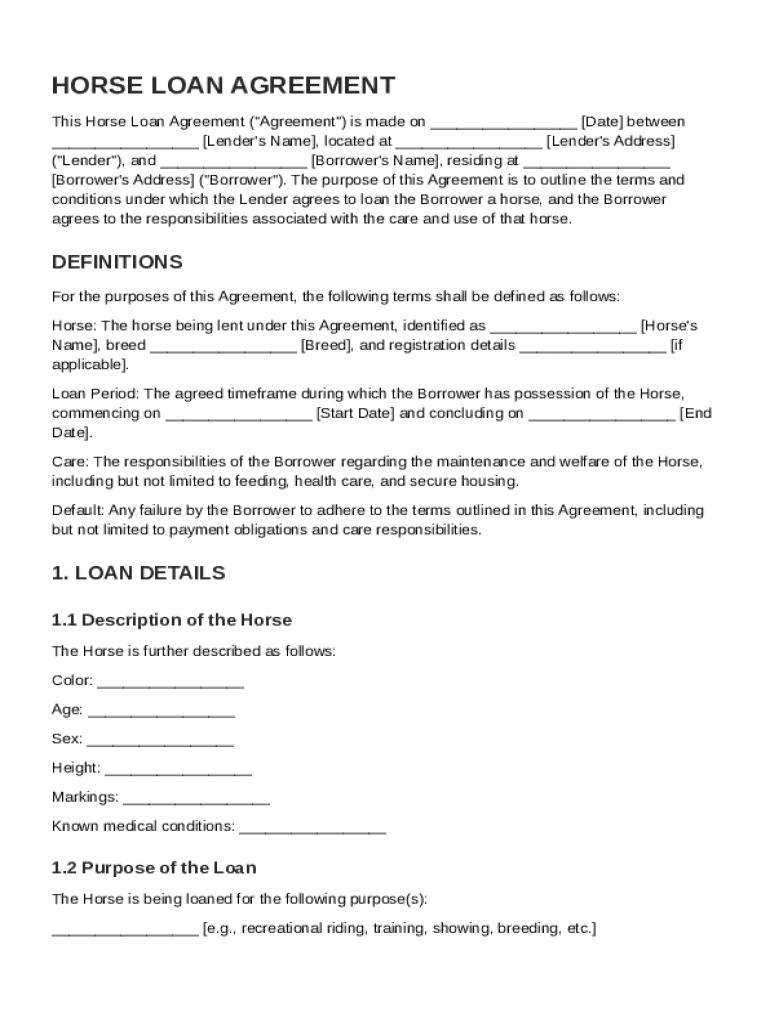

Key Elements of the Horse Loan Agreement Template

The Horse Loan Agreement Template outlines crucial terms and conditions essential for both lenders and borrowers. This document specifies the details of the horse being loaned, the responsibilities of each party, and the conditions under which the loan operates. Typically, it includes:

- Loan Duration and Terms: Specifies the start and end date of the loan agreement, as well as any conditions for early termination.

- Payment Obligations: Details any payments or fees associated with the loan, including maintenance costs or insurance payments.

- Care and Maintenance Responsibilities: Outlines who is responsible for the horse's day-to-day care, including feeding, stabling, and veterinary services.

- Insurance Requirements: May require the borrower to insure the horse, typically covering liability, mortality, and major medical expenses.

- Ownership and Title: Makes clear that ownership of the horse remains with the lender throughout the duration of the loan.

- Default Consequences: Outlines the actions that may be taken if either party fails to comply with the terms of the agreement.

- Governing Law: Specifies the legal jurisdiction overseeing the agreement, usually based on the location of the lender.

These elements ensure both parties understand their commitments and rights, minimizing disputes and clarifying expectations.

Steps to Complete the Horse Loan Agreement Template

Filling out the Horse Loan Agreement Template involves several key steps to ensure all necessary information is accurately recorded. Here’s a structured approach:

-

Identify the Parties: Start by entering the full legal names and contact details of both the lender and the borrower.

-

Describe the Horse: Provide a thorough description of the horse, including breed, age, color, and any unique identifiers like microchip or registration numbers.

-

Set the Loan Terms: Clearly define the loan period, including start and end dates, as well as any conditions for renewal or early termination.

-

Outline Responsibilities: Specify who will be responsible for the horse’s care, including feeding schedules, stabling arrangements, and veterinary care.

-

Include Payment Terms: Detail any financial agreements, such as loan fees, insurance premiums, or transportation costs.

-

Establish Legal Provisions: Include clauses for default consequences, governing law, and dispute resolution methods.

-

Review and Sign: Each party should thoroughly review the agreement to ensure all terms are correct and agreeable before signing. It’s advisable to have legal counsel review the document for compliance with state laws.

