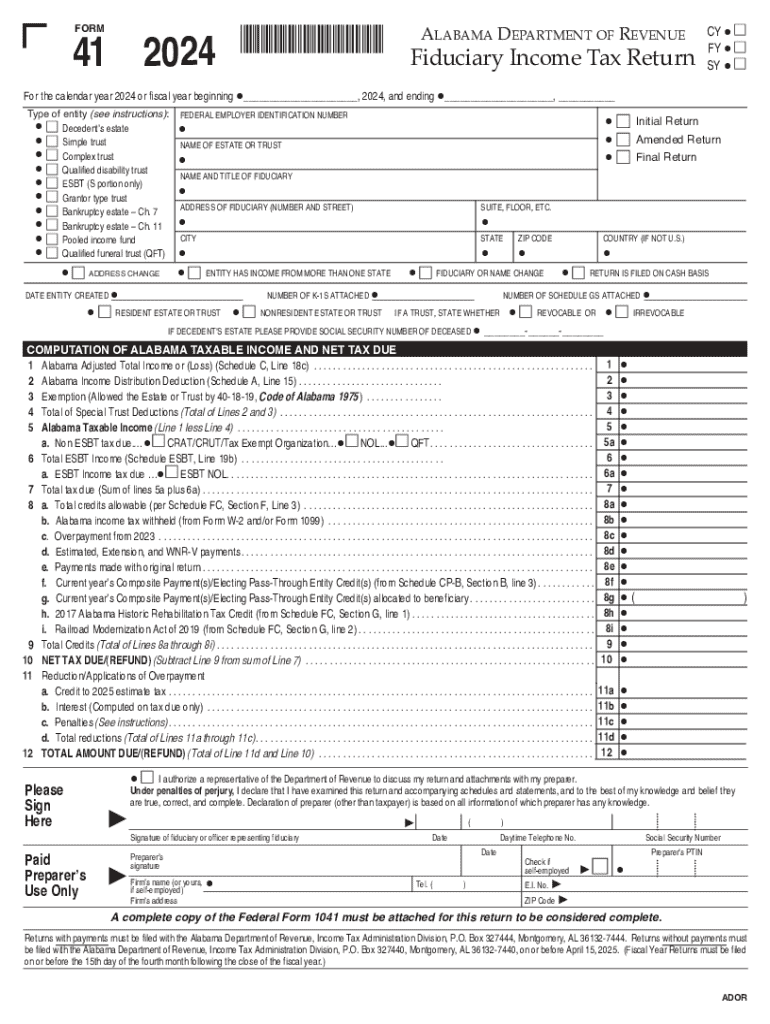

Definition and Purpose of the Alabama Fiduciary Income Tax Return (Form 41)

The Alabama Fiduciary Income Tax Return, often referred to as Form 41, is specifically designed for fiduciaries managing estates and trusts in Alabama. This form details the calculation of taxable income, applicable deductions, credits, and the total tax due for such fiduciary entities.

- Fiduciaries: Individuals or institutions such as executors, administrators, or trustees responsible for managing assets on behalf of others.

- Estates and Trusts: Legal arrangements that hold and manage assets for beneficiaries under the legal framework of Alabama law.

Key Elements and Sections

- Adjusted Total Income: This critical section captures the total taxable income after applying necessary adjustments.

- Income Distribution Deductions: Details deductions available when income is distributed to beneficiaries.

- Charitable Deductions: Information on allowable deductions for charitable contributions as part of estate and trust management.

- Filing Requirements: Instructions on the supporting documentation essential for submission.

Steps to Complete the Alabama Fiduciary Income Tax Return

Completing Form 41 involves a series of precise steps to ensure accuracy and compliance with state tax laws:

- Gather Required Documents: Assemble all financial records, including income statements, expense receipts, and previous tax returns.

- Calculate Adjusted Total Income: Begin with gross income and apply necessary adjustments to obtain the figure for adjusted total income.

- Determine Deductions: Summarize qualifying deductions, such as administrative expenses and distributions to beneficiaries.

- Compute Tax Liability: Apply the current Alabama tax rates to determine the total tax due.

- Attach Supporting Documents: Ensure all supporting documents such as income statements and proof of deductions are included.

- Review & Submission: Thoroughly review the completed form for accuracy before submission.

Filing Deadlines and Important Dates

Timely submission of Form 41 is essential:

- Regular Filing Deadline: Generally due by April 15 of the year following the taxable period.

- Extensions: Fiduciaries may apply for an extension if more time is needed, ensuring compliance with instructions provided by the Alabama Department of Revenue.

State-Specific Rules for Completion

Alabama has distinct rules that apply to fiduciary tax filings:

- Residency Requirements: Differentiate between resident and nonresident fiduciaries, as applicable rules and tax implications vary.

- Deductions Limitations: Particular deductions may only be claimable under specific state conditions, echoing Alabama’s distinct tax policies.

- Exemptions: Identify any state-specific exemptions pertinent to trusts and estates.

When and Why to Use the Alabama Fiduciary Income Tax Return

Using Form 41 ensures that fiduciaries responsibly report income and proper tax on behalf of estates and trusts:

- Legal Requirement: It is a mandatory filing for estates and trusts with income, beneficiaries, or a resident of Alabama.

- Financial Management: Crucial for effective financial planning and accurate tax reporting.

- Beneficiary Assurance: Provides transparency and accuracy in fiduciary management for beneficiaries.

Penalties for Non-Compliance

Failing to correctly file or submit Form 41 on time can lead to significant penalties:

- Late Filing Penalties: Fiduciaries may incur fines if submissions are delayed beyond the established deadlines.

- Inaccuracy Penalties: Incorrect reporting of income or deductions may lead to penalties or additional state scrutiny.

Software Compatibility and Digital Filing Options

Digital filing has become a more streamlined process for fiduciaries:

- Software Options: Tools such as TurboTax and QuickBooks can facilitate the accurate completion of Form 41.

- Online Submission: Many prefer the convenience and efficiency of electronic filing methods compared to traditional paper filing.

Advantages of Digital Filing

- Speed: Online submissions typically process faster.

- Accuracy: Software provides checks to reduce errors.

- Convenience: Easier tracking and record-keeping.

Examples and Use Cases

Fiduciaries managing different asset types or income sources might use Form 41 to address specific scenarios:

- Simple Estates: Estate with straightforward investment income and standard deductions.

- Complex Trusts: Trusts with income from diverse sources, requiring detailed allocations and deductions.

- Charitable Trusts: Filing that incorporates significant charitable contributions impacting available deductions.

By comprehensively understanding and executing the Alabama Fiduciary Income Tax Return, fiduciaries ensure legal compliance, efficient management, and transparency with regarded estate or trust affairs.