Definition & Meaning

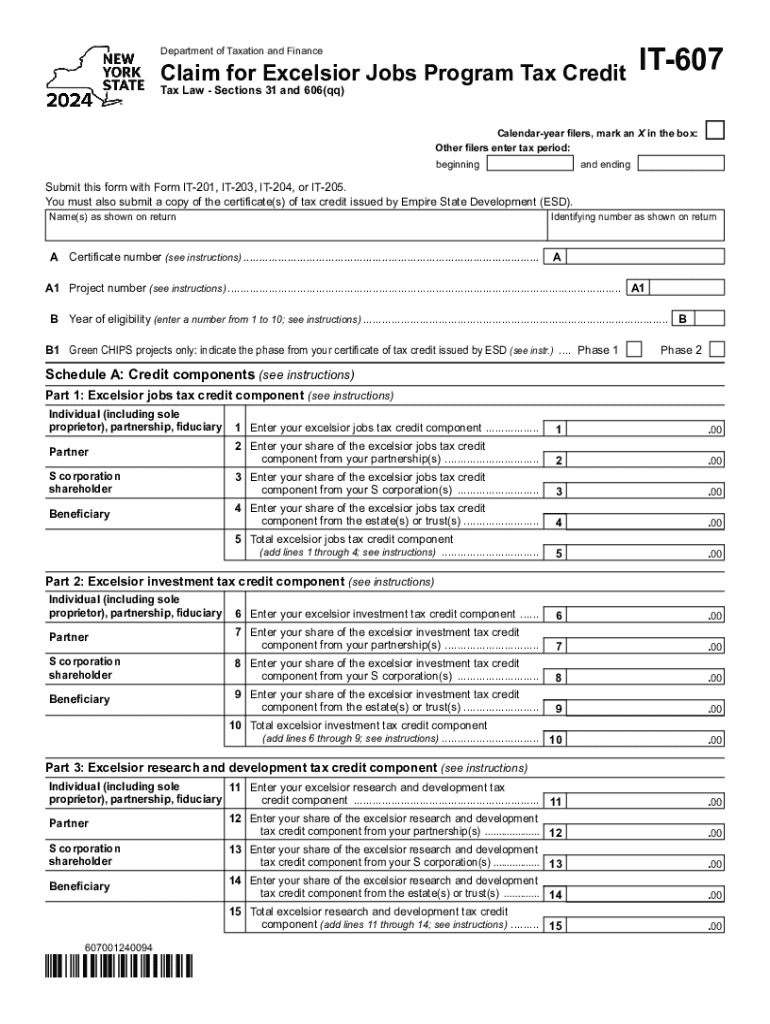

The Form IT-607 is essential for businesses participating in the Excelsior Jobs Program, which is a tax credit initiative offered by the New York Department of Taxation and Finance. This program incentivizes businesses that contribute to job creation, investment in research and development, and other economic activities within New York State. By completing this form for the tax year 2024, eligible businesses can claim various tax credits associated with their qualifying economic activities.

Key Elements of Form IT-607

Form IT-607 includes several vital sections that businesses need to fill out accurately:

- Basic Information: Collects necessary data about the business, such as its legal name, address, and identification numbers.

- Credit Calculation: Requires detailed input of numbers reflecting jobs created, investments made, and other qualifying activities to compute the applicable tax credits.

- Participant Certifications: Ensures that the company adheres to all program requirements, including maintaining certain employment levels and investment thresholds.

- Supplemental Schedules: May be required to provide further financial details or evidence supporting the claimed credits.

How to Use Form IT-607

Filling out Form IT-607 involves several steps to ensure all data is accurately represented:

- Gather Relevant Information: Collect the necessary financial records, including payroll data, investment details, and any other documentation supporting program eligibility.

- Complete Each Section: Work through each part of the form, carefully inputting the data that pertains to your organization.

- Apply for Related Tax Credits: In addition to the Excelsior Jobs Program, look for potential synergies with other tax credit opportunities to maximize benefits.

Steps to Complete Form IT-607

- Identify Eligibility: Confirm eligibility by reviewing the program’s criteria and ensuring the business meets all necessary requirements.

- Compile Data: Assemble all supporting documents related to job creation, capital investments, and qualifying costs.

- Accurate Input: Precisely enter all data into the correct sections of the form, double-checking for consistency with attached documentation.

- Verification and Submission: Verify all information is complete and accurate before submitting the form along with required schedules and attachments.

Eligibility Criteria

To qualify for the Excelsior Jobs Program tax credit using Form IT-607, businesses must meet specific criteria:

- Must be located within New York State.

- Should have participated in recognized economic activities such as job creation, R&D investment, or infrastructure improvement.

- Must provide documentation verifying their contributions to the state's economic development.

Who Typically Uses Form IT-607

The Form IT-607 is commonly used by various types of business entities:

- Corporations: Large businesses expanding operations within New York.

- Partnerships and S Corporations: Smaller entities that can distribute credit among stakeholders.

- LLCs: Engaging in business activities that qualify for tax credits under state guidelines.

Required Documents

Several documents are essential when filing Form IT-607, including:

- Payroll Records: Detailing employee hires and wages.

- Investment Receipts: Proof of capital investments and infrastructure improvements.

- Tax Returns: Previous year returns to establish a baseline for economic activities related to the program.

Filing Deadlines / Important Dates

Adhering to the timeline for filing Form IT-607 is crucial:

- Generally due alongside state income tax returns.

- Extensions might be available upon request, but it is vital to check New York State’s guidelines each tax year for specific deadlines.

Penalties for Non-Compliance

Failure to comply with the requirements of Form IT-607 can lead to several penalties:

- Potential loss of credited amounts.

- Interest on unpaid taxes if credits are disallowed upon audit or review.

- Possible fines for incorrect or fraudulent reporting of economic activities.

Examples of Using Form IT-607

Several scenarios illustrate the application of Form IT-607:

- Tech Startup in NYC: A technology firm expanding its operations hires additional staff and invests heavily in R&D. Form IT-607 allows them to claim credits against their expenses.

- Manufacturing Plant Upstate: A plant retools its operations for more efficient production, creating local jobs in the process, thus qualifying for program credits via Form IT-607.