Definition & Meaning

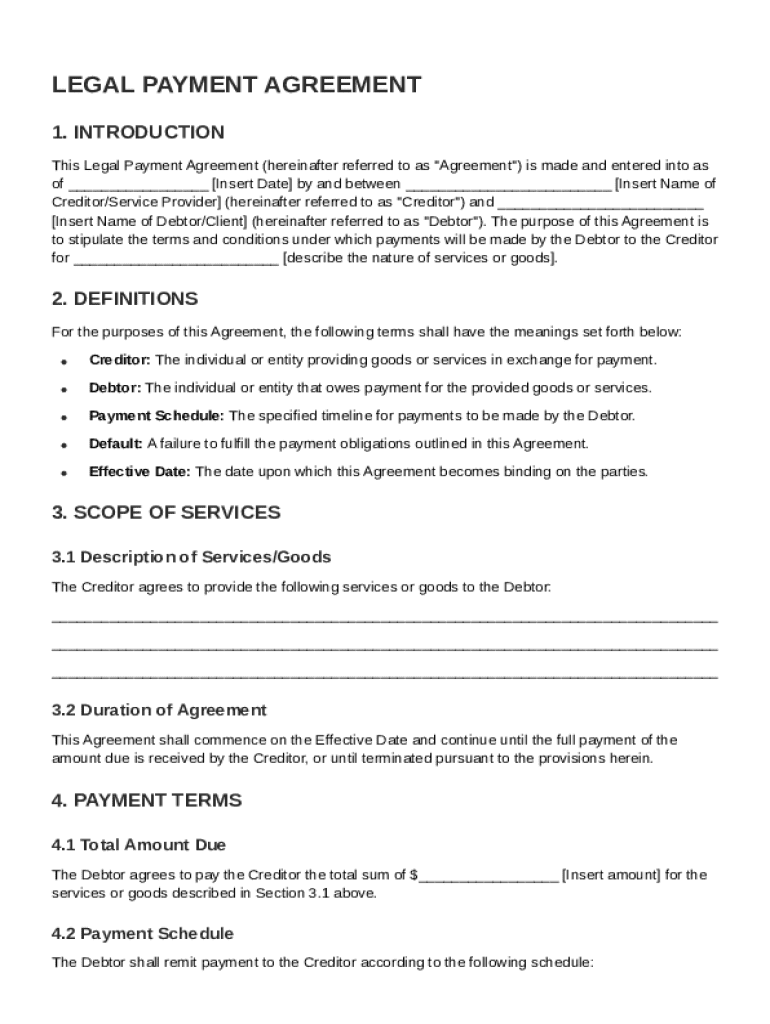

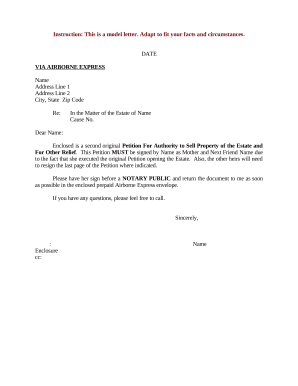

A Legal Payment Agreement Template is a standardized document that clarifies the terms and conditions related to payment obligations between a creditor and a debtor. This template facilitates the formalization of agreements where one party provides a good or service and the other party commits to compensation. Key components of this agreement often include definitions of involved parties, comprehensive payment schedules, methods of payment, stipulations for late fees, and termination guidelines. Its primary objective is to ensure clarity, enforceability, and understanding for all entities involved, mitigating the likelihood of disputes or misunderstandings.

Core Components

- Parties Involved: Clearly identifies the creditor supplying goods or services and the debtor responsible for payment.

- Payment Schedules: Specifies the timing and frequency of payments, including any due dates for installments.

- Methods of Payment: Enumerates acceptable payment options like electronic funds transfers, checks, or other agreed methods.

- Governing Law: Defines the legal framework applicable to the agreement to clarify resolution procedures for any disputes.

How to Use the Legal Payment Agreement Template

Using the Legal Payment Agreement Template involves several key steps to ensure it correctly represents the agreed-upon terms between parties and aligns with legal standards. This process requires input from both sides and sometimes a legal advisor to fine-tune the agreement to suit specific circumstances. Here’s a general guide on its usage:

Steps to Use

- Initial Review: Both parties should thoroughly read the template to understand its provisions.

- Customization: Modify sections related to payment amounts, schedules, and methods according to the specific transaction.

- Consultation: If needed, consult with legal professionals to address any specialty clauses or additional protection.

- Final Agreement: Ensure both parties agree on the contents and comprehend their obligations fully.

- Signatures: Obtain signatures from all parties to formalize and validate the agreement.

Considerations

- Accuracy: Ensure the details, like contact information and schedules, reflect current and accurate data.

- Legal Compliance: Verify that the template complies with state-specific laws if applicable, especially if parties operate in different jurisdictions.

Key Elements of the Legal Payment Agreement Template

The Legal Payment Agreement Template consists of multiple critical elements that must be meticulously detailed to ensure it is legally sound and effective. These components are crucial for defining responsibilities and expectations clearly and legally protecting all engaged parties.

