Understanding the 80115248 Form

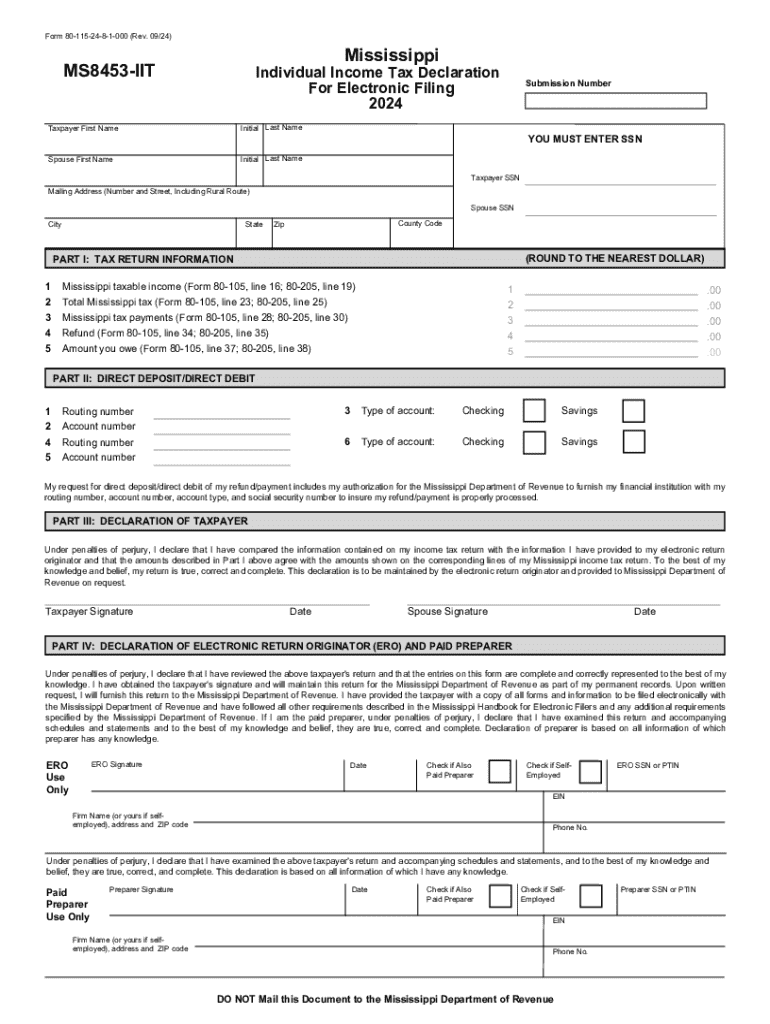

The 80115248 form serves as a Mississippi Individual Income Tax Declaration for electronic filing for the year 2024. This form is crucial for taxpayers in Mississippi as it ensures that the information submitted accurately reflects their income tax return details. It is designed to streamline the online filing process, ensuring compliance with state regulations.

Key Elements of the 80115248 Form

- Taxpayer Information: This section requires essential details such as the taxpayer's name, address, and Social Security Number. Accurate completion of this section is necessary for identification and processing purposes.

- Spouse Information: For joint filers, this segment collects similar details for the spouse, ensuring that both parties are represented in the tax return.

How to Use the 80115248 Form

Completing the form begins with gathering all necessary documents and information. Taxpayers need to input their details into the designated sections, ensuring that all entries are accurate.

- Enter Personal Details: Begin by carefully entering your personal information, followed by that of your spouse if filing jointly.

- Review Tax Return Information: Verify the accuracy of your tax return amounts to ensure they are correctly reflected on the form.

- Direct Deposit/Direct Debit Authorization: Here, you decide how refunds are received or payments are made, adding bank account details for electronic transactions.

How to Obtain the 80115248 Form

Obtaining the 80115248 form can typically be done through the Mississippi Department of Revenue's website. Forms can be downloaded and filled out digitally or printed for manual completion. Alternatively, tax preparation software and various online tax services may provide access to it as part of their filing process.

Steps to Complete the 80115248 Form Successfully

- Collect Required Documents: Gather W-2s, 1099s, and other income documentation, as well as receipts for deductions if applicable.

- Fill in Taxpayer and Spouse Details: Ensure all personal data is entered accurately to avoid delays or complications.

- Detail Tax Return Information: Double-check income, deductions, and credits to ensure correct amounts are reported.

- Submit Direct Deposit Details (optional): Opt for electronic refund or payment transactions for efficiency.

- Confirm and Sign the Document: Both taxpayer and spouse (if applicable) should verify the information for correctness and sign the form to affirm its accuracy.

Why Accurately Completing the 80115248 Matters

Accurate completion of the 80115248 form is critical as it serves as the declaration of an individual's or couple's income tax information for Mississippi. Any inaccuracies may lead to penalties, delays in processing, or complications with the Mississippi Department of Revenue. By ensuring a complete and truthful submission, taxpayers maintain compliance with state requirements.

Who Typically Uses the 80115248 Form

- Mississippi Residents: Anyone declaring Mississippi state income tax electronically will use this form.

- Taxpayers with Multiple Incomes: This form is essential for those with varied income sources, needing to report detailed financials to the state.

Important Terms Related to the 80115248 Form

- Electronic Return Originator (ERO): The individual or entity responsible for submitting tax returns electronically to the IRS.

- Penalties of Perjury: A legal assertion that all information provided is true, with consequences for any false statements.

Legal Use of the 80115248 Form

The 80115248 form must be used in accordance with Mississippi state laws, ensuring that all information provided is honest and complete. Any attempts to falsify information or omit relevant details can lead to significant legal issues, including fines and penalties as defined by state regulations.

Penalties for Non-Compliance

Failing to file the 80115248 form or submitting inaccurate information may result in penalties. This can include fines, interest on unpaid taxes, and more severe legal consequences depending on the nature of the error or omission.

Filing and Submission Methods

The 80115248 form can be submitted electronically through various tax preparation platforms or directly via the Mississippi Department of Revenue's online portal. Alternatively, taxpayers can choose to print the completed form and mail it, although electronic submission is recommended for speed and efficiency.

Digital vs. Paper Versions

- Digital Submission: Offers quick processing, immediate error-checking, and faster refunds.

- Paper Submission: Necessary for those without internet access; however, it may result in longer processing times.

Software Compatibility with the 80115248 Form

This form is compatible with widely used tax software solutions such as TurboTax and QuickBooks, enabling taxpayers to integrate their tax filing activities seamlessly. Using software can help identify errors before submission and provide helpful filing guidance.

State-by-State Differences

While the 80115248 is specific to Mississippi, different states require variations of their own forms for electronic tax filings, each with specific compliance requirements and procedures. Understanding these differences is essential for taxpayers who may move or work across state lines within the tax year.