Definition & Meaning

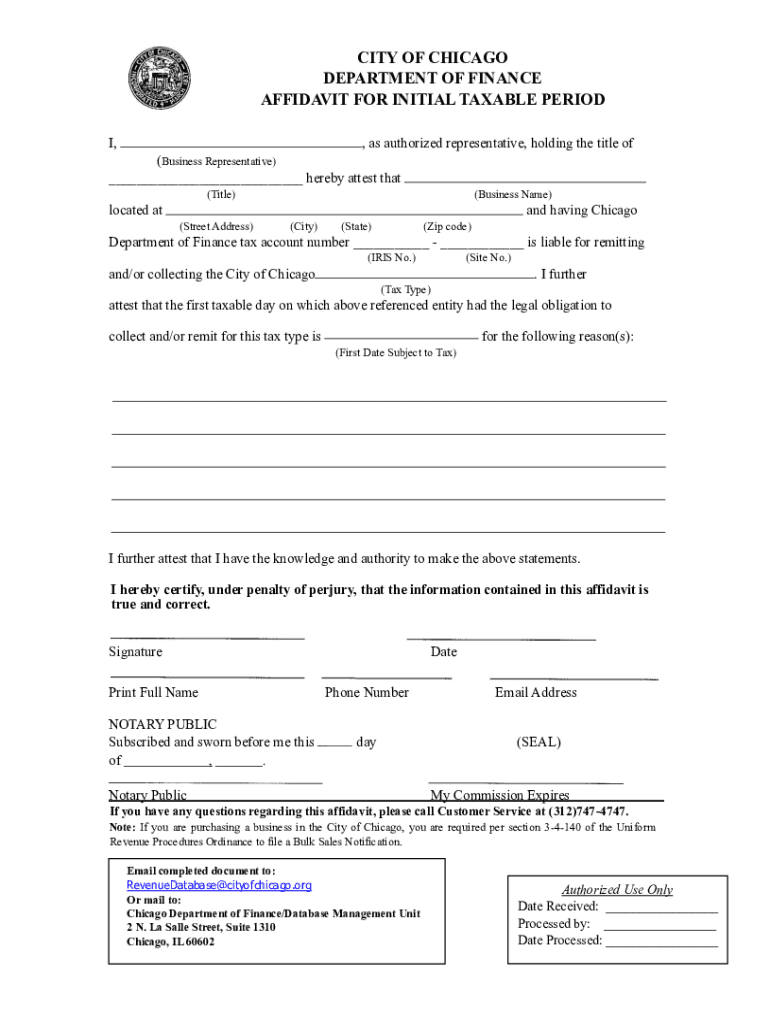

The "Affidavit for Initial Taxable Period" is a crucial document used by businesses to confirm their obligations regarding tax collection and remittance. This affidavit is a sworn statement that certifies a business's responsibility to collect and remit taxes to the relevant authority during its initial taxable period. It typically includes details such as the business name, address, and tax account number, along with the initial taxable day. The document must be signed and notarized to affirm the authenticity and accuracy of the information provided.

How to Use the Affidavit for Initial Taxable Period

Businesses can utilize the affidavit to formally acknowledge their tax obligations at the start of their business operations. This document is crucial for maintaining compliance with tax regulations. Once completed, the affidavit should be submitted to the appropriate government office, which in some cases might be the local Department of Finance. It serves as a formal record that the business has recognized its tax responsibilities and is prepared to engage in regular tax activities such as filing returns and making tax payments.

Steps to Complete the Affidavit for Initial Taxable Period

- Gather Required Information: Collect essential information such as business name, address, tax account number, and the date of your first taxable sale or activity.

- Fill Out the Form: Accurately enter the collected information into the affidavit, ensuring all fields are completed as required.

- Review for Accuracy: Double-check the details provided in the affidavit to confirm accuracy and completeness.

- Notarize the Affidavit: Arrange for the signed affidavit to be notarized to make it a legally binding document.

- Submit the Affidavit: Send the completed and notarized affidavit to the relevant authority, which may vary by location and business type.

Practical Example

Consider a new restaurant in Chicago. Upon opening, they need to file the "Affidavit for Initial Taxable Period" with the City of Chicago’s Department of Finance. This ensures they are on record as a tax-collecting entity from day one.

Key Elements of the Affidavit for Initial Taxable Period

The affidavit contains several essential components that must be completed accurately to ensure compliance:

- Business Name and Address: The formal registered name and physical location of the business.

- Tax Account Number: A unique identifier for the business issued by the tax authority.

- Initial Taxable Date: The specific date when the business's taxable activities began.

- Certification Statement: A declaration affirming the accuracy and truthfulness of the information provided.

- Signature and Notarization: The affidavit must be signed by an authorized company representative and notarized to validate the document's authenticity.

Legal Use of the Affidavit for Initial Taxable Period

Legally, the affidavit serves as a binding declaration of a business’s intent and obligation to commence tax-related operations. By submitting this form, a business commits to comply with tax laws applicable to its operations from the outset. It becomes part of the official records used by tax authorities to track compliance. Failure to properly complete or submit this affidavit may lead to legal consequences, including potential fines and penalties.

Filing Deadlines / Important Dates

Businesses must submit the affidavit within a specific timeline, typically before or shortly after initiating taxable activities. For instance, some jurisdictions might require filing within 30 days from the commencement of business operations. Missing these deadlines can result in penalties or delays in recognizing the business as a registered tax collection agent.

Required Documents

When preparing to complete the affidavit, businesses should have the following documents on hand:

- Business registration documents to verify legal name and structure.

- Tax identification numbers, including federal and state taxpayer IDs.

- Any relevant city or state permits, if applicable.

- A copy of previous tax documents if the business has undergone structural changes.

Penalties for Non-Compliance

Failing to file the affidavit on time or providing false information may lead to various penalties. These can include:

- Fines: Financial penalties imposed for each day of delay post the deadline.

- Legal Actions: Initiation of legal proceedings due to failure in meeting tax compliance requirements.

- Additional Scrutiny: Increased monitoring and audits by tax authorities to ensure compliance in other areas.

Example of Penalties

In Chicago, a business that fails to file the affidavit might incur immediate monetary fines and could also face ongoing assessments from the financial department, adding pressure to maintain compliance in future reporting periods.

These outlined aspects of the "Affidavit for Initial Taxable Period" reflect the document's importance within the broader framework of business tax obligations and the procedural steps necessary to ensure proper compliance.