Definition & Meaning

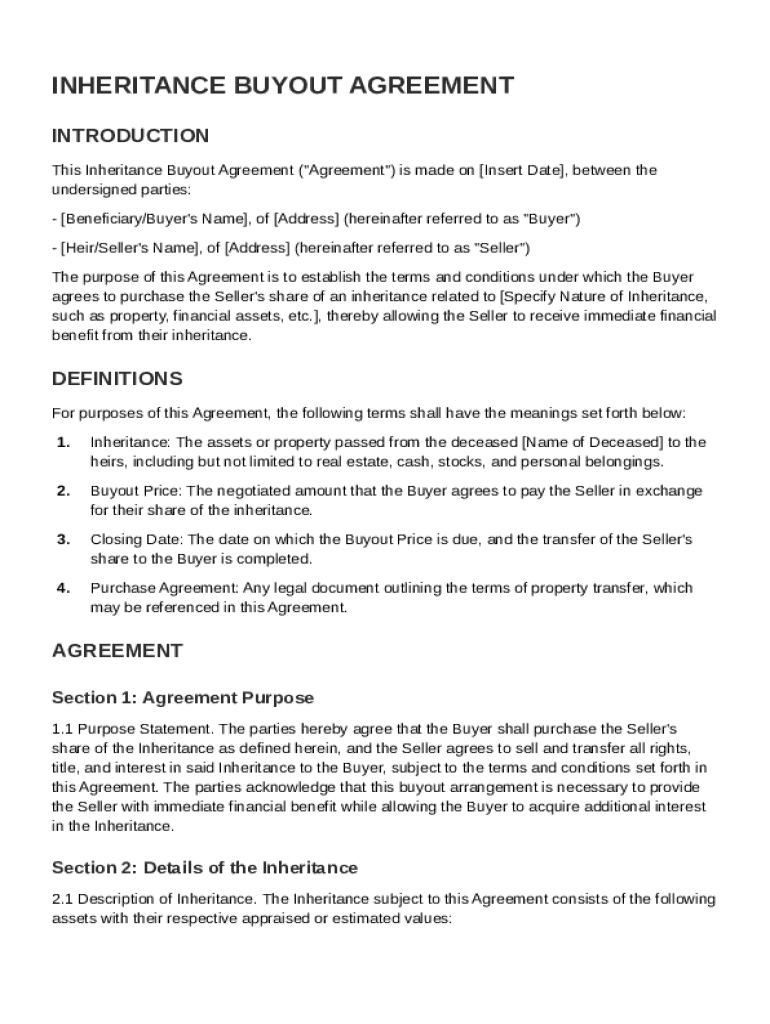

An Inheritance Buyout Agreement, formalized through a template, is a legal document that facilitates the transfer of inherited property from one party (the Seller) to another (the Buyer). This agreement outlines the conditions under which a buyer agrees to purchase a seller's share of an inheritance, which provides immediate financial benefits to the seller. Key terms defined within the agreement include 'Inheritance,' 'Buyout Price,' and 'Closing Date.' By clarifying these terms, the document helps avoid misunderstandings and ensures both parties are fully aware of their rights and obligations during the transaction process.

How to Use the Inheritance Buyout Agreement Template

Using the Inheritance Buyout Agreement Template involves several steps to ensure both parties' interests are protected. Firstly, download or access the template via an online platform such as DocHub. Once opened, review the document to understand each section thoroughly. Begin by filling out relevant information, including the names and contact details of both buyer and seller. Specify the details of the property or assets involved, the agreed buyout price, and the closing date. Make sure to customize any additional clauses that may pertain to the specific agreement within legal boundaries. After inputting all required details, review the document to ensure accuracy and completeness before proceeding to signatures.

Important Considerations

- Identification of Parties: Clearly state the full names and addresses.

- Asset Descriptions: Include detailed descriptions of the inherited assets.

- Financial Terms: Precisely outline the buyout price and payment structure.

Who Typically Uses the Inheritance Buyout Agreement Template

The Inheritance Buyout Agreement Template is used primarily by individuals inheriting property or assets but wishing to sell their share to another party. This scenario often arises among siblings or other family members who jointly inherit assets. Additionally, estate planners and legal professionals assisting clients with estate resolution may use this template. Real estate agents and financial advisors might also engage with the document to facilitate smoother transactions for their clients. This template ensures that all parties involved in the inheritance buyout have a clear, legally binding agreement that specifies their rights and responsibilities.

