Definition & Meaning

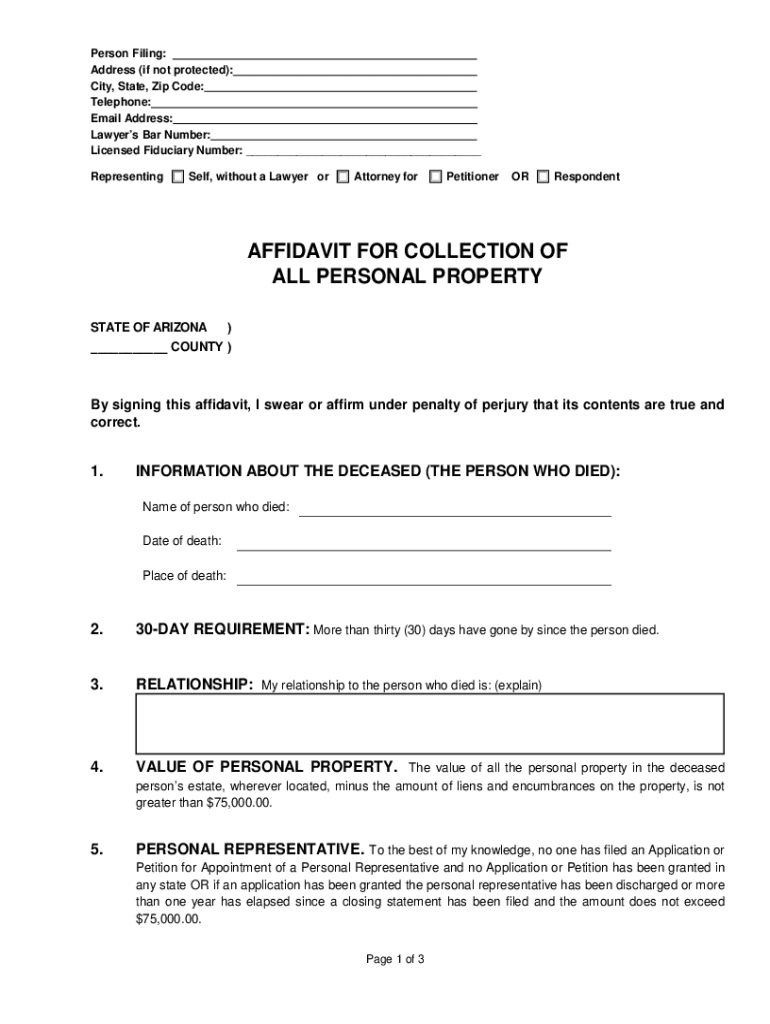

The Arizona Affidavit for Collection of All Personal Property is a legal document used by individuals to claim personal property from a deceased person's estate in Arizona. This affidavit allows the claimant to legally collect assets without going through a full probate process, provided specific conditions set by the state are met. The form is primarily aimed at simplifying the transfer of small estates.

Underlying Purpose

- Facilitates a quicker, more cost-effective method of asset transfer for small estates.

- Helps in bypassing the often lengthy probate process.

- Ensures that proper legal formalities are followed to protect all parties involved.

How to Use the Arizona Affidavit for Collection of All Personal Property

Step-by-Step Instructions

- Verify Eligibility: Ensure the estate qualifies as a "small estate" under Arizona law. The total value of personal property must not exceed the limit set by the state.

- Gather Required Information: Collect detailed information about the deceased, including the date of death and details of the estate's components.

- Complete the Affidavit: Fill out the forms accurately, providing information on the deceased, the claimant’s relationship to the deceased, and a breakdown of the asset values.

- Notarize the Document: Sign the affidavit in the presence of a notary public to validate its authenticity.

- Submit the Affidavit: Present the completed document to the relevant parties holding the deceased's assets, such as banks or other financial institutions.

Practical Examples

- Example 1: Claiming a deceased parent's bank account when the total estate is under the small estate threshold.

- Example 2: Collecting personal possessions from a deceased sibling without going through probate.

Steps to Complete the Arizona Affidavit for Collection of All Personal Property

- Collect Necessary Documentation:

- Obtain a certified copy of the death certificate.

- Compile any existing wills or estate documentation.

- Document the Value of the Estate:

- Create an itemized list of all personal property and their estimated values.

- Ensure the total value does not exceed Arizona’s statutory limit for small estates.

- Identify Debts and Obligations:

- List all known debts or obligations owed by the deceased.

- Complete the Legal Statements:

- Affirm that at least 30 days have passed since the death and all debts and obligations of the deceased are paid or otherwise provided.

Key Elements of the Arizona Affidavit for Collection of All Personal Property

Essential Components

- Details of the Deceased: Full name, date of death, and last known address.

- Claimant Information: Name, address, and relationship to the deceased.

- Property Description: Detailed list and valuation of the property being claimed.

- Affirmations: Legal affirmations regarding eligibility and correctness of provided information.

Eligibility Criteria

Requirements

- Estate qualifies as a "small estate" under Arizona law.

- At least 30 days have passed since the deceased’s passing.

- All claims and debts have been settled or appropriately managed.

State-Specific Rules for the Arizona Affidavit for Collection of All Personal Property

Arizona-Specific Regulations

- Small Estate Definition: Arizona defines a small estate by a specific value threshold which must not be exceeded by the personal property being claimed.

- Residency Requirement: The deceased must have been a resident of Arizona at the time of death.

Legal Obligations

- Adherence to exact state regulations to ensure the affidavit is legally binding and enforceable.

- Any misrepresentation can lead to penalties or invalidation of property claims.

Legal Use of the Arizona Affidavit for Collection of All Personal Property

Compliance and Enforcement

- Verification: Submit to financial institutions for processing claims on bank accounts or other held assets.

- Legal Standing: Recognized as a legitimate method for collecting specific estate assets without probate, if all legal requirements are met.

Potential Consequences

- Misuse or incomplete representation can lead to legal disputes or fines. It's imperative to ensure all information is accurate and truthful when completing the affidavit.

Penalties for Non-Compliance

Consequences of Misrepresentation

- Legal Action: Incorrect or false information can result in legal action against the claimant.

- Reversal of Asset Collection: Any property collected may need to be returned to the estate for proper distribution.

Preventive Measures

- Diligently verify all details before submission.

- Consult with a legal professional if uncertain about any aspect of the affidavit process, ensuring full compliance with Arizona state laws.