Completing this template with precise details helps prevent misunderstandings and legal issues down the line.

Legal Use of the Horse Loan Agreement Template

Utilizing the Horse Loan Agreement Template within legal frameworks ensures both parties are protected under the law. This document:

- Establishes Legal Rights: Clearly delineates the rights and duties of both the lender and borrower, preventing unilateral modifications or interpretations.

- Ensures Compliance: Adhering to state laws and requirements, the agreement serves as a legal contract that can be enforced in court if necessary.

- Records Consent and Intent: By signing, both parties acknowledge their understanding and agreement to terms, which is critical in the event of disputes.

- Protects Ownership Rights: Maintains the horse's ownership with the lender, even during the duration of the loan, safeguarding against unauthorized sales or transfers.

- Facilitates Conflict Resolution: Specifies procedures for dispute resolution, making it easier to handle legal disagreements efficiently.

Ensuring that all legal considerations are met is vital for the security and peace of mind of both parties involved.

Who Typically Uses the Horse Loan Agreement Template

The Horse Loan Agreement Template is utilized by a variety of individuals and organizations involved in the horse industry. Typical users include:

- Private Horse Owners: Owners who want to lend their horses for competition, breeding, or leisure purposes without transferring ownership.

- Equestrian Centers: Facilities that provide horses for training or lessons but want to maintain control over the horses provided.

- Breeders: Breeders who lend horses for breeding purposes while retaining rights to foals or future breeding rights.

- Event Organizers: Organizations that need horses for specific competitions or events and seek formal agreements to maintain order.

- Horse Trainers: Trainers who use borrowed horses for client training or exhibitions while ensuring proper terms are adhered to.

Using this template helps these individuals define clear terms, reduce misunderstandings, and maintain legal protections.

State-Specific Rules for the Horse Loan Agreement Template

Different states may have specific rules impacting the Horse Loan Agreement Template. Here are some considerations:

- Governing Law: The agreement must specify which state’s law will govern the contract, which is typically the state where the lender resides.

- Liability Releases: Some states have particular statutes regarding liability waivers related to animal use or interaction, which should be included in agreements within those states.

- Insurance Requirements: The need for specific insurance types or coverages may vary by state, including thresholds for liability or care coverage.

- Contract Enforcement: States have varying rules regarding the enforcement of contract terms, which may affect default penalties or dispute resolutions.

- Property Laws: Understanding the impact of state property laws on the ownership titles of horses is crucial in agreements.

Consulting local legal experts and customizing the agreement to adhere to specific state regulations can prevent legal complications.

Important Terms Related to Horse Loan Agreement Template

When dealing with the Horse Loan Agreement Template, understanding certain key terms is essential:

- Lender: The owner of the horse who provides the horse on loan to another party.

- Borrower: The party who receives the horse on loan for the duration specified in the agreement.

- Loan Term: The duration for which the horse is loaned, including start and end dates.

- Insurance: Policies that protect against liabilities and insure the horse’s health.

- Maintenance: The care responsibilities for the horse, including feeding, stabling, and veterinary care.

- Default: Failure to meet the terms of the agreement, resulting in potential penalties or legal action.

- Governing Law: The legal jurisdiction whose laws will apply to the agreement.

Understanding these terms helps ensure proper usage and interpretation of the agreement.

Software Compatibility and Integration

DocHub offers seamless compatibility with various document formats, facilitating the effective editing and customization of the Horse Loan Agreement Template. Key features include:

- Format Support: Compatible with PDF, DOC, XLS, PPT, and TXT files, ensuring easy integration of the template with existing documents.

- Cloud Integration: Works smoothly with services like Google Drive, Dropbox, and OneDrive, allowing for easy import and export of documents.

- Document Editing Tools: Provides robust editing capabilities such as adding text, images, and electronic signatures directly into the document, ensuring full customization.

- Mobile and Desktop Accessibility: Enables edits from both desktop and mobile devices, allowing users to manage agreements from anywhere.

These capabilities make handling extensive agreements efficient, relieving much of the administrative burden associated with document management.

Penalties for Non-Compliance with Horse Loan Agreement

Failure to adhere to the terms outlined in the Horse Loan Agreement Template can result in several penalties, such as:

- Reclamation of Horse: The lender may reclaim the horse if the borrower fails to meet care or maintenance obligations.

- Financial Penalties: Non-compliance might trigger fines or require the borrower to cover additional costs for damages incurred due to negligence.

- Legal Action: Breach of contract could lead to legal disputes, with possible court actions to enforce compliance or seek damages.

- Loss of Future Opportunities: A history of non-compliance might affect the borrower's reputation in the equestrian community, limiting future loan opportunities.

Understanding these penalties helps underscore the importance of fulfilling all contractual obligations and maintaining open communication.