Definition & Meaning

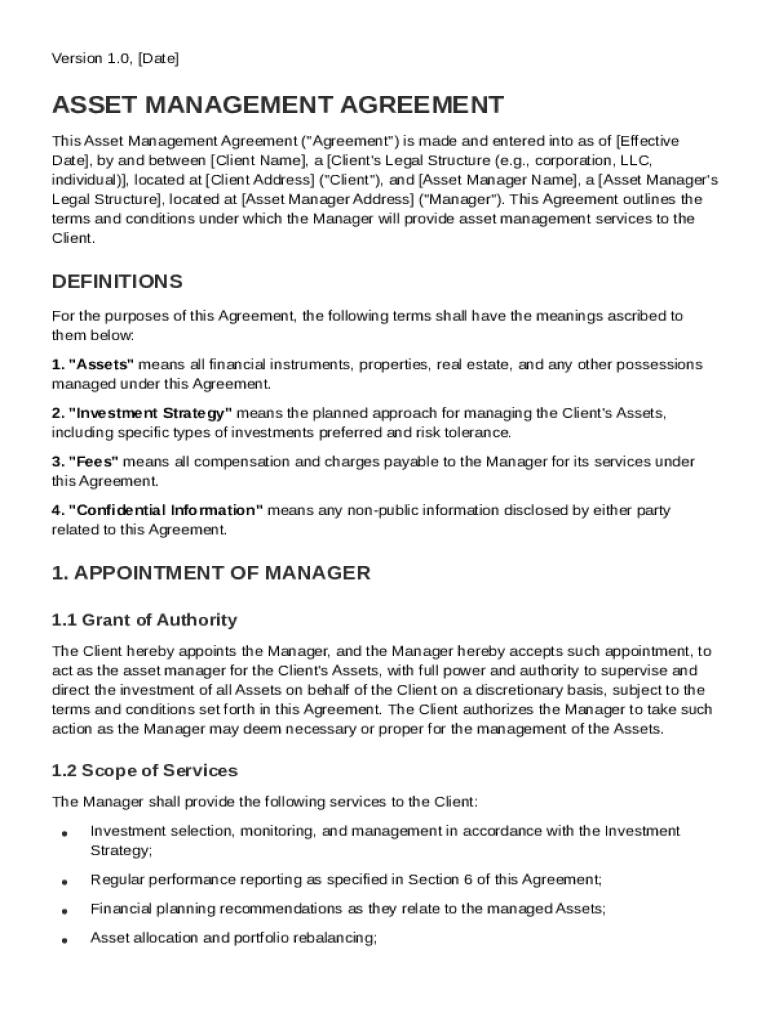

An Asset Management Agreement Template is a legally binding document used to establish and outline the terms and conditions between a client and an asset manager for the management of the client's assets. This agreement offers a structured approach to define the scope of services, compensation structures, investment objectives, fiduciary responsibilities, and more. It is essential for mitigating risks and ensuring that both parties clearly understand their rights and obligations.

The agreement covers several key areas, such as the appointment of the asset manager, the powers granted to them, and the reporting requirements. It also sets forth investment strategies aligned with the client's financial goals and preferences, including asset allocation and risk tolerance. By specifying these elements in detail, the template helps in fostering transparency and reducing potential disputes.

Key Elements of the Asset Management Agreement Template

The Asset Management Agreement Template encompasses several critical sections to ensure a comprehensive understanding between the involved parties.

- Appointment of Asset Manager: This section authorizes the asset manager to make investment decisions on behalf of the client within defined limits.

- Scope of Services: Clearly delineates the specific services the asset manager will provide, such as investment advisory, portfolio management, and financial planning.

- Compensation Structure: Details how the asset manager will be compensated, including fees or commission-based payments, and any performance-based incentives.

- Investment Objectives: Outlines the client's investment goals and strategies, taking into account their risk tolerance, time horizon, and expected returns.

- Responsibilities of Parties: Specifies the duties and obligations of both the client and the asset manager, including fiduciary responsibilities to act in the client's best interest.

