Definition & Meaning

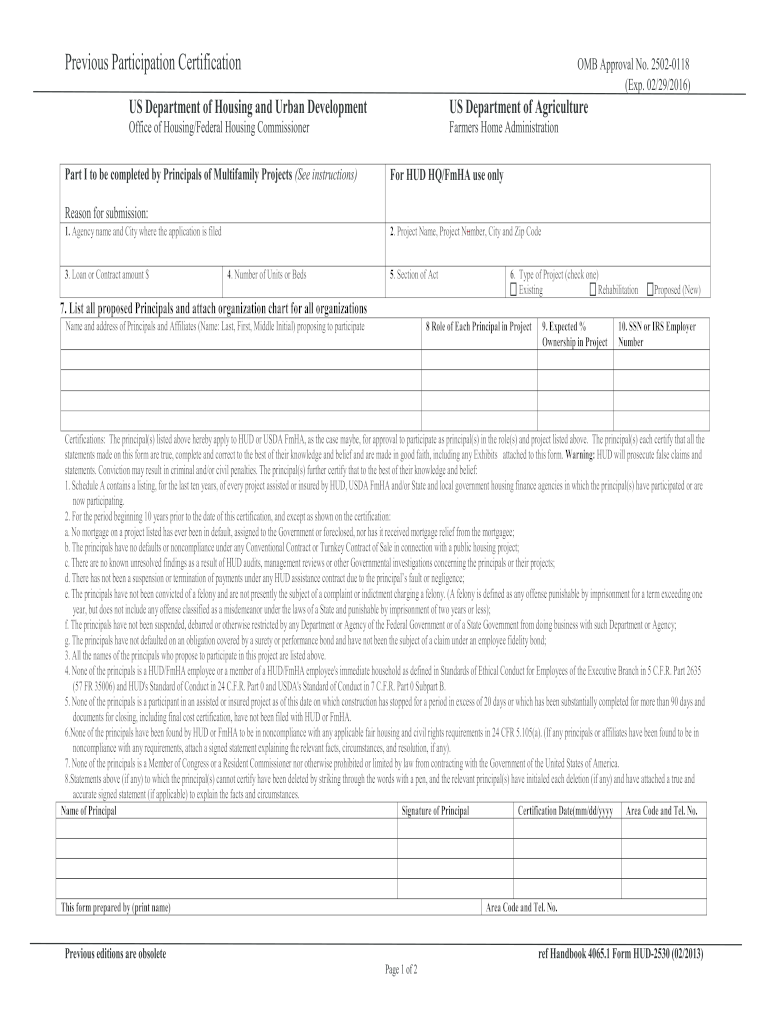

The HUD-2350, also known as the Previous Participation Certification, is a critical document used by the U.S. Department of Housing and Urban Development (HUD). It is designed for individuals or entities applying to take part in multifamily housing projects. This form collects comprehensive details about the applicants' historical involvement with HUD and other housing finance agencies like the USDA FmHA. The purpose is to ensure accountability and transparency by reviewing an applicant's roles, project statuses, and any related defaults or legal issues from past engagements.

Contextual Background

- Applicants: Typically, the HUD-2350 is required from developers, investors, or key stakeholders in housing projects.

- Purpose: It verifies the truthfulness and completeness of all statements, providing a foundation for HUD's decision on project participation.

How to Use the HUD-2350

Understanding the practical use of the HUD-2350 is essential for applicants to navigate the certification process effectively.

Usage Instructions

- Documentation Gathering: Collect all necessary historical data related to previous HUD projects, including project roles and outcomes.

- Accuracy Requirement: Ensure each entry is precise to avoid penalties associated with false declarations.

Real-World Application

- Developer Scenario: A new housing developer uses the HUD-2350 to disclose their past project participation details when applying for a new HUD-subsidized multifamily development.

How to Obtain the HUD-2350

Acquiring the HUD-2350 form is a crucial first step in the certification process.

Access Points

- HUD Website: The official HUD website provides downloadable versions of the form, ensuring easy access.

- Contact HUD Offices: Local HUD offices can provide the form and additional guidance.

Digital Access

- Quicker Process: Downloading the form from HUD’s website is often the fastest method.

Steps to Complete the HUD-2350

Accurate completion of the HUD-2350 involves several detailed steps.

Step-by-Step Process

- Fill Identification Sections: Begin with providing basic details such as name and contact information.

- Historical Data Entry: Input comprehensive information about prior participation in HUD projects, detailing roles and project outcomes.

- Final Review: Double-check the form for completeness and accuracy before submission.

Common Mistakes to Avoid

- Incomplete Information: Not filling all required fields can result in delays or rejections.

- Inaccurate Information: Inaccuracies can lead to legal consequences or loss of approval.

Why You Should Use the HUD-2350

The HUD-2350 serves as a gatekeeper in the multifamily housing project application process.

Benefits

- Ensures Compliance: Helps in maintaining compliance with HUD requirements, which is mandatory for project approvals.

- Enhances Credibility: Demonstrates the applicant's transparency and reliability, improving their standing with HUD.

Practical Example

- Investment Firm: An investment firm efficiently demonstrates its credibility by showcasing a history of successful projects, aiding seamless approval for upcoming projects.

Who Typically Uses the HUD-2350

The HUD-2350 is commonly used by various stakeholders in the housing industry.

Typical Users

- Developers: Individuals or firms responsible for creating housing projects.

- Financial Entities: Lending institutions evaluating prospective borrowers' histories for HUD-associated financing.

Use Case

- Financial Vetting: A bank evaluates a developer's past project involvements using the HUD-2350 before approving a project loan.

Key Elements of the HUD-2350

Understanding the core components of the HUD-2350 is crucial for its effective use.

Primary Sections

- Applicant Information: Includes names and contact details.

- Project History: Details of all previous participations in HUD or related projects.

Comprehensive Breakdown

- Roles and Responsibilities: Clearly define past roles to avoid ambiguity.

- Legal and Financial Issues: Disclosure of any defaults or legal issues faced in previous projects.

Important Terms Related to HUD-2350

Clarifying the terminology used within the HUD-2350 provides a clearer understanding of the certification requirements.

Essential Terms

- Upcoming Participation: Refers to projects for which the applicant is currently seeking approval.

- Certification: A statement ensuring that all provided information is true and accurate.

Definitions in Context

- Multifamily Housing Projects: Residential developments intended for multiple families, such as apartment complexes, that benefit from HUD's involvement.

Legal Use of the HUD-2350

The HUD-2350 must be completed in compliance with legal standards set forth by HUD.

Legal Framework

- Certification Accuracy: Applicants are required by law to certify that all submitted information is truthful.

- Consequences for Inaccuracies: Providing false information can lead to legal penalties and disqualification from future HUD projects.

Examples

- Non-compliance Case: An applicant faces penalties for submitting an incomplete form not aligned with HUD's certification standards.

This structured in-depth guide on the HUD-2350 seeks to provide clarity and support for applicants navigating the multifaceted certification process.