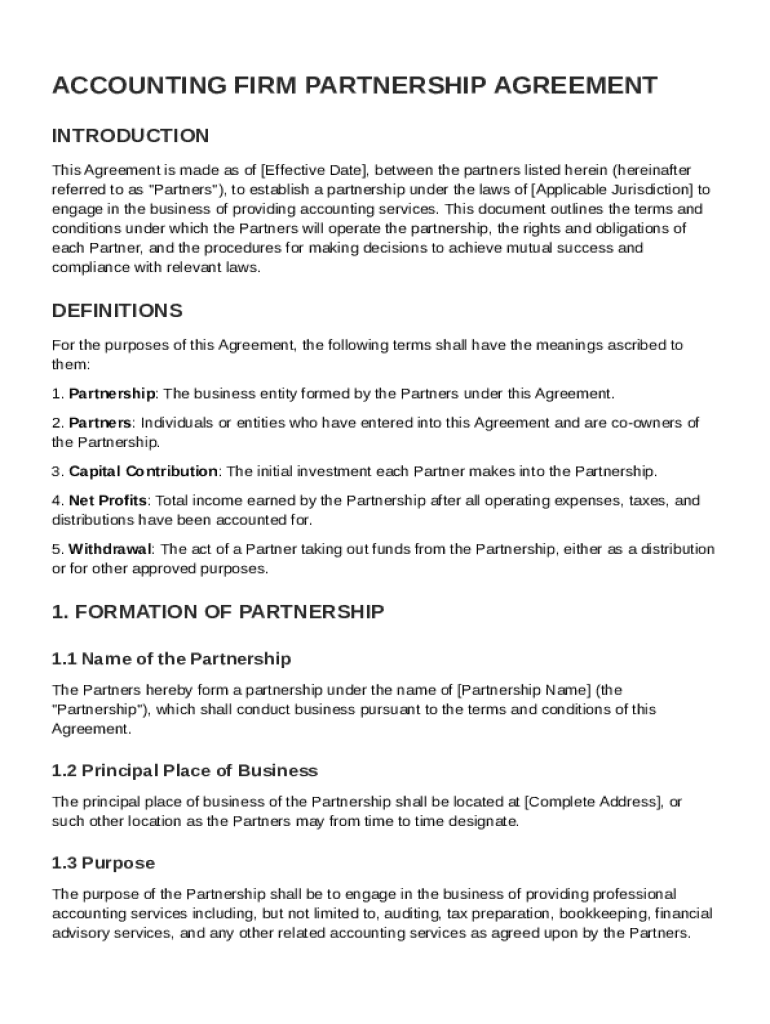

Definition and Purpose of an Accounting Firm Partnership Agreement Template

An Accounting Firm Partnership Agreement Template is a structured document designed to outline the legal and operational framework for partners entering into a business venture within the accounting sector. This template serves as a foundation for establishing partnerships, delineating responsibilities among partners, and detailing the allocation of profits and losses. It sets the ground rules for capital contributions, the overall management approach, and the methods for resolving disputes. This agreement is designed to safeguard the interests of all parties involved, ensuring clarity and compliance with applicable laws.

How to Use the Accounting Firm Partnership Agreement Template

Utilizing this template involves several key steps to tailor it to your specific partnership needs:

-

Review the Template: Begin by carefully reading through the entire document to understand its structure and terminologies.

-

Customize Partnership Details: Include specific information such as the names of the partners, the business name, and the business address.

-

Define Financial Contributions: Clearly specify each partner's capital contribution and the percentage of ownership.

-

Set Management Roles: Outline the decision-making processes and assign managerial roles as agreed upon by all partners.

-

Finalize and Sign: After customization, review the document with all partners and consult legal counsel if necessary before signing.

Key Elements of the Accounting Firm Partnership Agreement Template

-

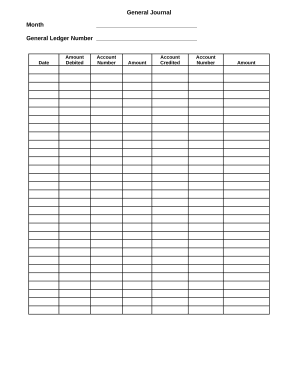

Capital Contributions: Specifies the initial financial investments made by each partner and how these assets are managed.

-

Profit and Loss Distribution: Details how profits and losses will be shared among partners based on their respective contributions and roles.

-

Management Structure: Describes the organization of the partnership including partner duties, responsibilities, and decision-making authority.

-

Withdrawal and Admission of Partners: Provides guidelines for adding new partners or the exit process for existing ones.

-

Confidentiality Obligations: Outlines the duty of partners to maintain the confidentiality of proprietary business information.

Steps to Complete the Accounting Firm Partnership Agreement Template

-

Gather Necessary Information: Collect relevant data including personal information of partners, business registration details, and financial terms.

-

Review and Understand Each Clause: Ensure all partners understand and agree to the terms included in the agreement.

-

Custom Tailor as Needed: Modify sections to fit the unique aspects of your partnership arrangement.

-

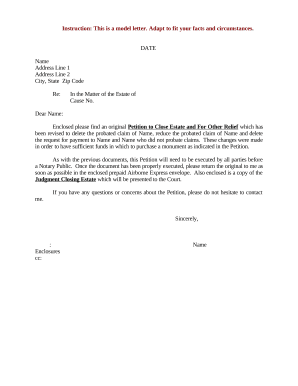

Seek Legal Advice: For a legally sound contract, consulting a professional attorney is recommended.

-

Execute the Agreement: Once all changes are made and consensus is reached, all partners should sign the document in the presence of a witness.

Legal Aspects of an Accounting Firm Partnership Agreement Template

-

Compliance with U.S. Laws: Ensures that the agreement adheres to federal and state regulations governing partnerships.

-

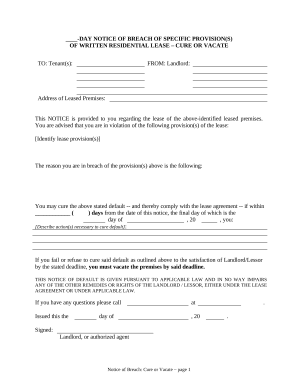

Dispute Resolution Mechanisms: Includes procedures for resolving conflicts such as mediation or arbitration.

-

Binding Nature: Once signed, the agreement becomes a legally binding document enforceable by law.

Important Terms to Understand in an Accounting Firm Partnership Agreement

-

General Partner: A partner involved in managing the business and liable beyond their initial investment.

-

Limited Partner: Typically an investor not involved in daily operations and whose liability is limited to their contribution.

-

Fiduciary Duty: The legal obligation to act in the best interest of the firm and its partners.

-

Dissolution Clause: Describes the conditions under which the partnership may be terminated.

Business Types That Benefit Most from an Accounting Firm Partnership Agreement

-

Small to Mid-Sized Accounting Firms: Start-ups or growing businesses aiming for clear governance and operational guidelines.

-

Family-Owned Business Ventures: Enterprises owned by multiple family members for streamlined decision-making processes.

-

Professional Corporations: Groups of certified accountants forming a joint venture to pool resources and expand clientele.

Examples of Using the Accounting Firm Partnership Agreement Template

-

Case Study: Smith & Brown LLP: Two accountants form a limited liability partnership, using the template to outline profit sharing and roles, thereby avoiding potential disputes.

-

Scenario: Expansion Plan: An existing accounting firm transitions from a sole-proprietorship to a partnership to bring in new expertise, customizing the agreement for incoming partners.

By providing a comprehensive framework, this template aids in forming a clear and legally robust partnership agreement, ensuring both legal protection and a defined path for success.