Definition and Purpose of the Mandatory e-Pay Election to Discontinue or Waiver Request

The Mandatory e-Pay Election to Discontinue or Waiver Request is a form utilized by taxpayers subject to specific electronic payment mandates under California law, primarily issued by the California Franchise Tax Board. This form serves to either discontinue or waive the mandatory electronic payment requirements. It is crucial for taxpayers who prefer alternative payment methods or who find themselves unable to comply with electronic mandates due to certain conditions. Understanding this form's function helps taxpayers effectively manage their obligations while staying compliant with state regulations.

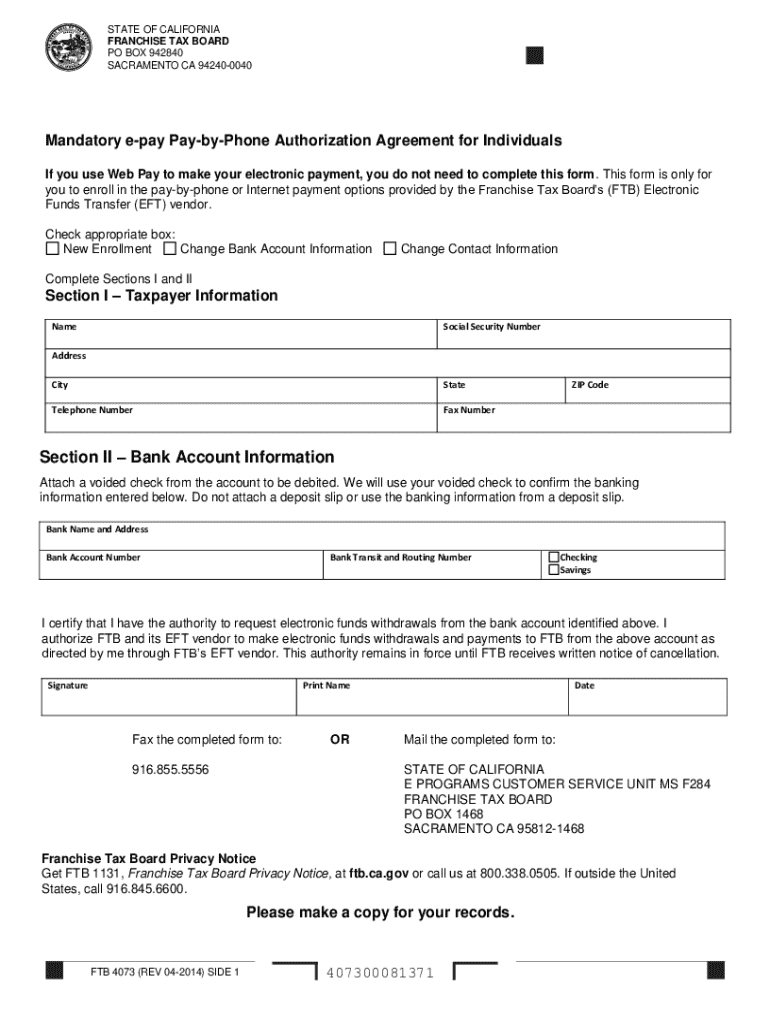

How to Use the Mandatory e-Pay Election to Discontinue or Waiver Request

Using the Mandatory e-Pay Election to Discontinue or Waiver Request involves several steps crucial for compliance and acceptance. Taxpayers should first review the form to understand its requirements fully. Then, they must gather all necessary information, such as taxpayer identification and payment history. Accurately complete the form following the instructions provided, ensuring all required fields are filled. Submission should be made through the designated methods, which could vary between online submission or mailing, depending on state requirements.

Steps to Complete the Mandatory e-Pay Election to Discontinue or Waiver Request

- Gather Required Information: Collect taxpayer identification numbers, relevant payment details, and any supporting documentation that justifies the request for discontinuation or waiver.

- Access the Form: Acquire the current version of the form from the California Franchise Tax Board’s website or an authorized distributor.

- Complete the Form: Carefully fill out all sections, ensuring accuracy in details such as personal information and reason for the request.

- Verify and Review: Double-check all entries for completeness and correctness; incomplete forms could result in delays or rejection.

- Submit the Form: Send the completed form through the specified method, such as mail or through an online portal, if available.

Legal Use and Significance

The legal use of the Mandatory e-Pay Election to Discontinue or Waiver Request is firmly rooted in the California tax code. This form helps taxpayers legally opt-out of mandatory electronic payments if they meet the criteria for waiver or discontinuation. It is significant in maintaining compliance while providing flexibility for taxpayers facing hardship or specific situations where electronic payments are not feasible.

Eligibility Criteria for Submitting the Form

The eligibility to submit a Mandatory e-Pay Election to Discontinue or Waiver Request typically includes taxpayers who are mandated to use electronic payments but face specific challenges or conditions. Such criteria may involve technological limitations, financial hardship, or special exemptions under California law. Understanding these criteria is essential in determining whether a taxpayer qualifies for using this form.

Common Eligibility Scenarios

- Technical Difficulties: Lack of access to reliable internet or technological barriers.

- Financial Hardship: Circumstances making electronic payments unfeasible.

- Age or Disability: Conditions where digital processing is highly inconvenient or impossible.

Key Elements of the Form

The Mandatory e-Pay Election to Discontinue or Waiver Request form consists of various key sections that require detailed attention:

- Taxpayer Information: Includes name, taxpayer identification number, and contact details.

- Reason for Waiver or Discontinuation: A description of why mandatory e-pay is unsuitable, supported by documentation if necessary.

- Declaration and Signature: The taxpayer's confirmation that the information provided is accurate, finalized with a signature.

Examples of Using the Waiver Request

Consider a small business owner in a rural area with limited internet access who finds complying with mandatory e-pay requirements challenging. By completing the waiver request, the owner can legally make payments through mail. Another example involves retirees without digital literacy skills who prefer traditional payment methods; they can utilize the waiver to avoid electronic payments.

Important Terms Related to the Form

Understanding the terminology associated with the Mandatory e-Pay Election to Discontinue or Waiver Request is vital for proper compliance:

- Mandatory Electronic Payment: A requirement by which certain taxpayers must process payments electronically.

- Waiver: An official exemption from the mandatory electronic payment requirement.

- Franchise Tax Board (FTB): The governmental body issuing and processing the form.

Form Submission Methods

Taxpayers have multiple methods available for submitting the Mandatory e-Pay Election to Discontinue or Waiver Request. These methods include:

- Online Submission: Some taxpayers may submit via the California Franchise Tax Board website.

- Mail: Paper submissions sent to the designated address with appropriate postage.

- In-Person: Submission at specific FTB offices, aligning with current health and convenience policies.

Selecting the correct submission method ensures timely processing and compliance with the requirements outlined by the California Franchise Tax Board.