Definition and Meaning of Online Forms

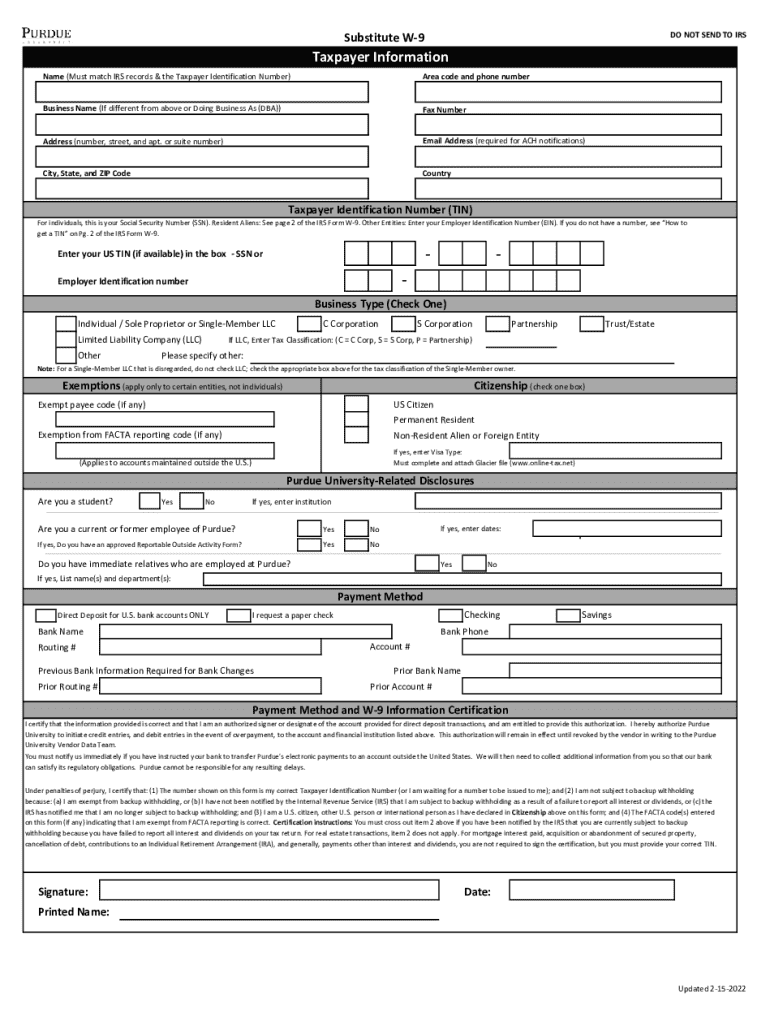

Online forms are digital versions of traditional paper forms, allowing users to input and submit information through a web platform. They can range from simple contact forms to complex tax forms, enabling various types of data collection and processing. Online forms offer advantages such as increased efficiency, reduced paperwork, and quick submission. For example, the Substitute W-9 form serves as an online tool for collecting taxpayer information, including crucial details like the Taxpayer Identification Number (TIN) and business type, thus streamlining financial documentation processes.

Steps to Complete the Form Online

Completing an online form involves several straightforward steps, designed to enhance user experience and data accuracy:

-

Access the Form: Navigate to the form's hosting platform, such as a government or business website, and find the specific form you need.

-

Enter Personal Information: Input personal details as prompted, such as your name, address, and contact information. For the Substitute W-9, provide your TIN and business type.

-

Complete Additional Sections: Address any additional sections related to specific needs, like exemptions or disclosures. Each section should be filled out according to its requirements.

-

Review and Confirm Entries: Carefully review all entered information to ensure accuracy and completeness, as errors might cause delays or rejections.

-

Sign Electronically: If the form requires a signature, use the electronic signature feature, which can include drawing, typing, or uploading a signature image.

-

Submit the Form: Finalize the process by submitting the form through the designated online portal, ensuring a record of submission is provided.

-

Save a Copy: Download or print a copy of the completed form for your records, which is recommended for any potential future references.

How to Obtain the Form Online

To obtain an online form, users typically need to follow these steps:

-

Visit the Relevant Website: Access the official website where the form is provided, such as a governmental or corporate portal. For tax-related forms like the Substitute W-9, this might include the IRS or a university site for affiliated forms.

-

Navigate to the Forms Section: Locate the 'Forms' or 'Resources' section on the website, which usually categorizes available forms for easier identification.

-

Identify Your Form: Search through the list to find the form you need, using search functionality or browsing through categories.

-

Download or Fill Online: Some platforms allow immediate online filling of forms, while others offer downloadable PDF versions for offline completion. Ensure you have the correct version and format that suits your completion preferences.

Legal Use of the Form Online

Understanding the legal implications of using online forms is crucial:

-

Compliance: Online forms must comply with regulations like the ESIGN Act, ensuring electronically signed documents hold the same legal weight as their paper counterparts.

-

Confidentiality: Sensitive forms, such as those involving taxpayer information, must incorporate robust security measures, like SSL encryption, to protect personal data.

-

Verification: An audit trail is often maintained for forms requiring signatures, documenting every interaction with the form to ensure authenticity and traceability, important in legal scenarios or disputes.

-

Archiving: Retaining copies of completed forms is recommended as they may be necessary for audits, legal disputes, or record-keeping.

Key Elements of an Online Form

Online forms consist of essential elements that ensure effectiveness:

-

Input Fields: Text boxes, drop-down menus, and checkboxes for entering varied data types.

-

Validation Controls: Features that verify data accuracy in real-time, minimizing user errors by enforcing formats or required field completion.

-

Instructions and Tips: Clear guidance to help users understand each section's purpose and proper filling methods, reducing mistakes and uncertainty.

-

Security Features: Data protection mechanisms, such as encryption and authentication, safeguarding user information from unauthorized access.

Digital vs. Paper Version

The transition from paper forms to digital formats offers distinct advantages:

-

Accessibility: Digital forms provide easier access, being available online without the need for physical distribution.

-

Efficiency: Submission processes are streamlined with built-in verification and submission functionalities, saving time and resources.

-

Environmentally Friendly: Reducing paper use benefits the environment, aligning with sustainable practices and reducing an organization's carbon footprint.

-

Enhanced Features: Online forms can incorporate interactive features, like dropdowns and file uploads, improving user experience as compared to static paper forms.

Software Compatibility for Handling Online Forms

Managing online forms effectively involves leveraging compatible software solutions:

-

Document Management Software: Tools like DocHub facilitate form editing, signing, and storing, offering an integrated approach to handling digital forms.

-

Accounting Software: For forms related to finance or taxation, compatibility with systems such as QuickBooks or TurboTax ensures seamless data import, enhancing accuracy and efficiency.

-

Cloud Storage Integration: Integration with services like Google Drive allows for easy storage, sharing, and collaborative work on online forms, promoting flexibility and teamwork.

Taxpayer Scenarios for Form Online Usage

Understanding different taxpayer scenarios tailors the online form usage:

-

Self-Employed Individuals: They must frequently submit forms like the Substitute W-9 when interacting with clients to verify their TIN and manage tax obligations effectively.

-

Students: In certain cases, students working under certain programs or as independent contractors may need to submit forms to confirm tax details.

-

Retired Individuals: They might need to provide forms related to investments or retirement plans, ensuring all income streams are adequately documented for tax purposes.

These practical scenarios illustrate the broad applicability of online forms across various user demographics, enhancing relevance and utility.