Definition & Meaning

The Transamerica 1035 Exchange Form is an essential document used for facilitating tax-deferred exchanges under Internal Revenue Code Section 1035. This form allows policyholders to exchange life insurance or annuity contracts without incurring current tax liabilities. By utilizing this process, policyholders can potentially upgrade their insurance coverage or investment options while deferring any recognition of gain for tax purposes. This form specifically streamlines the administrative aspects of executing such exchanges, making it a crucial tool for policyholders and financial advisors aiming to manage life insurance portfolios more effectively.

How to Use the Transamerica 1035 Exchange Form

-

Review Eligibility: Before using the form, confirm that the policies involved meet the criteria for a 1035 exchange. Typically, eligible exchanges involve life insurance to life insurance, annuity to annuity, or life insurance to annuity exchanges.

-

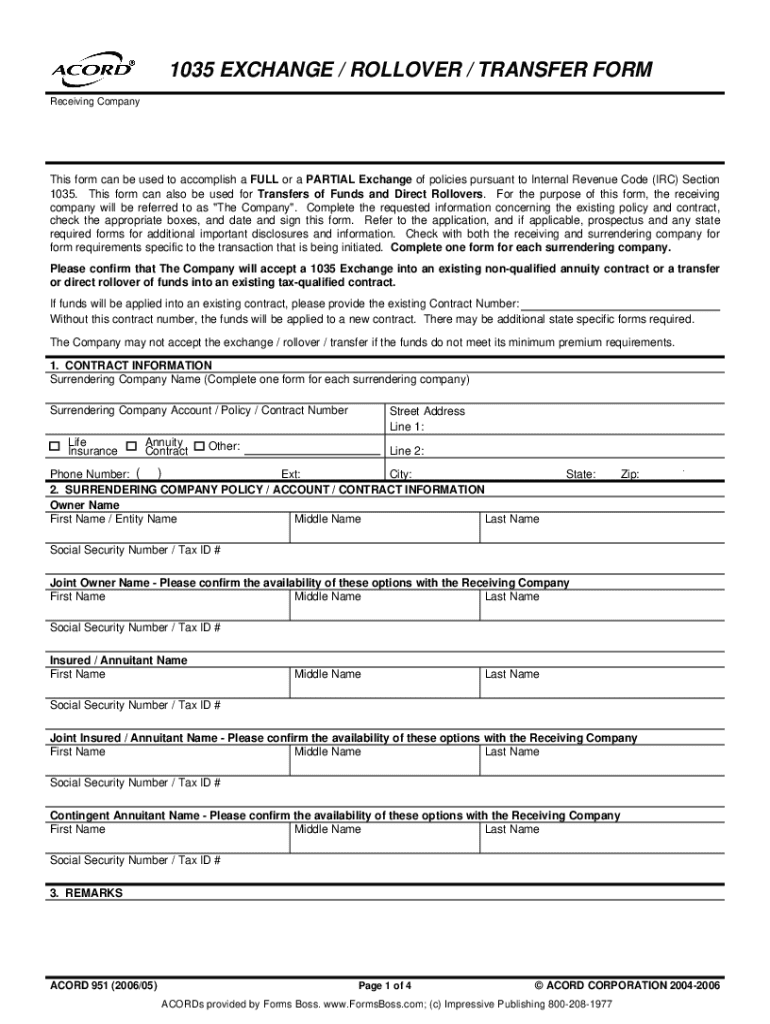

Complete Required Fields: Fill out the form with accurate policy information. Critical data includes the policyholder's details, existing policy information, and the receiving insurance company details.

-

Sign and Authorize: Ensure all parties authorize the exchange by signing the form. This includes the policyholder's signature and any necessary signatures from the receiving insurance company.

-

Submit the Form: Send the completed form to Transamerica for processing. Submissions can typically be done via mail or through authorized financial advisors who handle the administrative process.

Steps to Complete the Transamerica 1035 Exchange Form

-

Gather Necessary Information: Collect information on the existing and new policies, including policy numbers, types, and company names.

-

Fill Out Policyholder Information: Provide all relevant personal details, such as full name, address, and contact information.

-

Policy Details: Under the policy details section, include information about the existing policy, such as the insurer’s name, policy number, and coverage type.

-

New Policy Information: Input the information for the new policy, ensuring all details match the intended new coverage.

-

Authorization and Signature: Carefully review the filled form for accuracy before signing. Signature of the policyholder is mandatory for form validity.

-

Attach Required Documents: If required, attach any supportive documents, such as existing policy statements or proof of identity.

Who Typically Uses the Transamerica 1035 Exchange Form

This form is predominantly used by policyholders looking to optimize their insurance coverage or investment potential. It is also widely utilized by financial advisors who manage multiple client portfolios. Additionally, insurance companies may employ this form when handling large volumes of exchanges for their clientele. Notably, individuals seeking to convert life policies to annuities for retirement planning are frequent users, given the tax advantages offered under Section 1035.

Important Terms Related to Transamerica 1035 Exchange Form

- Policyholder: The individual or entity that owns the insurance policy being exchanged.

- Tax-Deferred Exchange: A swap of life insurance policies or annuities that allows delay in tax liability until a future time.

- Internal Revenue Code Section 1035: U.S. federal tax provision allowing policy exchanges without current recognition of gain.

- Annuity Contract: Financial product that pays out a fixed stream of payments to an individual, primarily used for retirement purposes.

Legal Use of the Transamerica 1035 Exchange Form

Legal compliance is critical when executing a 1035 exchange. The form must strictly adhere to the standards set by the Internal Revenue Service (IRS) under Section 1035. This ensures the exchange does not trigger a taxable event. Both policyholders and issuing companies must verify that the exchanged policies comply with existing legal requirements, including maintaining the policy's nature and ensuring that contractual obligations are fulfilled.

Key Elements of the Transamerica 1035 Exchange Form

-

Policyholder Identification: Includes detailed personal information of the individual or business entity initiating the exchange.

-

Existing Policy Information: Details of the current insurance contract, including policy number and issuer.

-

New Policy Specifications: Information pertinent to the new or receiving policy.

-

Authorization Signatures: Required section for signatures to legally validate and authorize the exchange process.

Required Documents

When submitting the Transamerica 1035 Exchange Form, several accompanying documents may be required:

-

Current Policy Statements: To verify existing coverage details.

-

Identification Proof: Valid ID copies might be needed to confirm the policyholder’s identity.

-

Signed Authorization: Copies of the signed authorization from all parties involved in the exchange.

Ensure that all necessary documentation is complete to avoid processing delays, and consult Transamerica or a financial advisor for a full list of required documents based on specific circumstances.

Examples of Using the Transamerica 1035 Exchange Form

-

Upgrade Coverage: An individual exchanges their existing life insurance policy for a broader coverage option without tax consequences.

-

Annuity Conversion: A policyholder swaps from a life insurance policy to an annuity to better align with retirement goals.

-

Streamlined Transfer: Leverage the form for administrative ease when moving from one insurer to another while maintaining policy benefits and terms.