Definition & Meaning

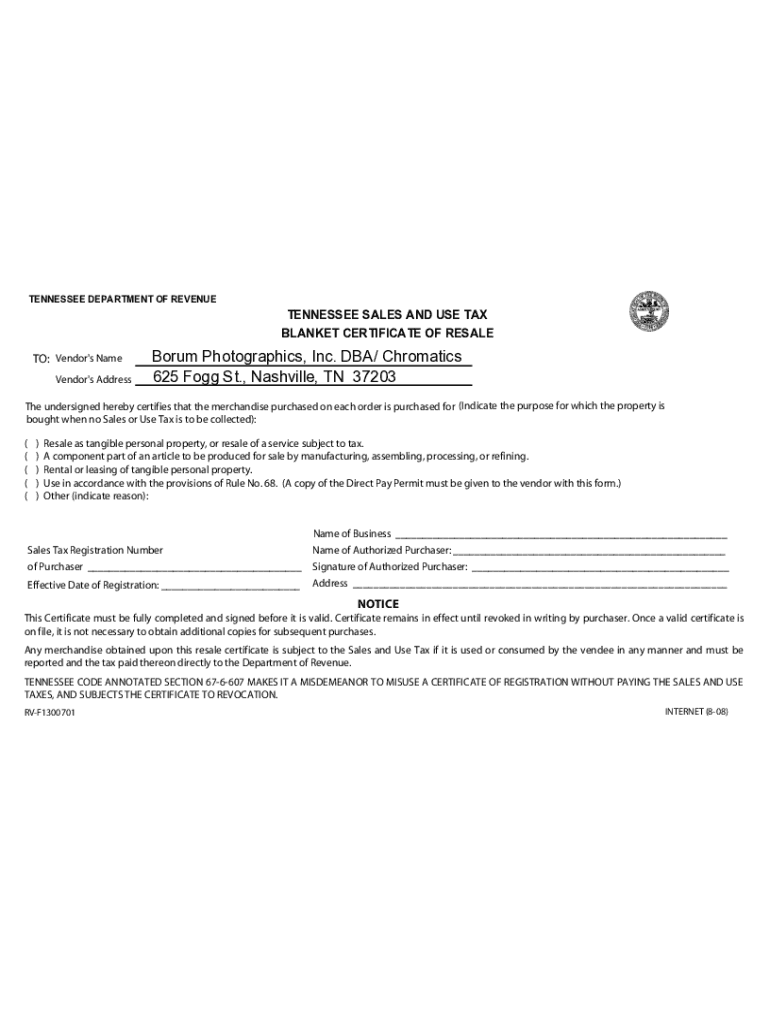

The Tennessee Sales and Use Tax Blanket Certificate of Resale is a legal document that allows purchasers to certify that goods purchased are intended for resale or other purposes that exempt them from sales tax. By using this certificate, businesses avoid paying sales tax on qualifying purchases. The form includes essential information, such as the purchaser's business details, sales tax registration number, and a legally binding signature, ensuring compliance with state tax laws. Misuse of this certificate carries legal consequences, highlighting its formal and binding nature.

How to Use the Tennessee Sales and Use Tax Blanket Certificate of Resale

Utilizing the certificate involves presenting it to vendors during transactions to indicate that items will be resold or otherwise exempted from tax. This means the vendor does not charge sales tax on the purchase. For effective use, businesses should maintain accurate records of these transactions, including copies of certificates for each vendor. Validity persists until revoked, making it crucial for businesses to manage and update certificates to reflect any changes in their tax exemption status.

Business Scenarios for Use

- Retailers buying stock for resale

- Wholesalers purchasing from manufacturers

- Exporters acquiring goods for international shipping

- Construction companies purchasing materials for projects exempt from sales tax

Steps to Complete the Tennessee Sales and Use Tax Blanket Certificate of Resale

Completing the certificate involves several steps to ensure accuracy and compliance:

- Obtain the Form: Acquire the certificate from the Tennessee Department of Revenue or download it from official websites.

- Fill Out Business Information: Provide complete business details, including name, address, and contact information.

- Include Sales Tax Registration Number: Enter the current sales tax registration number associated with your business.

- Specify the Resale Purpose: Clearly state the intended use of purchases covered by the certificate.

- Sign the Document: Have an authorized representative of the business legally sign the form.

- Submit to Vendor: Provide a signed copy to each vendor from whom tax-exempt purchases are made.

Why You Need the Tennessee Sales and Use Tax Blanket Certificate of Resale

Having this certificate is essential for businesses seeking to legally avoid paying sales tax on goods meant for resale. It protects cash flow by reducing upfront costs on inventory and other qualifying expenses. Additionally, it ensures compliance with Tennessee's tax laws, preventing potential legal and financial repercussions from improper taxation practices. This certificate is invaluable for businesses selling goods in a competitive market where managing costs is crucial for long-term success.

Important Terms Related to the Tennessee Sales and Use Tax Blanket Certificate of Resale

Understanding key terms helps in accurately utilizing the certificate:

- Sales Tax: A tax on sales or receipts from retail sales.

- Use Tax: A tax on goods purchased out of state for use within.

- Resale: Selling purchased goods in the same form as they were bought.

- Exemption: Permission not to pay taxes on certain goods and services.

- Certificate Revocation: Canceling the certificate due to changes in tax status or business operations.

Legal Use of the Tennessee Sales and Use Tax Blanket Certificate of Resale

The certificate's primary legal function is to document a purchaser's claim that the items bought will be resold or are for exempt purposes. Legal use mandates:

- Exact documentation of purchases covered by the certificate

- Verifying that the nature of purchases aligns with the stated exemption

- Keeping a valid and updated certificate to present upon request by state authorities

Failure to comply with these legalities can result in penalties or revocation of resale privileges.

Key Elements of the Tennessee Sales and Use Tax Blanket Certificate of Resale

The core elements necessary for completing and utilizing the certificate include:

- Purchaser Information: Essential business identification details.

- Vendor Name: Identification of the supplier from whom items will be purchased tax-free.

- Nature of Business: Explains the business type and operations, justifying the resale exemption.

- Sales Tax Number: Valid identification to confirm the purchaser's right to the exemption.

- Authorized Signature: Must be signed by a representative with authority within the purchasing entity.

State-Specific Rules for the Tennessee Sales and Use Tax Blanket Certificate of Resale

Tennessee enforces unique regulatory aspects associated with the certificate:

- Specific documentation requirements that ensure the validity of the exemption across multiple transactions

- Periodic audits by state authorities to verify the proper application of the exemptions

- Conditions under which the certificate must be revised, such as changes in business location or operational scope

Staying informed on these details helps mitigate compliance risks and ensures seamless commercial operations within the state.