Definition & Meaning

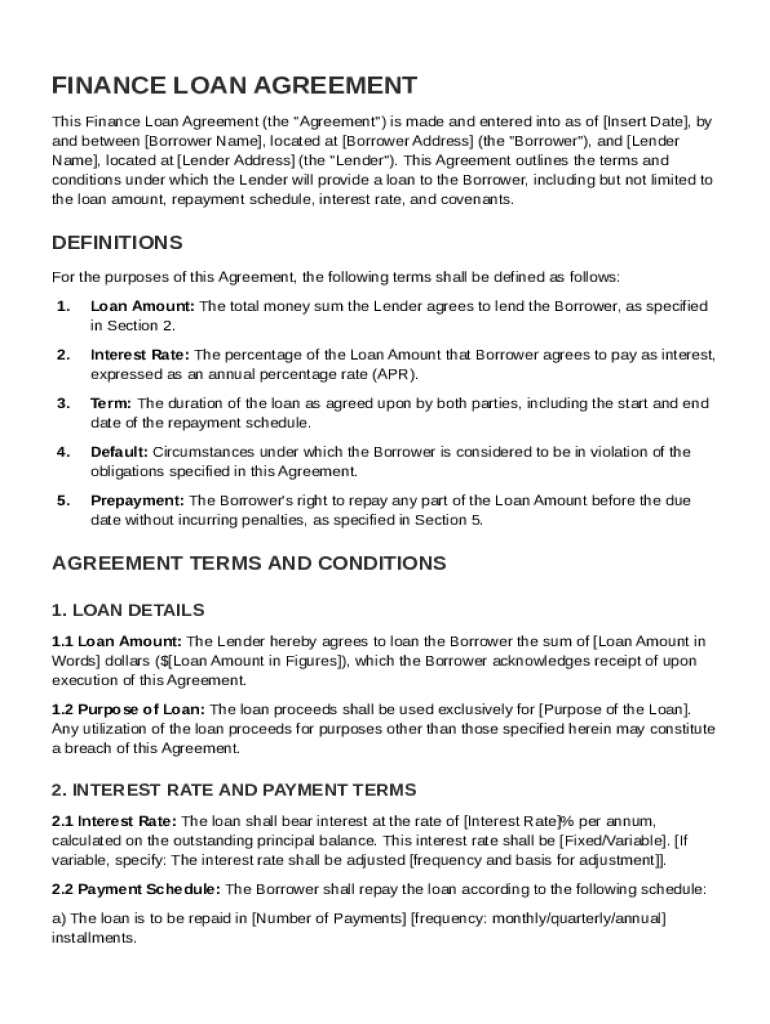

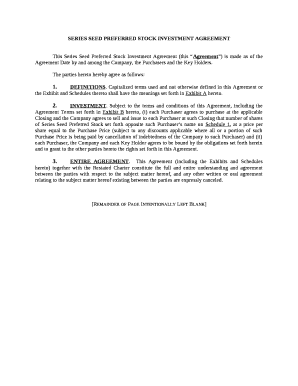

A Finance Loan Agreement Template is a legally binding document that outlines the terms and conditions between a lender and a borrower. It specifies details like the loan amount, interest rate, repayment schedule, and duties of both parties involved. By clearly defining terms such as Default and Prepayment, both parties have a mutual understanding of expectations, ensuring transparency and minimizing potential disputes. The template often contains provisions related to collateral, outlining what assets the borrower commits to securing the loan. Additionally, it includes information about remedies available to the lender in the event of a default, thus protecting the lender's interests. This document is governed by the laws of a specified jurisdiction, meaning that legal proceedings related to the loan agreement would adhere to the laws of the chosen area.

Key Elements of the Finance Loan Agreement Template

The Finance Loan Agreement Template contains multiple crucial sections that must be addressed comprehensively for the document to be effective. First, the loan amount and interest rate need to be explicitly stated. This section usually includes detailed calculations to ensure the borrower fully understands the cost of the loan over time. Next, the repayment schedule outlines when and how payments are to be made, offering clarity through tables or timelines. It's equally important to include obligations of both parties, emphasizing the borrower's duty to use the loan responsibly and the lender's commitment to providing funds under the agreed terms. Moreover, the collateral specified in the agreement must be described with precision, including the type and value of assets. Lastly, the agreement should detail other critical components, such as amendment processes, conditions for termination, and the severability clause, ensuring the agreement remains legally enforceable even if some parts become invalid.

