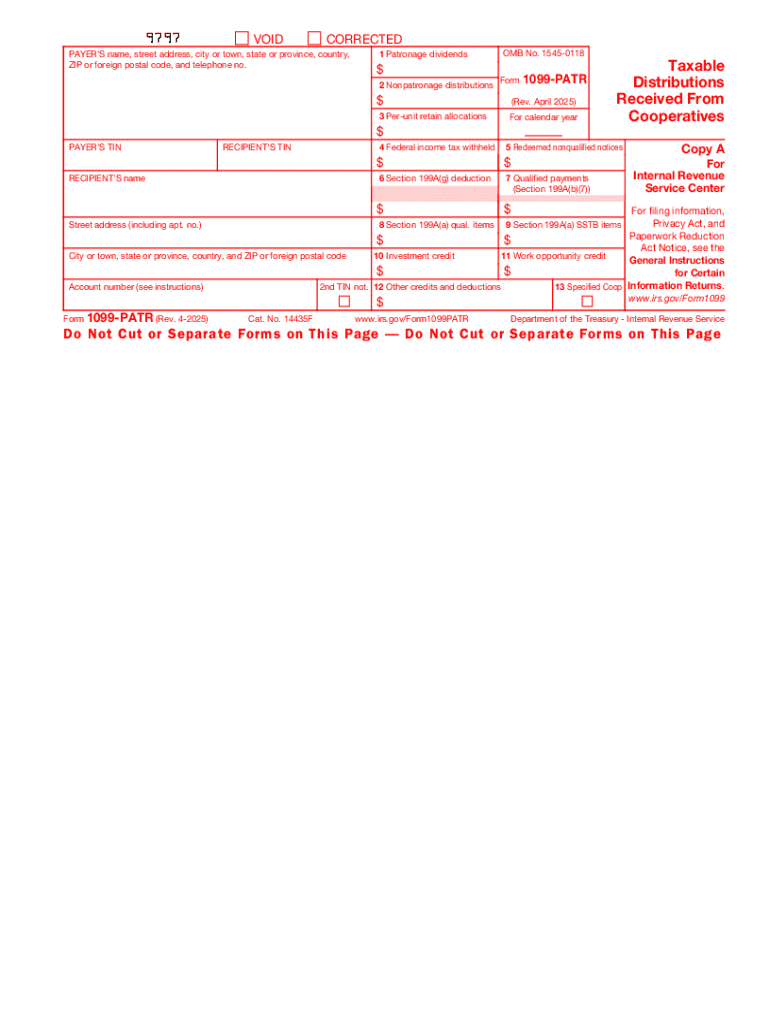

Form 1099-PATR (Rev April 2025), "Taxable Distributions Received From Cooperatives," is a tax document used in the United States. It records taxable distributions from cooperatives to its members, primarily involving patronage dividends and similar payments. These distributions are often related to the business done by the cooperative with its members, who could be individuals, businesses, or other cooperatives. Understanding this form is crucial for members of a cooperative who receive such distributions, as it ensures the accurate reporting of income for tax purposes.

Key Components

- Patronage Dividends: These are the most common distributions reported on this form. They reflect the profits a cooperative returns to its members based on the level of business each member conducts with the cooperative.

- Other Distributions: The form can also include information on other types of distributions such as allocated equity or per-unit retains.

- Tax Reporting: Properly completing and filing this form is essential for aligning with IRS regulations and avoiding potential tax inaccuracies.

How to Use Form 1099-PATR

Understanding the process of using Form 1099-PATR effectively involves knowing when and how to report the taxable distributions you receive from a cooperative.

Reporting Income

- Receive the Form: Typically, cooperatives issue this form to their members by January 31 following the tax year in which the distributions were made.

- Review Components: Check the amounts reported under different categories like patronage dividends and adjustments.

- Include in Tax Return: Report these distributions as income on your federal income tax return, typically on Schedule F if you’re a farmer or on the general income section if not involved in farming.

Maintaining Accurate Records

- Record Keeping: Keep detailed records of all transactions with your cooperative to ensure the amounts on Form 1099-PATR align with your records.

- Supporting Documents: Maintain any additional documentation provided by the cooperative, explaining the distributed amounts.

Steps to Complete Form 1099-PATR

Filling out Form 1099-PATR involves several key steps to ensure accurate completion and compliance with IRS requirements.

-

Gather Necessary Information:

- Obtain your member account details and distribution records from the cooperative.

- Have your Taxpayer Identification Number (TIN) handy.

-

Fill Out the Form:

- Complete the form with careful attention to accuracy, ensuring all reportable distributions are included.

- Verify each section, cross-referencing with your records.

-

Submit Your Tax Return:

- When filing your return, ensure the Form 1099-PATR information is included in the right section, based on the nature of your business or income type.

-

Double-Check for Accuracy:

- Before submission, review all information to confirm its accuracy.

Why Use Form 1099-PATR

There are compelling reasons why Form 1099-PATR is essential for both cooperatives and their members.

Compliance and Tax Reporting

- Legal Obligation: Cooperatives are required to issue this form to report taxable distributions.

- Accurate Tax Filings: Members rely on this form for precise income reporting to comply with federal tax laws.

Financial Insights

- Income Tracking: Helps members track their income from cooperative distributions, vital for effective financial management.

- Understanding Benefits: Provides a clear picture of the financial benefits derived from membership in a cooperative.

Important Terms Related to Form 1099-PATR

Familiarizing yourself with specific terms helps enhance understanding of Form 1099-PATR and supports accurate reporting.

Key Terminology

- Patronage Dividends: A portion of the cooperative's profits distributed back to its members based on business volume.

- Per-Unit Retains: Amounts held by the cooperative from payments for goods, which may also form part of taxable distributions.

- Adjusted Basis: The original value of a member's investment in the cooperative, adjusted for various factors, influencing taxable amounts.

IRS Guidelines

The Internal Revenue Service (IRS) provides clear directions on how to deal with Form 1099-PATR.

Compliance Requirements

- Distribution Reporting: Cooperatives must report forms by January 31 to both members and the IRS.

- Accuracy in Filing: Members must ensure the information matches IRS records to avoid discrepancies.

Exceptions and Variations

- Non-Taxable Amounts: Certain distributions may not be taxable, depending on specific IRS updates or pronouncements.

- Common Errors: Misreporting of non-taxable distributions as taxable is a frequent error requiring attention to IRS guidelines.

Filing Deadlines and Important Dates

Staying aware of relevant deadlines is essential for those involved with Form 1099-PATR.

Critical Dates

- January 31: The deadline by which cooperatives must send Form 1099-PATR to members.

- February 28: If filing by mail, this is typically the deadline to submit to the IRS.

- March 31: For electronic filing, this is often the submission deadline.

Missed Deadlines

- Late Penalties: Missing these deadlines can result in penalties for both the cooperative and its members, reinforcing the importance of timely compliance.

Penalties for Non-Compliance

Non-compliance with Form 1099-PATR requirements can lead to significant penalties.

Types of Penalties

- Late Filing: Penalties can accrue if forms are issued late or not at all.

- Inaccurate Reports: Providing incorrect information can trigger penalties, emphasizing the need for accuracy.

Avoiding Penalties

- Thorough Review: Ensuring all reported amounts are accurate minimizes the risk of penalties.

- Timely Submission: Submitting forms within the required timeframe is critical to compliance.