Definition & Meaning

A life estate deed in South Carolina is a legal document that transfers ownership interest in a property while retaining the right to use and occupy the property during the grantor's lifetime. This deed allows the original owner (life tenant) to remain on the property until their death, after which the ownership passes to another individual or entity, known as the remainderman. The creation of such a deed is often used for estate planning to avoid probate and to ensure seamless transition of property ownership.

How to Use the Life Estate Deed in South Carolina

The life estate deed is typically used in estate planning to manage property distribution without the need for probate. The life tenant retains rights to reside in or rent out the property, including collecting rental income. Upon their death, the property automatically transfers to the remainderman without going through probate. This strategic use aids in shielding the property from creditors, provided the transfer occurs well before any creditor claims are made.

How to Obtain the Life Estate Deed in South Carolina

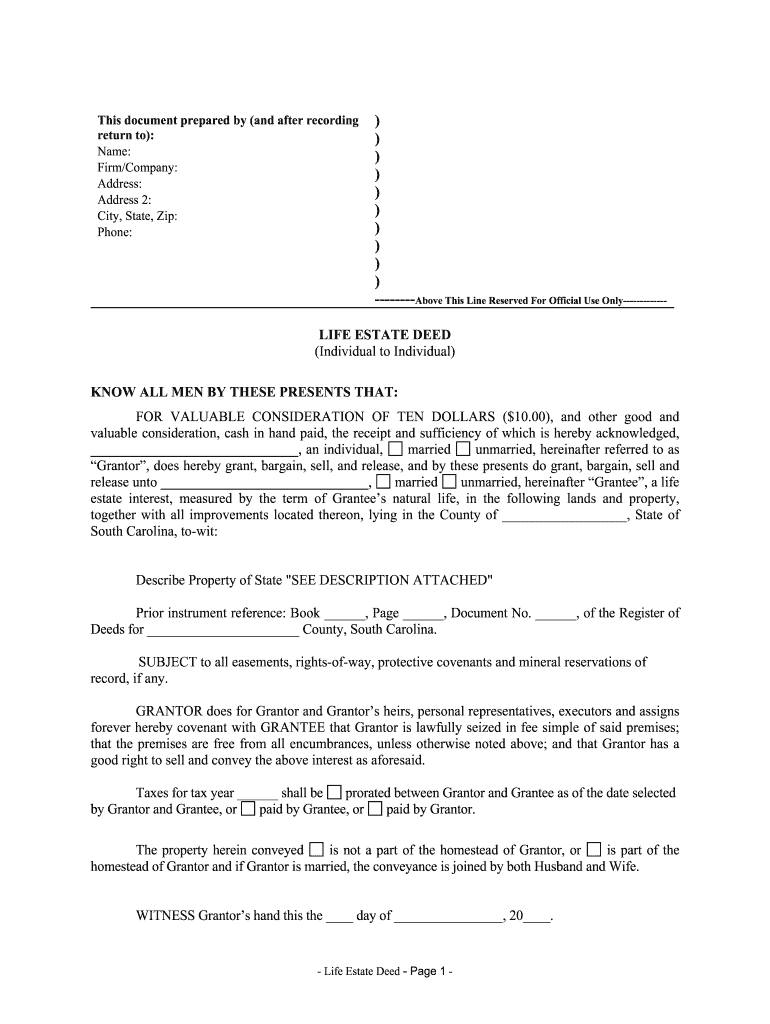

To acquire a life estate deed in South Carolina, individuals can consult legal professionals or use platforms like DocHub for assistance with form preparation. The deed must be accurately drafted, encompassing clear terms and the parties involved. Once drafted, it needs to be signed by all parties and notarized. The notarized deed is then submitted to the local county's Register of Deeds to be officially recorded, ensuring legal recognition.

Steps to Complete the Life Estate Deed in South Carolina

- Draft the Deed: Include details of the property, the life tenant, and the remainderman.

- Review Provisions: Ensure clarity on rights and responsibilities of each party.

- Seek Legal Advice: Consult with an attorney to verify the document complies with state laws.

- Notarization: Obtain signatures and have the deed notarized.

- Recording: File the notarized deed with the local Register of Deeds for it to take effect.

Why You Should Consider a Life Estate Deed in South Carolina

Using a life estate deed offers various advantages, including avoiding probate, providing a straightforward transition of property, and potential tax benefits. It provides the life tenant security of living in the property for life while allowing property pass to chosen heirs automatically after death. This legal arrangement can also protect assets from creditors, ensuring the property remains with the desired beneficiaries.

Key Elements of the Life Estate Deed in South Carolina

- Life Tenant Rights: Maintain use and occupancy of the property for life.

- Remainderman Assignment: Designated individual or entity to receive the property post-death.

- Legal Descriptions: Accurate depiction of the property involved.

- Signatures: Must bear signatures of all parties with notarization.

- Recording: Submission to the Register of Deeds for formal registration.

State-Specific Rules for the Life Estate Deed in South Carolina

South Carolina imposes specific regulations concerning life estate deeds, emphasizing the need for accurate recording in the appropriate county. Legal descriptions within the deed must comply with state survey standards, and notarization is mandatory for legitimacy. The deed must reflect state-specific language to ensure enforceability and clear conveyance of future rights.

Important Terms Related to the Life Estate Deed in South Carolina

- Life Tenant: The individual retaining rights to use the property for life.

- Remainderman: Person or entity inheriting the property once the life tenant passes away.

- Life Estate: The interest or rights granted to the life tenant, lasting for their lifetime.

- Fee Simple: Ownership interest reverts to fee simple for the remainderman once life tenancy ends.

- Probate Avoidance: The process bypasses the probate court system.

Examples of Using the Life Estate Deed in South Carolina

A common scenario involves an elderly parent conveying a life estate deed to their adult children. This allows the parent to live on the property for the remainder of their life, after which the ownership transitions to the children without encountering probate proceedings. Another example could involve a couple setting up a life estate for each other, ensuring that the surviving spouse retains residence rights until their passing, after which it passes to a pre-determined beneficiary.

Required Documents

To successfully process a life estate deed, the following documents are needed:

- A fully completed life estate deed form.

- Identification documents for the life tenant and remainderman.

- Existing property deeds or titles for reference.

- Proof of notarization.

- Filing receipt post-recording with the Register of Deeds.

Form Submission Methods (Online / Mail / In-Person)

The life estate deed can be submitted physically to the Register of Deeds office in the applicable South Carolina county. Alternatively, some counties may allow for online submission, depending on their technology infrastructure. It's vital to follow county-specific guidelines for form submission to avoid processing delays.

Legal Use of the Life Estate Deed in South Carolina

The life estate deed is utilized within the framework of South Carolina property laws to legally ensure a smooth transition of property rights. It reinforces the life tenant's legal right to reside on the property, contains necessary provisions to protect the remainderman's future interests, and complies with state mandates governing property transfers. All actions taken under a life estate deed must adhere to state laws to preserve its validity.