Each element plays a vital role in the agreement, ensuring clarity and legally enforceable adherence to defined terms.

Important Terms Related to Asset Management Agreement Template

To effectively utilize an Asset Management Agreement Template, comprehension of the relevant terminology is crucial.

- Fiduciary Duties: Legal obligation of the asset manager to act in the client's best interests.

- Investment Portfolio: A collection of assets that the asset manager oversees and manages.

- Asset Allocation: The process of distributing investments among various asset categories like stocks, bonds, and real estate.

- Indemnity Provisions: Clauses providing protection against certain potential losses or damages.

- Governing Law: Legal framework that governs the terms of the agreement, typically based on state or federal laws.

Understanding these terms facilitates effective communication and minimizes misunderstandings between the client and the asset manager.

Legal Use of the Asset Management Agreement Template

The legal use of an Asset Management Agreement Template varies depending on jurisdiction, but generally, it must comply with federal and state laws in the United States. The agreement should include provisions to adhere to relevant securities regulations and financial laws to ensure its enforceability.

- Compliance with Applicable Laws: Ensures operations align with relevant laws, such as the Investment Advisers Act of 1940.

- Confidentiality Obligations: Protects sensitive client information from unauthorized access or use.

- Amendment Conditions: Specifies how revisions to the agreement will be handled, ensuring both parties consent to any changes.

It's crucial to tailor the document to comply with specific legal requirements and best practices, possibly involving legal counsel for review.

How to Use the Asset Management Agreement Template

Using an Asset Management Agreement Template efficiently requires a systematic approach. Here’s a step-by-step guide:

- Review the Template: Start with a comprehensive review of the template to identify areas relevant to your specific situation.

- Customize the Sections: Modify sections such as scope of services, compensation, and investment objectives to reflect your unique objectives and preferences.

- Consult Legal Counsel: Engage with a legal professional to ensure compliance with applicable laws and adequate protection against potential liabilities.

- Discuss with Stakeholders: Collaborate with anyone involved, like co-investors or financial advisors, to ensure mutual understanding and consent.

- Finalize and Execute: Once all edits and discussions are complete, sign the agreement in the presence of relevant parties, ensuring the inclusion of e-signatures if executing digitally.

Documenting the process is crucial for tracking and future reference.

Steps to Complete the Asset Management Agreement Template

Completion of the Asset Management Agreement Template involves several structured steps:

- Gather Information: Compile all necessary information about the client, asset manager, and any investment goals and strategies.

- Draft the Agreement: Use the template to draft the comprehensive agreement, ensuring all key sections are addressed.

- Internal Review: Conduct a meticulous internal review to ensure accuracy and completeness.

- Legal Assessment: Have a legal expert assess the agreement for compliance and risk management.

- Revise as Needed: Make any revisions based on legal feedback and internal evaluations.

- Final Review and Approval: Conduct a final review, obtain approvals, and execute the agreement.

- Record Keeping: Store the finalized document in a secure location for easy access and future reference.

Each step ensures precision and reduces the risk of oversight or error.

Who Typically Uses the Asset Management Agreement Template

Various entities utilize the Asset Management Agreement Template for asset management needs:

- Individuals: High-net-worth individuals seeking professional management of personal investments.

- Corporations: Businesses looking to maximize return on their investment portfolios or manage pension funds.

- Trusts and Estates: Executors of estates or trustees managing trust assets.

- Funds and Institutions: Hedge funds or mutual funds hiring asset managers for professionally managing complex portfolios.

These entities rely on the template to establish formal relationships and achieve clearly defined investment objectives.

State-Specific Rules for the Asset Management Agreement Template

State-specific rules can influence the terms and enforceability of an Asset Management Agreement Template. It's vital to consider:

- State Securities Regulations: Compliance with the state's rules regarding investment advisory services and practices.

- Licensing Requirements: Verification that the asset manager has the appropriate licenses mandated by state authorities.

- Governing Law Preferences: Incorporating the preferred state laws into the agreement, which may impact dispute resolution and arbitration processes.

These considerations ensure the document aligns with the specific legal landscape in which it operates and maintains its integrity and enforceability.