Essential Components

- Definitions and Interpretations: Clearly articulates each party’s role and specific terms used in the document to prevent misinterpretation.

- Payment Obligations: Details each payment's quantity and currency, ensuring there is no ambiguity about the expectations.

- Termination Conditions: Specifies circumstances under which the agreement can be terminated, including breaches or failure to meet obligations.

Supporting Elements

- Late Payment Fees: Lists applicable fees or penalties for payments not made according to the schedule.

- Responsibilities of Each Party: Outlines what each party must do to fulfill their end of the agreement ahead of payment completion.

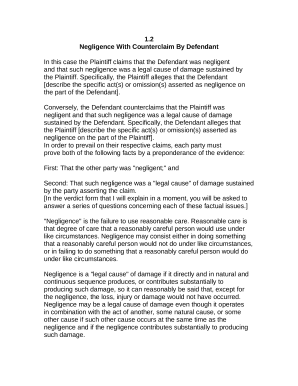

Legal Use of the Legal Payment Agreement Template

The Legal Payment Agreement Template is primarily used to formalize and document the financial agreements between parties in a legally binding manner. Its purpose is to clarify monetary obligations and provide a structured outline that can be used in legal contexts if disputes arise.

Legal Considerations

- Enforceability: Designed to be enforceable in a court setting, provided it meets specific legislative requirements local to the jurisdiction.

- Documentation: Acts as formal evidence of agreed terms and can serve as a reference point in case of legal proceedings or audits.

Steps to Complete the Legal Payment Agreement Template

Completing this document requires careful input by both participating parties to ensure accuracy and compliance with any relevant legal standards. The following steps outline a structured approach to fill out the agreement effectively:

Step-by-Step Procedure

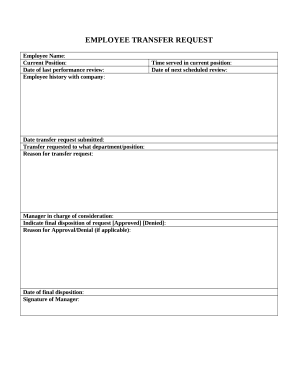

- Gather Necessary Information: Assemble all required details about the creditor, debtor, and the transaction specifics like amounts and dates.

- Fill Out Basic Information: Complete sections dealing with the identities and contact information of the involved parties.

- Define Payment Terms: Clearly document scheduling, amounts, and methods included in the payment agreement.

- Review and Revise: Double-check for accuracy, and agree on any additional stipulations or amendments with legal backing.

- Finalize and Sign: Once approved by all parties, sign the document to seal it as a formal agreement.

Examples

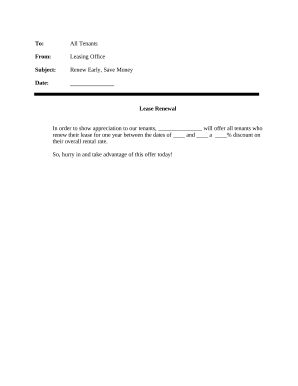

- Businesses: Common for service providers and manufacturers who extend credit terms to buyers.

- Individual Transactions: Sometimes used in personal loans to ensure repayment conditions are legally recorded.

State-by-State Differences

While the fundamental principles of a Legal Payment Agreement are similar, there may be specific legal considerations that vary by state. Some jurisdictions might have detailed requirements regarding what constitutes a compliant payment agreement.

Key Regional Variations

- Governing Laws: Each state might impose different rules about interest rates, fees, and general contractual obligations.

- Template Formats: Some states provide officially recognized formats or require notarization for enforceability.

Impact on Enforcement

Variances in state law dictate whether an agreement is enforceable within that jurisdiction, influencing its design and structure.

State-Specific Rules for the Legal Payment Agreement Template

Having state-specific knowledge is essential for ensuring the Legal Payment Agreement Template adheres to regional legal requirements, particularly when it involves inter-state transactions.

Legal Precedents

- Contractual Obligations: State-defined obligations might include restructuring terms or renegotiating upon mutually agreed circumstances.

- Usury Laws: Define acceptable interest rates and penalties applicable to the agreement, and exceeding these may render parts of the agreement void.

Customization Needs

Tailor the agreement to comply with local regulations while ensuring adherence to federal laws applicable across states.

Examples of Using the Legal Payment Agreement Template

Real-world application of the Legal Payment Agreement Template demonstrates its flexibility and practicality across various scenarios.

Practical Applications

- Business Operations: Companies routinely use these agreements to manage vendor payments or supply chain transactions.

- Individual Loans: Used in personal lending situations to formalize friend-to-friend or family loans for accountability.

Case Studies

- Startup Vendor Agreements: Small businesses use this as a tool to ensure cash flow while scaling operations.

- Legal Defense Tools: Employed in litigation to support claims regarding unpaid debts or disputed settlements through documented agreements.

By integrating the use of a Legal Payment Agreement Template within different contexts, parties benefit from clear documentation and reduced risks of misunderstanding or non-compliance.