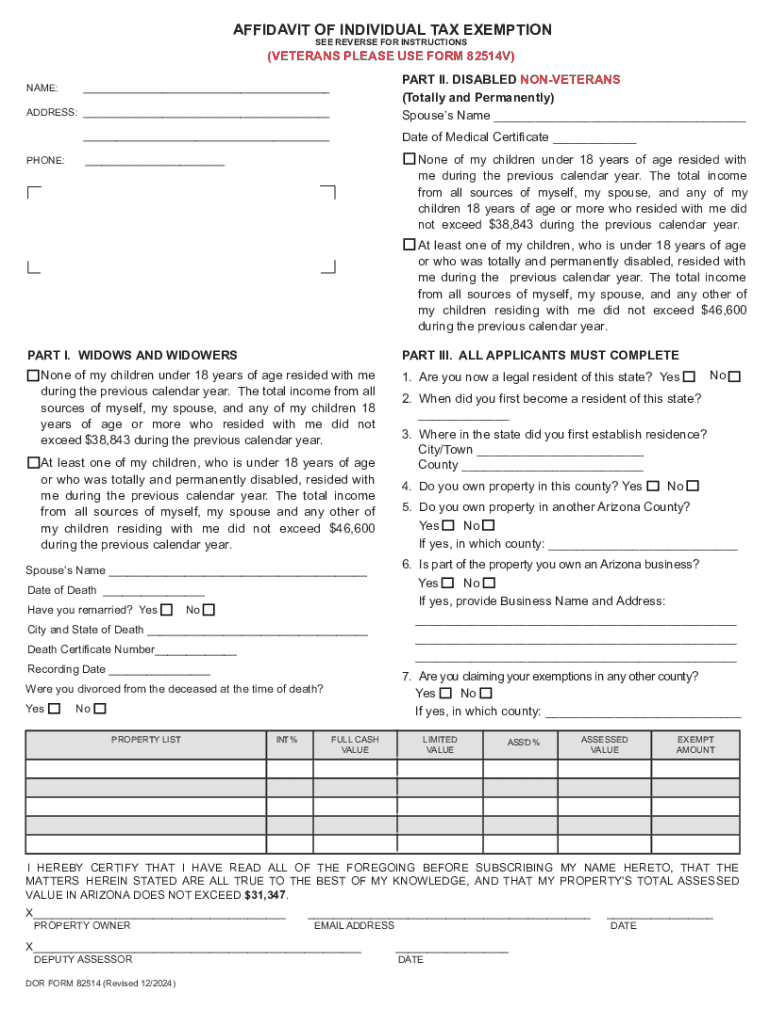

Definition & Meaning

The DOR 82514 form serves as the Affidavit of Individual Tax Exemption for property tax purposes, specifically targeting disabled non-veterans and widows or widowers. Its primary purpose is to facilitate tax relief for those who qualify, based on certain income limits and residency criteria. Understanding the eligibility and requirements of the DOR 82514 is crucial for maximizing tax benefits legally and efficiently.

Eligibility Criteria

Eligibility for the DOR 82514 typically hinges on several factors. Firstly, the applicant must either be a disabled non-veteran or a widow/widower. Income limits also apply, ensuring that the form targets individuals who genuinely require tax relief. Residency is another important criterion, as the form is meant for those who reside within the state and meet its specific living stipulations. Understanding and meeting these criteria is essential for a successful application.

Steps to Complete the DOR 82514

Completing the DOR 82514 requires attention to detail and adherence to specific instructions. Here is a step-by-step guide:

-

Gather Necessary Information and Documents: Collect all relevant financial documents, proof of disability (if applicable), and proof of residency.

-

Download the Form: Obtain the DOR 82514 via the local tax assessor's office or official governmental websites.

-

Fill Out Personal Information: Include all personal details as requested, such as name, address, and Social Security number.

-

Provide Financial Information: Accurately fill in income details to demonstrate compliance with income limits.

-

Certification and Signatures: Ensure all statements are true and sign the form. If required, obtain any additional necessary signatures.

-

Submit the Completed Form: Send the form to the designated county assessor’s office by the submission deadline.

Common Mistakes

- Omitting Required Details: Double-check for all mandatory fields.

- Incorrect Financial Disclosure: Ensure income details are accurate.

- Missed Deadlines: Late submissions may render the application invalid.

Required Documents

Applicants must provide several documents with the DOR 82514:

- Proof of Disability: If applicable, a recent statement from a certified medical professional verifying disability status.

- Income Statements: Documentation to confirm income levels, such as tax returns or pay slips.

- Residency Proof: Valid documents that confirm state residency, like utility bills or lease agreements.

Organizing these documents in advance can streamline the application process and reduce the risk of delays.

Legal Use of the DOR 82514

The DOR 82514 is used legally to claim property tax exemptions. It serves as a formal declaration of eligibility and must be completed truthfully to avoid any potential legal ramifications. Misrepresentation on the form can lead to penalties, so it's significant to ensure all information provided is accurate and well-documented.

State-Specific Rules for the DOR 82514

Different states may have specific regulations or additional requirements for the DOR 82514. It is crucial to consult the relevant state tax authority to understand any unique stipulations or variations. For example, some states might require periodic renewal of exemption status, while others may impose additional criteria for certain categories of applicants.

Form Submission Methods (Online / Mail / In-Person)

Submitting the DOR 82514 can commonly be done in several ways, tailored to the applicant's preference or ability:

- Online: Some states provide an electronic submission option via the tax department's website.

- Mail: Traditional submission via postal service, where forms and documents are mailed to the local tax office.

- In-Person: Direct submission at the county assessor’s office, which might be beneficial for immediate feedback and confirmation of receipt.

Penalties for Non-Compliance

Failure to comply with the DOR 82514 requirements or misrepresenting information can lead to several penalties:

- Denial of Exemption: Ineligibility for tax benefits for that year.

- Fines and Legal Repercussions: Potential financial penalties or legal action for fraudulent claims.

- Future Ineligibility: Repeated non-compliance can lead to disqualification from future exemptions.

Understanding and adhering closely to the guidelines can help applicants avoid these repercussions and secure the desired tax relief.

By carefully examining these aspects, users can navigate the complexities surrounding the DOR 82514, ensuring compliance and maximizing available tax benefits.