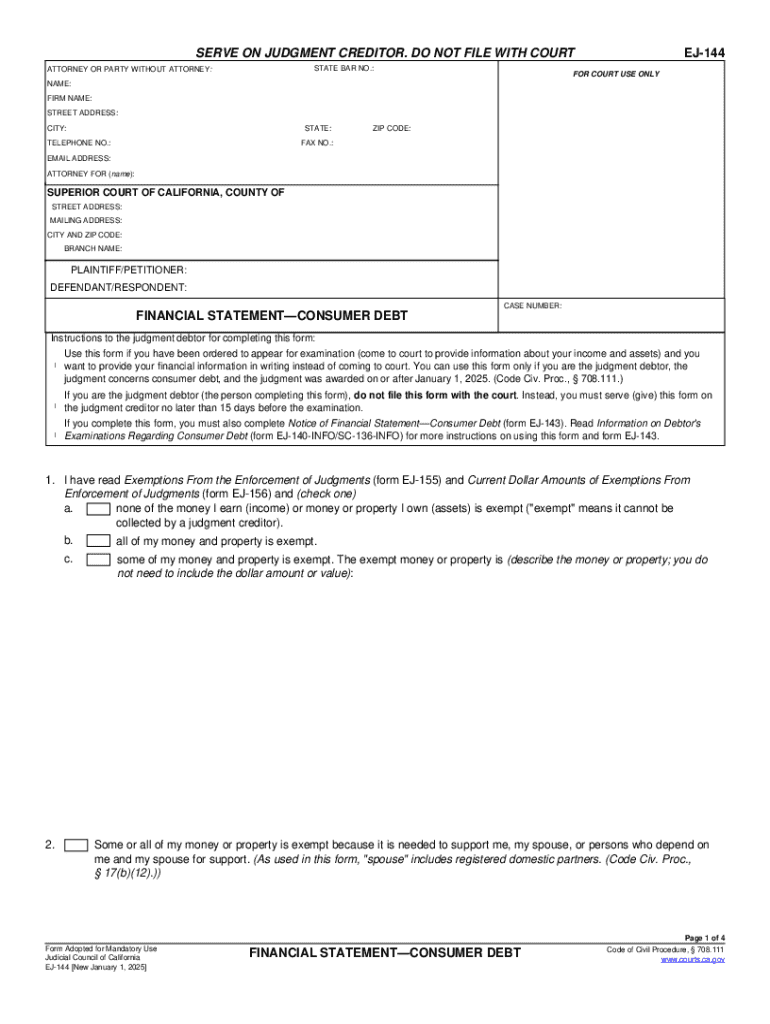

Definition and Purpose of EJ-144

The EJ-144 form, officially known as the Financial Statement for Consumer Debt, is a legal document used in the United States for judgment debtors who are ordered to provide detailed financial information. This requirement is instead of making a physical court appearance. The form's primary goal is to outline a debtor's financial status, including monthly income, expenses, debts, and any pertinent financial details. It is not filed with the court; instead, it is served to the judgment creditor.

How to Use the EJ-144

To effectively utilize the EJ-144, judgment debtors must provide a comprehensive account of their financial situation. This involves filling out sections related to income sources, monthly expenses, debts, and any assets or properties owned.

- Income Section: Requires information on all income streams, such as salaries, rental income, or any government assistance.

- Expense Overview: Details monthly expenses categorized by housing, utilities, groceries, and other essentials.

- Debt and Asset Disclosure: Lists all outstanding debts and assets, including real estate, vehicles, or significant investments.

Completing the form accurately ensures the judgment creditor receives an honest view of the debtor's ability to satisfy outstanding debts.

Important Terms Related to EJ-144

Understanding the terminology related to the EJ-144 is crucial for accurate completion. Key terms and their meanings include:

- Judgment Creditor: The entity that has won a judgment in court and seeks repayment from the debtor.

- Judgment Debtor: The individual or entity obliged to pay the judgment as determined by the court.

- Exemptions from Enforcement: Refers to certain income or assets that cannot be seized to satisfy the debt, such as social security benefits or specific retirement funds.

- Financial Statement: A declaration of financial status, encompassing income, liabilities, and overall net worth.

Steps to Complete the EJ-144

Completing the EJ-144 involves a structured approach to ensure all financial aspects are adequately covered. Follow these steps:

- Gather Financial Documents: Collect recent pay stubs, bank statements, and credit reports to provide precise income and debt details.

- Accurately Report Income: Detail all sources of income, using exact figures and documentation for verification.

- List Monthly Expenses: Include all household expenses, ensuring every expenditure category is covered comprehensively.

- Disclose Debts and Assets: Provide a transparent account of outstanding debts and any owned assets.

- Review for Accuracy: Double-check all entries to ensure financial data accuracy, providing a reliable perspective on financial health.

- Serve the Document: Once completed, serve the form to the judgment creditor as required.

Legal Use of the EJ-144

The EJ-144 serves as a legal mechanism to facilitate the debt recovery process. Its compliance with legal standards ensures it meets judicial requirements for financial disclosure. Key aspects include:

- Accuracy and Honesty: It is legally imperative to provide truthful and complete financial disclosure.

- Exemption Awareness: Identify and list all exempt assets and income streams to protect debtor rights under the law.

- Legal Consequences: Providing false information may result in legal penalties, including potential charges of perjury.

Examples of Using the EJ-144

To understand the EJ-144's application, consider these scenarios:

- Case of Insolvency: A debtor unable to meet financial obligations can use the EJ-144 to demonstrate financial constraints and negotiate more favorable terms.

- Debt Settlement: Creditors require the EJ-144 to assess the debtor's ability to propose a partial debt repayment plan.

- Protection of Exempt Assets: Debtors can illustrate which assets are protected by exemptions to prevent unauthorized asset seizure.

State-Specific Rules for the EJ-144

While the general purpose of the EJ-144 is consistent nationwide, some states may have variations in details or additional requirements:

- California: Complies with specific state exemption laws for property and income.

- Texas: May require additional documentation or alternative forms to address specific debtor categories.

- New York: Adheres to distinct processes related to debtor financial disclosure and asset protection.

Understanding state-specific requirements is essential for accurate form completion and compliance.

Penalties for Non-Compliance

Non-compliance with the requirements of the EJ-144 can incur serious legal repercussions. Possible penalties include:

- Contempt of Court: Failing to submit the EJ-144 or providing incomplete information can result in contempt charges.

- Increased Financial Burden: Non-compliance may lead to additional financial liabilities, including fines or interest.

- Legal Action: Creditors may pursue further legal action if the EJ-144 is not completed as required, exacerbating the debtor’s financial situation.

Software Compatibility

For those looking to streamline the process of completing an EJ-144, several software solutions can be utilized for enhanced efficiency:

- DocHub: Provides tools for filling and editing forms, adding electronic signatures, and enabling collaboration.

- TurboTax: Assists in financial calculations and integration with government tax records if applicable.

- QuickBooks: Useful for tracking financial data, particularly for business-related financial statements.

These solutions help ensure accuracy and compliance with form requirements, minimizing errors in the submission process.