Key Elements of the Stanbic Bank Account Opening Form

The Stanbic Bank account opening form consists of several sections that are crucial for gathering comprehensive information about the applicant. These elements collectively facilitate the process of setting up a new bank account.

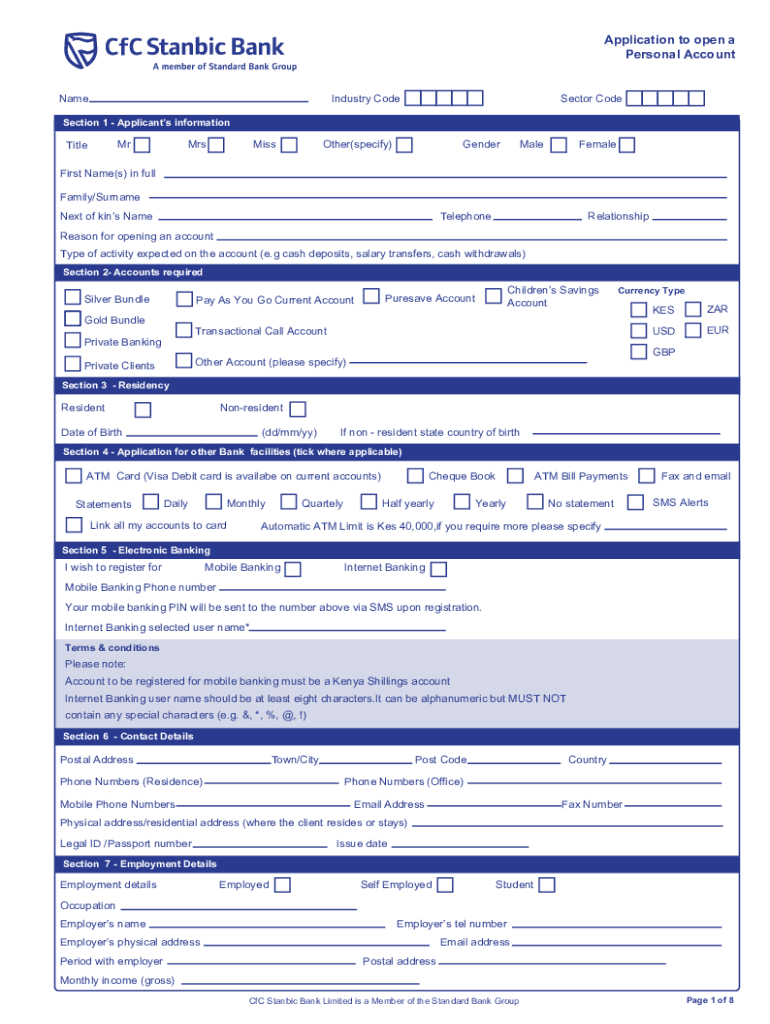

Personal Information

- Full Name: The applicant is required to provide their full legal name as it appears on official documents such as a government-issued ID or passport.

- Date of Birth: This is necessary to verify age and eligibility for account ownership.

- Contact Details: The form requires both physical and email addresses, along with phone numbers. This information enables the bank to communicate with the applicant effectively.

- Identification Numbers: The applicant must include personal identification numbers such as social security number or national ID, which are essential for verification and compliance with legal requirements.

Account Preferences

- Account Type Selection: Applicants can choose from various account types, such as savings, checking, or joint accounts. Each type has different features tailored to specific needs.

- Currency Choice: Depending on the applicant's requirements, they can select the currency in which they prefer to operate their account.

- Additional Services: Options for requesting ATM cards and electronic banking services are available. These facilities enhance convenience and accessibility for account management.

Employment Information

- Occupation Details: The form requires information about the applicant’s employment status, job title, and employer. This assists in understanding the financial background of the applicant.

- Income Information: Details about regular income help the bank assess the applicant’s financial health and tailor services accordingly.

Consent and Legal Agreements

- Marketing Consent: Applicants have the option to consent to receive marketing materials and promotional offers by choosing their preferred communication channels.

- Terms and Conditions: The document includes a comprehensive section outlining the terms related to account management, confidentiality, and compliance. Applicants must agree to these terms to proceed.

How to Obtain the Stanbic Bank Account Opening Form

Applicants can access the Stanbic Bank account opening form through multiple channels, ensuring accessibility and convenience.

Online Access

- Bank’s Official Website: The form is readily available for download or can be filled out directly on Stanbic Bank’s website. This method allows for convenience and efficiency, enabling applicants to complete the form at their own pace.

In-Person Requests

- Bank Branches: Prospective customers can visit local Stanbic Bank branches to request a physical copy of the form. Bank personnel are available to provide assistance and answer any related questions.

Steps to Complete the Stanbic Bank Account Opening Form

Completing the form accurately and thoroughly ensures a smooth account opening process.

- Read the Instructions Carefully: Before filling out the form, applicants should review all instructions to understand the requirements fully.

- Fill in Personal Information: Enter all personal details as required, double-checking for accuracy to prevent delays or rejections.

- Select Account Preferences: Indicate preferred account types and additional services like debit cards or online banking.

- Provide Employment and Financial Details: Include accurate employment information and income details to aid the bank in their assessment.

- Review Terms and Consent: Carefully read, understand, and agree to the terms and conditions, indicating consent for marketing communication if desired.

- Submit the Form: Depending on the chosen method, submit the form online or return it to a bank branch either by mail or in person.

Required Documents

Submitting the correct documents along with the application form is crucial for verification and approval.

- Identification Proof: A copy of a government-issued ID, such as a driver’s license or passport, is mandatory.

- Proof of Address: Utility bills or a lease agreement can serve as evidence of the applicant’s current residence.

- Income Proof: Recent pay stubs or employment letters may be required to substantiate income claims.

Application Process & Approval Time

Understanding the process and expected timelines is essential for applicants to manage their expectations.

Submission and Review

- Submission: Once the form and required documents are submitted, Stanbic Bank reviews the application for completeness and accuracy.

- Verification: The bank may contact the applicant or their employer for additional information or clarification as necessary.

Approval Timeline

- Processing Time: Typically, the application processing can take between seven to fourteen business days, depending on the completeness of the application and the verification process.

Legal Use of the Stanbic Bank Account Opening Form

Using the Stanbic Bank account opening form appropriately ensures compliance with legal standards and bank protocols.

Compliance and Verification

- Regulatory Compliance: The form complies with local and international banking regulations, ensuring a lawful account setup process.

- Data Protection: All information provided is safeguarded under data protection laws, ensuring applicant privacy and security.

Digital vs. Paper Versions

Applicants have the option to choose between digital and paper versions of the form based on their convenience and preference.

Benefits of Digital Forms

- Ease of Access and Use: Digital forms can be accessed and completed online, making them suitable for applicants who prefer managing tasks digitally.

- Time Efficiency: Submitting forms online can expedite the application review process, reducing wait times compared to paper submissions.

Advantages of Paper Forms

- Traditional Approach: Some applicants may prefer filling out a tangible form and submitting it in person for a more personal touch.

- Assistance Available: Bank staff can assist with filling out physical forms, offering guidance and answering any questions on the spot.

Software Compatibility

The Stanbic Bank account opening form is compatible with various document management platforms, including DocHub.

Supported Platforms

- DocHub Integration: Applicants can use DocHub to fill out, sign, and submit their form digitally. DocHub’s tools facilitate efficient document handling, annotation, and collaboration.

By understanding the various facets of the Stanbic Bank account opening form, applicants can ensure a seamless experience when establishing their new bank account.