Steps to Complete the Finance Loan Agreement Template

-

Collect Required Information: Gather all necessary details about the lender, the borrower, and specifics of the loan itself, such as the amount, interest rate, and repayment schedule.

-

Draft Initial Terms: Begin by filling out sections related to the loan's terms, including repayment timelines and interest calculations.

-

Specify Collateral: Clearly detail any assets being offered as collateral. Include descriptions and estimated values.

-

Outline Default and Prepayment Terms: Define what constitutes a default and the implications of such an event, as well as any prepayment conditions and penalties.

-

Review Legal Terms: Ensure that the document adheres to state-specific laws and any other relevant legal guidelines.

-

Consult Legal Counsel: Before the finalization, it's wise to have a lawyer review the document to confirm all legal bases are covered and that the agreement is enforceable.

-

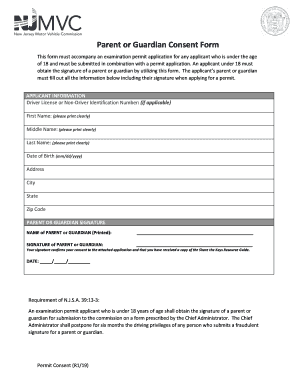

Signatures and Notarization: Once the document is complete and verified, both parties should sign it in the presence of a notary to legitimize the agreement.

Who Typically Uses the Finance Loan Agreement Template

This template is broadly used by different types of financial entities, businesses, and individuals. Commercial banks and financial institutions frequently use these agreements when lending to small businesses or corporations. Private lenders and investors also rely on such a template to outline terms when providing personal loans or business loans. Within businesses, the document is crucial for structuring loans among stakeholders or between companies and their affiliates. This agreement is essential for any transaction where a formal loan structure with clearly defined terms is required, ensuring mutual understanding and legal protection for all involved parties.

Important Terms Related to Finance Loan Agreement Template

- Principal: The original sum of money borrowed before interest and fees are added.

- Interest Rate: The percentage charged on the principal, which affects total repayment.

- Collateral: Any asset pledged by the borrower, like real estate or equipment, to secure loan repayment.

- Default: A condition in which the borrower fails to meet the payment schedule or other agreed terms.

- Prepayment: The act of paying off a loan early, which may incur penalties or fees based on the agreement's terms.

- Amortization Schedule: A detailed table showing each loan payment, delineating principal reduction and interest payments.

Legal Use of the Finance Loan Agreement Template

The agreement must meet specific legal criteria to be enforceable. It needs to explicitly include the legal names of both parties, defined obligations, and all terms related to the loan conditions. The document should comply with the Uniform Commercial Code (UCC) or other applicable state laws, ensuring it is recognized as valid in legal proceedings. This agreement often requires notarization to add an extra layer of legal authentication, verifying the identities of the signatories. Furthermore, the agreement stipulates how legal notices should be communicated between parties, ensuring clear channels for amendments or addressing violations.

State-Specific Rules for the Finance Loan Agreement Template

Different states in the U.S. have variations in regulations governing loan agreements, affecting interest rates, lender liability, and borrower protections. For instance, usury laws dictate maximum allowable interest rates for loans, which may vary considerably from one state to another. In some jurisdictions, certain fees may be restricted, or additional disclosures may be mandatory, meaning lenders must be diligent in understanding and adhering to these local laws. Additionally, processes for repossession or foreclosure on collateral can differ, impacting how remedies are pursued in cases of default.

Examples of Using the Finance Loan Agreement Template

Examples of scenarios where the Finance Loan Agreement Template is used include personal loans for major purchases, like home improvement or education expenses. Small businesses might employ this agreement when securing a loan to expand operations or purchase new equipment. Another example could be real estate transactions, where the agreement outlines the terms under which investors fund property purchases. Cross-company loans, where one entity extends financial assistance to another within a corporate group, also utilize this type of document to formalize terms and conditions. These diverse applications highlight the template's versatility and essential role in structuring formalized, fair loan arrangements.