Key Elements of the Inheritance Buyout Agreement Template

The template encompasses several key elements that ensure comprehensive coverage of the inheritance transaction. These include a clear identification of the parties involved and a detailed description of the inherited property or assets. The document outlines the closing date, specifies the buyout price and payment terms, and delineates each party's responsibilities. The template may also include legal protections such as indemnification clauses and representations and warranties. These elements serve to protect the interests of the buyer and seller and assist in enforcing the agreement.

Essential Clauses

- Representation & Warranties: Assurances given by both parties regarding the assets.

- Indemnification Provisions: Outlines compensation for any potential losses.

- Governing Law: Specifies the legal jurisdiction that oversees the agreement.

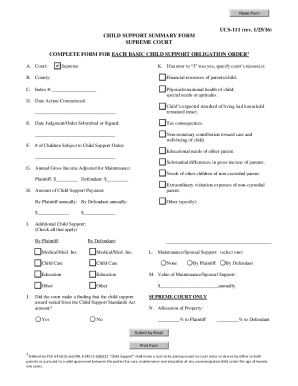

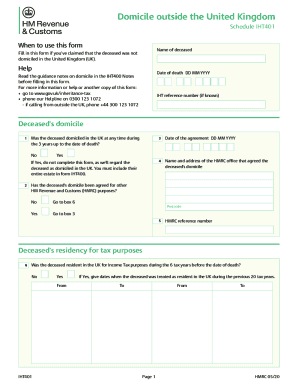

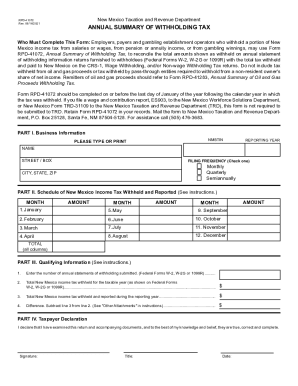

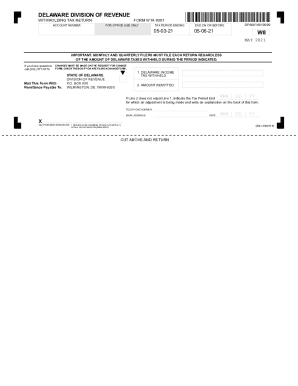

State-Specific Rules for the Inheritance Buyout Agreement Template

When completing an Inheritance Buyout Agreement, it's crucial to be aware of state-specific legal requirements that may affect the transaction. Each state in the U.S. might have unique rules concerning inheritance, property transfer, and applicable taxes. For instance, some states may have additional requirements for notarization, while others might enforce specific inheritance laws that affect property rights or buyer-seller responsibilities. It is advisable to consult with a local attorney or legal expert familiar with real estate and inheritance laws in the relevant state to ensure compliance with all necessary legal obligations.

Legal Use of the Inheritance Buyout Agreement Template

The legal use of the Inheritance Buyout Agreement Template ensures that the rights and obligations of all involved parties are formally recognized and enforceable. This document serves as a binding contract that protects both the buyer and the seller by clearly stating the terms of the property transfer. It provides legal clarity and protection by detailing each party's rights and responsibilities and specifying the consequences of breach or non-compliance. The agreement's binding nature, along with its representations and indemnification clauses, enhances its legal stature, thereby minimizing the risk of disputes and potential litigation.

Steps to Complete the Inheritance Buyout Agreement Template

- Gather Information: Collect all necessary information about the inheritance and the involved parties.

- Customize the Template: Tailor the template to reflect unique aspects of the transaction.

- Detail the Terms: Enter the buyout price, payment terms, and closing date.

- Review Clauses: Ensure all terms, representations, and indemnifications are understood and agreed upon.

- Execute the Agreement: Have parties sign where indicated, ensuring any required notarization or witness signatures are obtained.

Subsections

- Payment Detail: Clearly set out any deposits, installment plans, or final payment dates.

- Signatures: Include space and directives for signing parties and witness acknowledgements.

Examples of Using the Inheritance Buyout Agreement Template

The Inheritance Buyout Agreement Template can be utilized in various real-world scenarios to streamline the property transfer process. For instance, two siblings inheriting a family home may decide that one will keep the home, requiring a buyout agreement. Another scenario could involve a business partner inheriting shares of a company that they wish to sell to their current partner. Each example showcases the template's adaptability to different types of inherited property, ensuring a straightforward, legally protected transaction for all parties. These use cases highlight the template's role in minimizing disputes and facilitating transparent buyout processes.