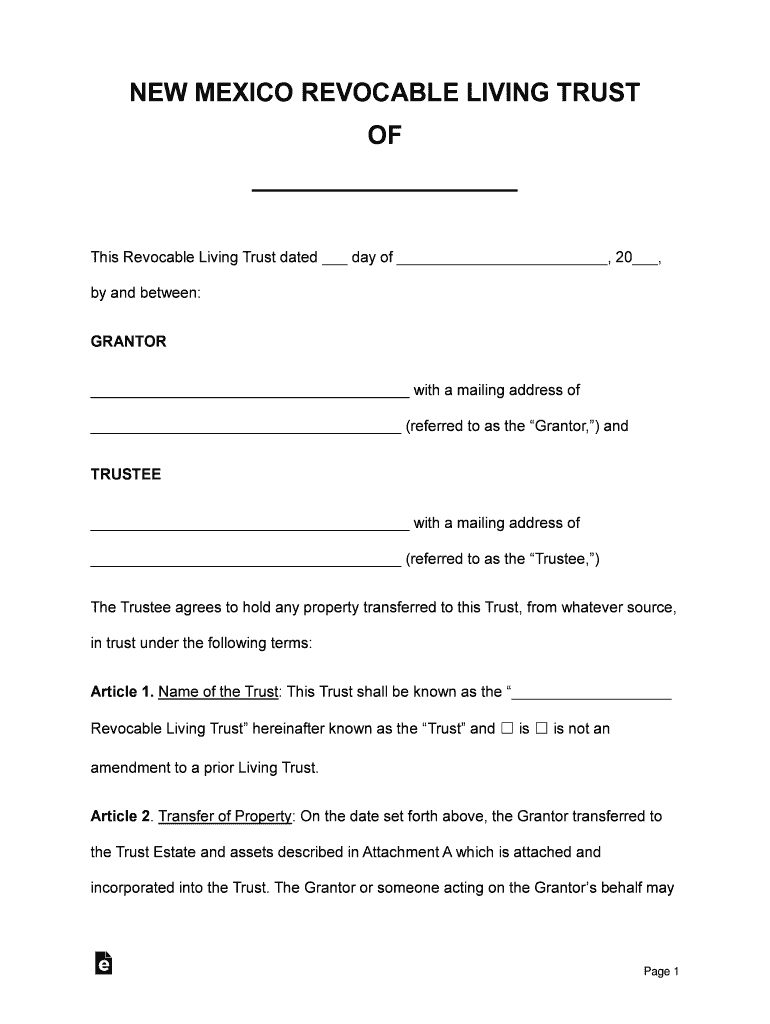

Definition and Meaning of a New Mexico Revocable Living Trust

A New Mexico Revocable Living Trust is a legal document that allows a Grantor to transfer ownership of their assets to a trust during their lifetime. The Grantor designates a Trustee to manage these assets based on the terms outlined in the trust agreement. Revocable Living Trusts are valuable tools in estate planning as they provide flexibility and control over asset distribution and management. This agreement remains revocable during the Grantor's lifetime, meaning it can be altered, amended, or terminated at any time. Only upon the Grantor's death does the trust become irrevocable, ensuring that assets are distributed to beneficiaries according to the trust’s provisions without the need for probate.

How to Use the New Mexico Revocable Living Trust Form

Using a New Mexico Revocable Living Trust Form involves several key steps:

- Gather Required Information: Collect details about the Grantor, Trustee, and beneficiaries, as well as a comprehensive list of assets to be included in the trust.

- Determine Asset Allocation: Decide how the assets will be managed during the Grantor's lifetime and how they will be distributed upon their death.

- Establish Provisions for Incapacity: Include instructions on how the trust should be managed if the Grantor becomes incapacitated.

- Detail Specific Wishes: Ensure certain personal wishes, such as care for pets or charitable donations, are clearly articulated.

- Execute the Trust: Sign the document in the presence of a notary public to formalize and legally activate the trust.

By following these steps, a Grantor can ensure their assets are managed according to personal wishes and legal requirements.

Steps to Complete the New Mexico Revocable Living Trust Form

Completing the New Mexico Revocable Living Trust Form can be broken down into clear steps:

- Identify the Trust Components: Begin by filling in the names and addresses of the Grantor, Trustee, and any Successor Trustees.

- List Assets: Specify all assets to be included in the trust, ensuring each is accurately described.

- Define Beneficiaries: Clearly identify each beneficiary and outline the percentage or specific portion of the trust they will receive.

- Incapacity Provisions: Outline procedures for managing the trust if the Grantor becomes unable to do so.

- Add Special Instructions: Detail any additional requirements or stipulations, such as pet care or funeral arrangements.

- Finalize the Document: Have the Grantor and Trustee sign the document in the presence of a notary to validate the trust.

These steps ensure the trust is comprehensive and effective in managing and distributing the Grantor's assets.

Key Elements of the New Mexico Revocable Living Trust Form

This form encompasses several essential components:

- Grantor and Trustee Information: Names and contact information of the persons involved in managing the trust.

- Asset List: Detailed enumeration of the assets being transferred into the trust.

- Beneficiary Designation: Identification of all beneficiaries and their respective shares.

- Trustee Powers and Responsibilities: Explicit description of what the Trustee is authorized to do regarding asset management.

- Successor Trustee: Name and details of the person who will assume the role of Trustee if the original Trustee is unable to perform their duties.

- Provisions for Modifications: Procedures through which the Grantor can modify or revoke the trust while alive.

These elements are integral to forming a legally sound and functional trust document.

Legal Use of the New Mexico Revocable Living Trust Form

The New Mexico Revocable Living Trust Form is utilized to legally manage and transfer assets during and after the Grantor's life. It is often employed to:

- Avoid Probate: Assets in the trust do not go through probate, allowing quicker distribution to beneficiaries.

- Privacy: Keep the details of asset distribution private, unlike the public probate process.

- Control: Maintain control over the distribution of assets after death.

- Provision for Incapacity: Ensure assets are managed according to the Grantor's wishes if they become incapacitated.

Understanding its legal functions helps in effectively using the form to meet estate planning goals.

Who Typically Uses the New Mexico Revocable Living Trust Form

This form is typically used by individuals seeking to manage their estate efficiently. It is particularly beneficial for:

- Estate Planners: Individuals with a significant asset portfolio concerned about wills and probate courts.

- Parents: Those wishing to ensure a structured inheritance plan for their children.

- Elderly Individuals: Adults planning for potential incapacity and future asset management.

- Pet Owners: Those desiring to provide specific care and financial resources for pets upon their passing.

These users benefit from the trust’s ability to bypass probate and provide clear asset management instructions.

Important Terms Related to New Mexico Revocable Living Trust

Understanding key terms is crucial to using the trust form effectively:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust's assets.

- Beneficiary: Those designated to receive assets from the trust.

- Revocable: The trust can be altered or terminated by the Grantor during their lifetime.

- Irrevocable: A trust becomes irrevocable upon the death of the Grantor, meaning it cannot be changed.

Familiarity with these terms ensures a clear understanding of the form's functionality.

State-Specific Rules for the New Mexico Revocable Living Trust Form

In New Mexico, specific regulations govern Revocable Living Trusts:

- Notary Requirements: The trust must be signed in the presence of a notary to be legally binding.

- Incapacity Clauses: New Mexico law allows for clear directives on trust management in the event of Grantor incapacity.

- Homestead Protections: Certain statutory exemptions may apply to property within the trust.

- Trust Amendments: Procedures for modifying the trust must comply with state legal standards.

Adhering to these rules ensures the trust is compliant with state laws, reinforcing its legal validity.