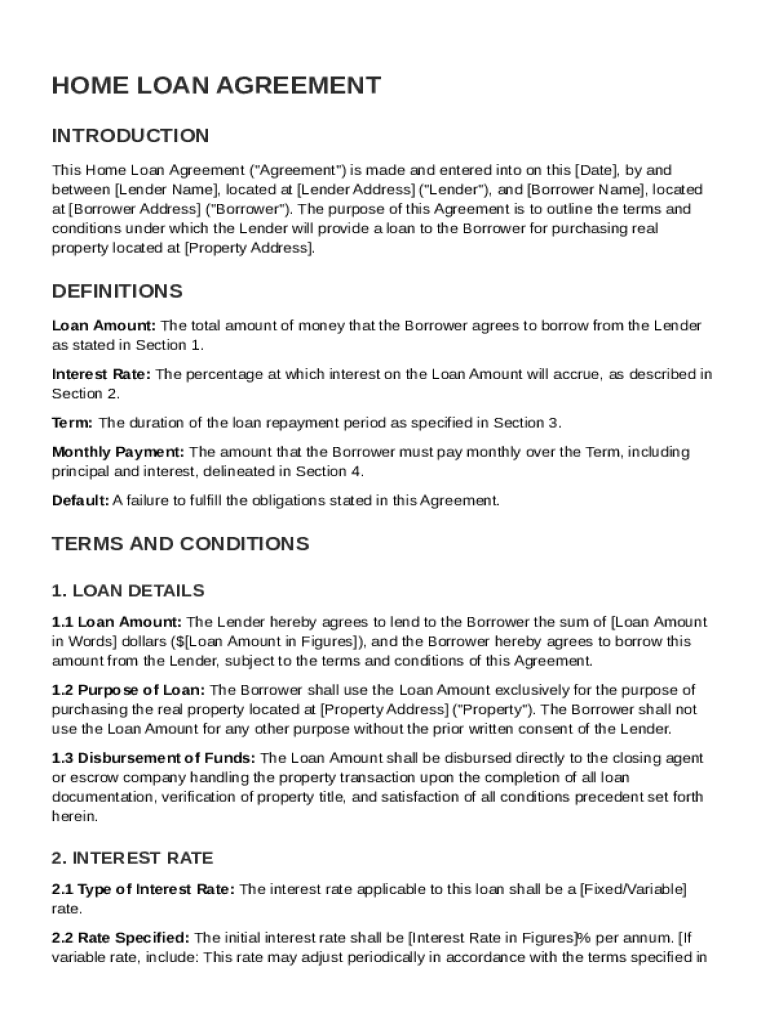

Definition & Meaning

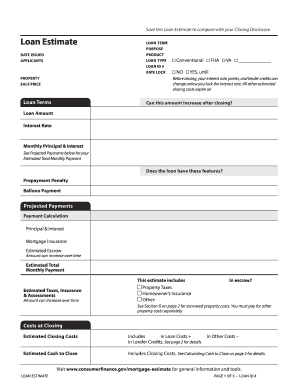

The Home Loan Contract Template is a structured document that outlines the contractual agreement between a lender and a borrower for purchasing real estate. It formalizes the loan terms, ensuring both parties understand their rights and responsibilities. This template covers details such as loan amount, interest rates, payment terms, collateral requirements, and conditions of default, serving as a legally binding agreement.

Key Elements of the Home Loan Contract Template

This template comprises several critical sections that detail the financial and legal terms of the loan. Key elements include:

- Loan Amount and Interest Rate: Specifies the total loan amount disbursed and the applicable interest rate.

- Repayment Schedule: Outlines the timeline and structure of payments, including the frequency and amount of installments.

- Collateral and Security: Details the assets pledged as security for the loan, ensuring the lender's interests are protected.

- Default and Remedies: Defines what constitutes a default and the actions the lender may take in response.

- Governing Law: Indicates the jurisdiction that governs the contract, often essential in legal disputes.

How to Use the Home Loan Contract Template

To efficiently utilize the Home Loan Contract Template, follow these steps:

- Review and Customize Elements: Evaluate each section of the template, ensuring specific loan terms reflect the agreed-upon conditions between the lender and borrower.

- Fill in Essential Details: Complete all necessary fields such as borrower and lender information, loan amount, interest rate, and repayment terms.

- Legal Review: Have a legal professional review the completed template to ensure compliance with applicable laws and regulations.

- Secure Signatures: Obtain signatures from all involved parties to formalize the contract as a legally binding document.

Steps to Complete the Home Loan Contract Template

Completing the Home Loan Contract Template involves a systematic approach:

- Gather Necessary Information: Ensure all relevant data about the borrower, lender, loan terms, and property are readily available.

- Draft Initial Terms: Begin by inputting preliminary data into the template, focusing on loan details.

- Refine Financial Sections: Clarify payment structures and interest calculations to avoid future misunderstandings.

- Incorporate Legal Provisions: Add clauses that address potential risks, such as defaults or prepayment penalties.

- Finalize the Document: Conduct a thorough review, and secure final approval from all parties.

Important Terms Related to Home Loan Contract Template

Understanding the terminology used in a Home Loan Contract Template is crucial:

- Principal: The amount of money borrowed from the lender.

- Amortization: The process of paying off the loan through regular payments over time.

- Escrow: An account where funds are held in trust until specific conditions are met.

- Lien: A lender's legal right or interest in the property until the debt obligation is satisfied.

Legal Use of the Home Loan Contract Template

This template operates within the legal framework of loan agreements, and its use must comply with relevant laws such as the Truth in Lending Act (TILA) in the United States. It provides a transparent disclosure of credit terms to borrowers and protects both parties against unfair lending practices.

State-specific Rules for the Home Loan Contract Template

Loan agreements can vary based on state regulations:

- Interest Caps: Some states impose limits on the interest rates that can be charged.

- Foreclosure Laws: Procedures and timelines for handling defaults differ significantly across states.

- Recording Requirements: Certain jurisdictions may require the contract to be filed with local authorities to be enforceable.

Examples of Using the Home Loan Contract Template

Consider real-world scenarios involving the Home Loan Contract Template:

- Purchasing Residential Property: A borrower uses the template to formalize a mortgage agreement for a new home.

- Refinancing an Existing Loan: A homeowner renegotiates loan terms for better rates, requiring a new or modified contract template.

- Investment Property Loans: Real estate investors leverage the template to secure funding for rental properties or commercial investments.

With these comprehensive blocks, users can gain a detailed understanding of the Home Loan Contract Template and its practical applications.