Definition & Meaning

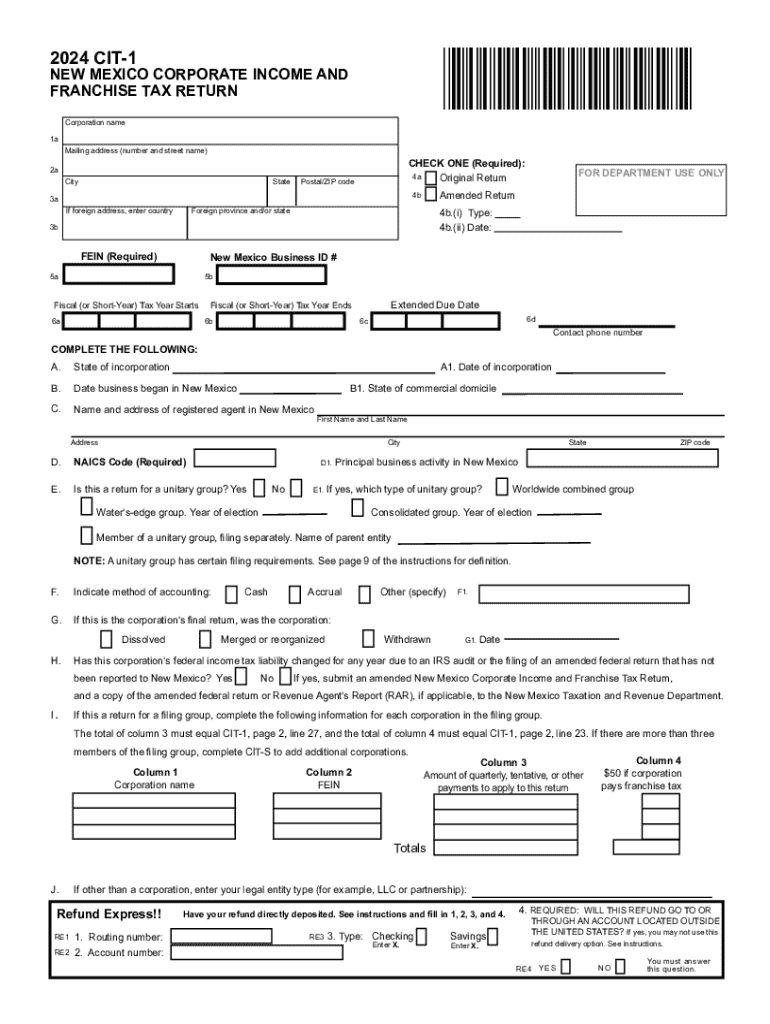

The New Mexico CIT-1 form, officially known as the 2024 New Mexico Corporate Income and Franchise Tax Return, is a crucial document for corporations operating within the state. It is designed to facilitate the reporting of corporate income, deductions, and tax obligations specific to New Mexico. The form is essential for ensuring compliance with state tax laws and determining the amount of franchise and income tax owed. Corporations must accurately complete and submit this form annually to maintain good standing with the New Mexico Taxation and Revenue Department.

Key Elements of the New Mexico CIT-1

Completing the CIT-1 involves several significant components that must be meticulously addressed:

- Corporate Identification: This section requires details including the corporation's name, address, and federal employer identification number (FEIN).

- Financial Details: Corporations must report their total income, deductions, and resulting taxable income.

- Apportionment of Income: For multistate corporations, this portion is used to determine the portion of income sourced from New Mexico.

- Allocation of Non-Business Income: Any income not related to core business activities must be allocated separately.

- Specific Deductions: These include claims related to foreign dividends and other non-operational incomes.

Steps to Complete the New Mexico CIT-1

- Gather Required Information: Collect financial records, apportionment details, and any specific deduction documentation.

- Complete Corporate Identification: Fill in the corporation's identifying information and verify for accuracy.

- Report Income and Deductions: Input the total income and record all eligible deductions to calculate taxable income.

- Calculate Tax Liability: Use the tax rates provided to compute the tax due.

- Sign and Submit: Ensure the form is signed by an authorized official and submit via the chosen method.

How to Obtain the New Mexico CIT-1

Corporations can access the CIT-1 form through the New Mexico Taxation and Revenue Department's official website. The form is available for download, and businesses can also request a paper version by contacting the department. It is crucial for corporations to ensure they are using the most current version of the form to comply with any recent changes in tax legislation.

Filing Deadlines / Important Dates

The New Mexico CIT-1 must be filed annually by a specified deadline to avoid penalties. Typically, the deadline is aligned with federal tax obligations for corporations. Extensions are possible but must be applied for before the original due date. Corporations should mark these key deadlines in their calendars and account for mailing times if submitting a paper form.

Legal Use of the New Mexico CIT-1

The CIT-1 form serves as a legal document ensuring that corporations report and pay the required taxes to New Mexico. Failure to file or inaccurately completing the form can result in legal repercussions, including fines and penalties. It's important for corporations to correct any errors promptly and adhere to all disclosure requirements associated with the form.

Penalties for Non-Compliance

Not filing the CIT-1 form or paying the due tax can result in penalties. Late filing incurs additional fees and interest on unpaid taxes. Corporations must also be mindful of the potential for audit or legal action if discrepancies are found in their submissions.

Software Compatibility

Corporations often use tax preparation software such as TurboTax or QuickBooks to facilitate form completion. These software applications typically integrate state-specific forms, including the New Mexico CIT-1, allowing for a seamless data transfer and accurate calculations. However, it is crucial to verify that the software is up-to-date with the latest tax codes before using it for tax filing purposes.

Taxpayer Scenarios

The New Mexico CIT-1 form applies to various business structures, including corporations, LLCs, partnerships, and more. Different scenarios may arise based on the nature and size of the business. For instance, a multistate corporation may need to apportion income differently than a corporation solely based in New Mexico. Understanding these nuances ensures accurate and efficient tax filing.