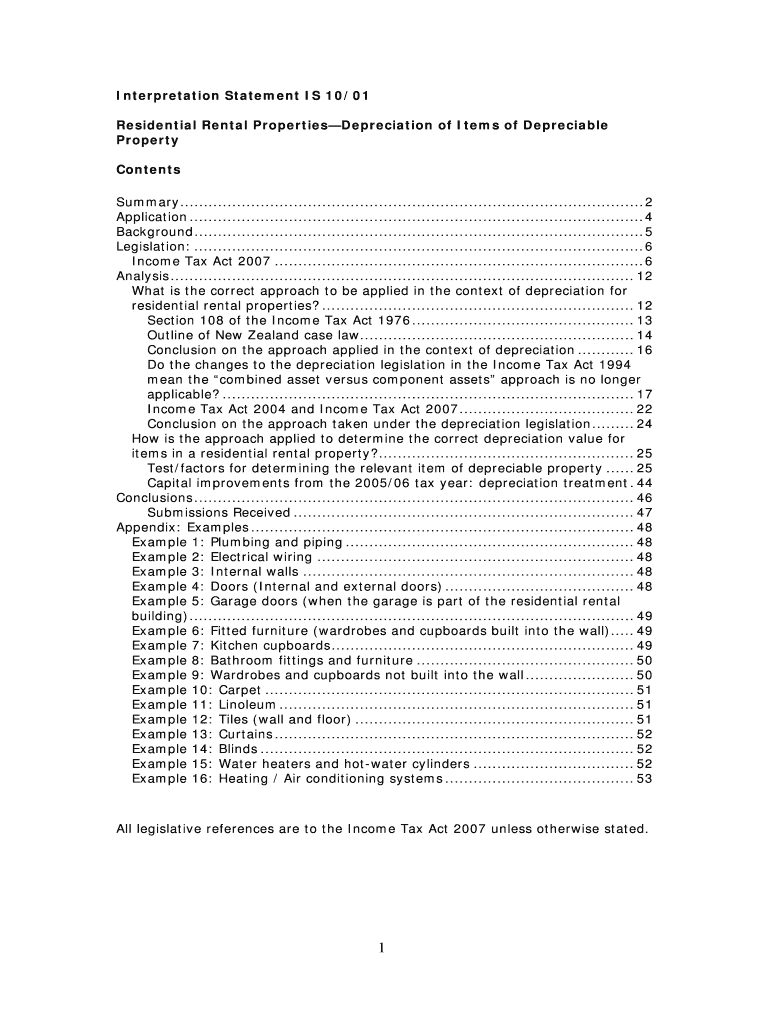

Definition and Meaning

The Interpretation Statement IS 10/01 outlines guidelines for the depreciation of residential rental property items. It defines how to determine whether an item is a separate depreciable asset or part of the building. This statement helps taxpayers understand what qualifies as a separate asset versus what should be depreciated with the building. The emphasis is on ensuring compliance with tax requirements by clearly distinguishing between these two categories. This aids in properly managing depreciation, ultimately affecting tax calculations.

Separate vs. Integral Assets

- Separate Assets: Items like appliances or furniture that are not integral to the building can be depreciated independently.

- Integral Assets: Structural components like plumbing or wiring that are part of the building are depreciated as part of the structure itself.

Consistency Across Tax Acts

- Ensures consistency in tax reporting by applying a combined asset versus component asset approach across various tax regulations, promoting uniformity in how assets are treated.

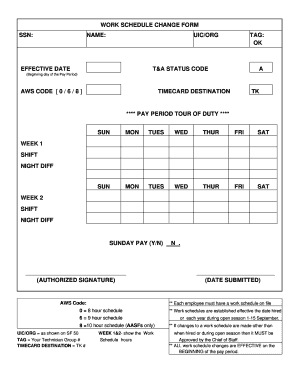

Steps to Complete the Interpretation Statement IS 10/01

Completing IS 10/01 involves a careful review and categorization of assets within residential properties. Following these specific steps ensures accurate depreciation reporting.

-

Identify Items: List all items within the property, separating those that are moveable from structural components.

-

Apply the Three-Step Test: Use the guidance provided to determine whether each item is a separate asset or part of the building.

-

Consult Relevant Legislation and Case Law: Refer to the applicable laws and past cases that resemble your property's situation.

-

Document the Findings: Clearly record the classification of each item, including justifications for your decisions.

-

Implement Depreciation Strategy: Calculate and apply the correct depreciation rates based on the classification for accurate tax reporting.

Key Elements of the Interpretation Statement IS 10/01

Understanding the components of IS 10/01 is crucial to properly apply its guidelines.

Three-Step Test

- A methodical approach to classify items accurately:

- Determine if the Item is Movable: Can the item be removed without causing damage?

- Assess Usage: Is the item used independently of the building?

- Check for Structural Integration: Does the item contribute to the building's function as a whole?

Depreciation Framework

- Defines how each classified item should be depreciated based on its role within the property structure.

Legal Use of the Interpretation Statement IS 10/01

IS 10/01 assists taxpayers in aligning with legal standards for property depreciation. By following this interpretation, one ensures compliance with the American tax code concerning asset classification and depreciation. It helps avoid disputes with tax authorities by providing clear guidelines backed by legal precedents.

Case Law References

- Offers insight into how similar depreciation issues have been resolved in court, which aids in forming a robust depreciation strategy.

Examples of Using the Interpretation Statement IS 10/01

Practical applications of IS 10/01 make its concepts easier to grasp and implement.

Case Study: Kitchen Renovation

- Scenario: A property owner renovates a kitchen, adding new appliances.

- Application: Appliances like refrigerators are separate assets due to their independent function and movability, while new cabinetry integrated into the structure are part of the building.

Real-World Application

- Work scenarios wherein electrical wiring upgrades are treated as integral parts, whereas standalone lighting fixtures can be depreciated separately.

IRS Guidelines

IS 10/01 operates within the framework set by the IRS for asset depreciation, ensuring compliance.

Alignment with Tax Acts

- The statement ensures procedures align with relevant IRS codes, reducing risks of audit issues and penalties due to misclassification.

Eligibility Criteria

Understanding who can utilize IS 10/01 is fundamental for its proper application. Generally, any taxpayer with residential rental properties in the U.S. can apply this interpretation to manage asset depreciation.

Qualifying Properties

- Primarily targets residential properties used for rental purposes but can be extended to mixed-use buildings with distinct documentation and classification.

Digital vs. Paper Version

The choice between using a physical or digital form depends on user preference, technology access, and integration with tax software.

Advantages of Digital Versions

- Efficiency and Convenience: Easily updated and integrated with tax software.

- Security: Digital versions often have better encryption and protection against loss or unauthorized access.

Paper Form Uses

- Useful for those preferring traditional methods or lacking tech access, though harder to update and store securely.

Understanding these elements allows taxpayers to accurately apply and benefit from the Interpretation Statement IS 10/01. Proper implementation ensures legal compliance and optimal property tax management.