Definition and Meaning

The UBS deceased claim form is an official document used to settle claims related to deceased depositors' accounts at UBS AG. This form facilitates the process of transferring assets from the deceased's account to the legal heirs or nominated beneficiaries. Understanding how this form operates is critical for ensuring a smooth claims process and timely payment distribution. Its significance lies in its role in legally documenting the request for asset transfer, aligning with both legal protocols and beneficiary rights.

Steps to Complete the UBS Deceased Claim Form

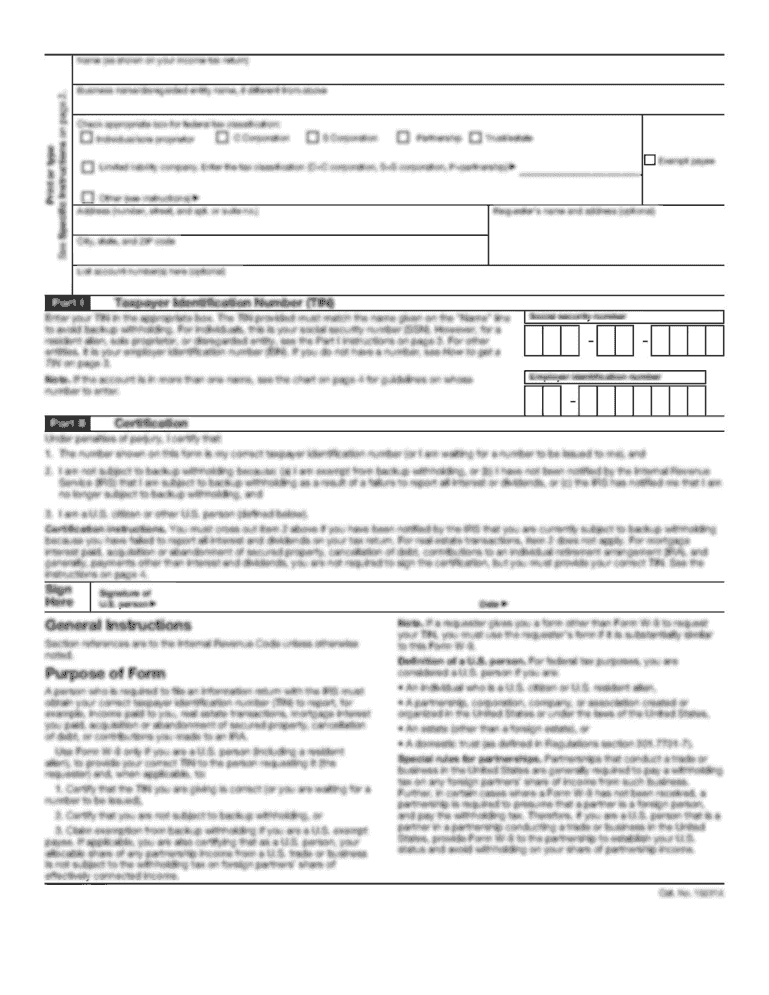

- Gather Documentation: Before initiating the form, collect all necessary documents such as the deceased's death certificate, proof of identity of the claimant, and any existing nomination papers.

- Fill in Personal Information: Enter the full name, address, and contact information of the claimant, ensuring accuracy for verification purposes.

- Account Details: Provide detailed information about the deceased's UBS account, including the account number and type.

- Nomination or Will Information: If applicable, include details about any existing nomination or will, specifying beneficiaries to streamline the approval process.

- Signature and Authorization: After reviewing the form for accuracy, sign in the designated areas to authorize the claim.

- Submit the Form: Submit the completed form along with the gathered documents via the preferred method (online, mail, or in-person) to UBS for processing.

Required Documents

- Death Certificate: An official copy of the deceased's death certificate is mandatory to confirm the claim.

- Identity Proof: The claimant's identity documents such as a passport or driver's license are required for verification.

- Legal Heir Certificate: If there’s no nomination, a legal heir certificate might be needed to establish the rightful claimant.

- Account Information: Relevant UBS account details of the deceased, including statements or passbooks.

- Nomination Details: If a nomination exists, provide related paperwork to ease claim processing.

Legal Use of the UBS Deceased Claim Form

The UBS deceased claim form is a legally binding document used to request the transfer of funds or assets from a deceased depositor’s account. It serves to formalize the claimant's intention and stands as a legal instrument adhering to inheritance laws. The form's use aligns with the regulatory requirements set forth by financial institutions and ensures compliance with inheritance procedures.

Key Elements of the UBS Deceased Claim Form

- Claimant Information: Personal details of the person making the claim, establishing their relationship with the deceased.

- Deceased’s Account Details: Specifics about the account being claimed, including numbers and branch information, ensuring the claim is directed correctly.

- Legal Declarations: Sections requiring confirmation of the claimant’s right to the assets, possibly involving declarations by legal heirs or executors.

- Signature Section: Spaces for signatures to validate the form and confirm agreement with the presented information and terms.

Form Submission Methods: Online, Mail, and In-Person

- Online Submission: The form can be submitted online through UBS’s secure platform, offering swift processing and acknowledgment.

- Mail Submission: Traditional mail remains an option, albeit slower, providing a physical acknowledgment upon receipt.

- In-Person Submission: Visiting a UBS branch allows direct consultation, ensuring completeness and immediate rectification of any issues.

Who Typically Uses the UBS Deceased Claim Form

The form is primarily utilized by:

- Legal Heirs: Direct descendants or legal representatives of the deceased.

- Executors or Administrators: Those appointed by a court to manage the deceased's estate.

- Nominated Beneficiaries: Individuals explicitly named in the deceased’s nominations or will documents.

Eligibility Criteria

- Proof of Death: A certified death certificate is essential for initiating a claim.

- Verification of Relationship: Documents establishing the legal heir status or nomination need to be presented.

- Completeness of Form: The form must be accurately filled without omissions, and all required supporting documents must be attached.

Ensuring that these steps and requirements are carefully followed can significantly streamline the process of settling claims through the UBS deceased claim form.integration