Definition & Meaning

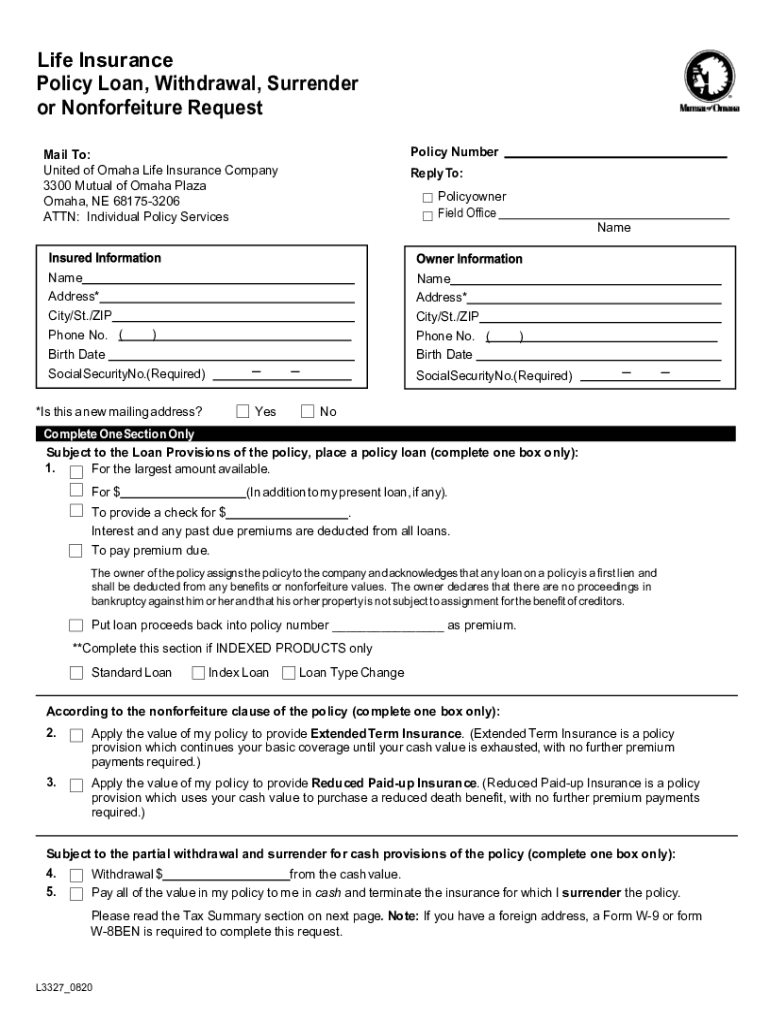

The "nationwide personalinsuranceLife Insurance Forms - Nationwide Mutual Insurance Company" form is a crucial document for policyholders of life insurance policies under Nationwide Mutual Insurance Company. This form facilitates requests related to policy loans, withdrawals, surrenders, and nonforfeiture options. It serves as a formal request mechanism for policyholders who wish to adjust their policy terms or access accrued benefits. Understanding the significance of this form helps ensure that policyowners can efficiently manage their life insurance policies.

How to Use the Nationwide Personal Insurance Life Insurance Forms

Using the "nationwide personalinsuranceLife Insurance Forms - Nationwide Mutual Insurance Company" requires careful attention to detail. Policyowners must fill out their personal information accurately, which serves as the basis for all further processes. Depending on the desired transaction—whether it is a policy loan, withdrawal, or surrender—applicable sections must be completed. By following precise instructions on the form, users ensure that their requests are processed smoothly and efficiently.

- Collect personal and policy information.

- Specify the type of request, such as loan or withdrawal.

- Provide necessary identification details, if applicable.

- Review form for completeness before submission.

Steps to Complete the Nationwide Personal Insurance Life Insurance Forms

Completing the "nationwide personalinsuranceLife Insurance Forms - Nationwide Mutual Insurance Company" involves several steps that ensure accuracy and compliance with policy requirements.

- Gather Required Information: Collect your policy number, personal identification, and relevant financial details.

- Select Desired Transaction: Indicate whether the request pertains to a loan, withdrawal, or policy surrender.

- Provide Additional Details: For loans, specify the desired amount; for surrenders, indicate the percentage or portion to be surrendered.

- Sign and Date: Ensure all necessary parties have signed the form where indicated.

- Review and Submit: Double-check all entries for accuracy before submitting.

Important Terms Related to Nationwide Personal Insurance Life Insurance Forms

Understanding key terminology is vital for navigating the "nationwide personalinsuranceLife Insurance Forms - Nationwide Mutual Insurance Company."

- Policy Loan: A loan against the cash value of the life insurance policy.

- Withdrawal: The act of taking out part of the accumulated cash value.

- Surrender: Fully terminating the policy in exchange for its cash value.

- Nonforfeiture: Options available to preserve a policy’s value if premiums are not paid.

Legal Use of the Nationwide Personal Insurance Life Insurance Forms

Legal compliance is crucial when using the "nationwide personalinsuranceLife Insurance Forms - Nationwide Mutual Insurance Company." Each state may have unique requirements and regulations, including proper identification and signature mandates. Additionally, for community property states, spousal consent may be necessary. Understanding and adhering to these legal obligations ensures that the requested actions are valid and enforceable.

Required Documents

Submitting the "nationwide personalinsuranceLife Insurance Forms - Nationwide Mutual Insurance Company" requires various supporting documents. These may include:

- Government-issued identification for the policyholder.

- Proof of policy ownership, such as a policy document or recent statement.

- Spousal consent in applicable states.

- Any additional forms requested by the insurance provider.

Form Submission Methods (Online / Mail / In-Person)

Multiple submission options are available for the "nationwide personalinsuranceLife Insurance Forms - Nationwide Mutual Insurance Company":

- Online: Through the insurance company’s secure portal.

- Mail: Sending the completed form to the designated insurance company address.

- In-Person: Visiting a Nationwide office for direct assistance and submission.

Each method ensures the form reaches its destination, though processing times and confirmation methods may vary.

Digital vs. Paper Version

The "nationwide personalinsuranceLife Insurance Forms - Nationwide Mutual Insurance Company" can be completed digitally or via traditional paper forms.

- Digital Version: Offers convenience and faster processing times. It can be filled out online, ensuring all fields are completed before submission.

- Paper Version: Suitable for those who prefer or require physical copies. It necessitates mailing or in-person submission and may involve longer processing.

Understanding the benefits and limitations of each version can help policyholders choose the most efficient method for their circumstances.