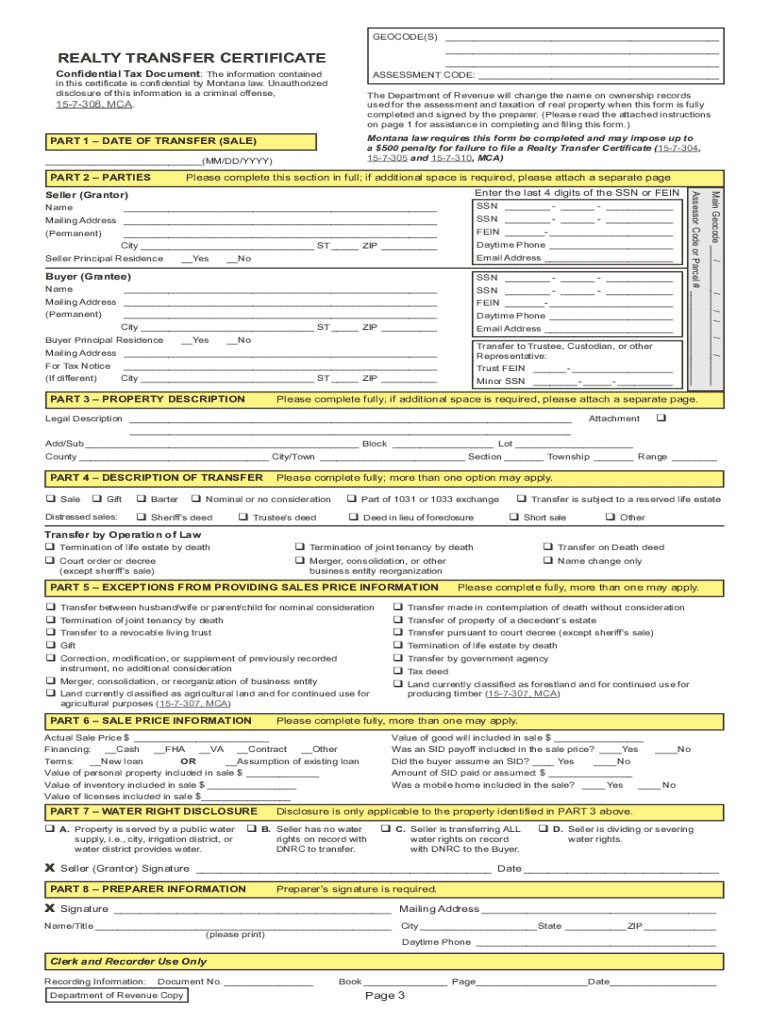

Definition & Meaning

The Realty Transfer Certificate is a crucial state-specific document used in Sanders County, Montana, to record every transfer of real property. This certificate serves as a confidential tax form, ensuring that local authorities are aware of all property transactions within the county. It includes detailed information about the parties involved in the transaction, a description of the property, and specifics about the nature of the transfer. The document plays a significant role in evaluating potential income tax implications for both the seller and buyer due to gains accrued from the transfer. Additionally, it incorporates sections dedicated to disclosing any water rights associated with the property, which is vital for buyers and sellers to acknowledge.

Key Elements of the Realty Transfer Certificate - Sanders County

Understanding the essential components of the Realty Transfer Certificate is vital for accurate completion. This document comprises several key elements:

- Seller and Buyer Information: Includes names, addresses, and contact details of both parties.

- Property Description: Provides legal descriptions, parcel number, and any pertinent characteristics of the property.

- Transfer Details: Outlines the type of transaction, whether it's a sale, gift, or exchange, including the transaction date.

- Declaration of Value: Requires the declaration of sale price or value, crucial for tax assessment.

- Water Rights Disclosure: Mandates the disclosure of any water rights tied to the property, ensuring transparency between buyer and seller.

Steps to Complete the Realty Transfer Certificate - Sanders County

- Gather Required Information: Collect personal details of the buyer and seller, property identification numbers, and transaction specifics.

- Fill Out the Seller and Buyer Details: Input names, addresses, and contact information accurately.

- Complete Property Description: Enter the legal description and property identification numbers to ensure precision.

- Declare the Transaction Type: Indicate whether the property transfer is a sale, gift, or exchange, and include the transfer date.

- Specify Water Rights: Affirm any water rights associated with the property, providing necessary documentation if applicable.

- Review and Sign: Double-check the accuracy of all details, and both parties involved must sign to validate the form.

- Submit the Document: Follow local submission guidelines for filing with the appropriate county office.

Who Typically Uses the Realty Transfer Certificate - Sanders County

This document is mainly utilized by:

- Property Sellers and Buyers: Individuals or entities involved in real estate transactions within Sanders County.

- Real Estate Agents: Professionals who assist clients in buying or selling real estate are often involved in completing this form.

- Attorneys and Legal Advisors: Legal professionals who oversee property transactions for compliance and accuracy.

- Title Companies: Entities responsible for ensuring the legally sound transfer of property titles typically handle these forms during closing processes.

Legal Use of the Realty Transfer Certificate - Sanders County

The certificate is mandated by Montana state law; its primary legal use is to provide a documented record of property transfers that can be used to confirm ownership changes, assess taxes, and ensure compliance with local property regulations. The information submitted is kept confidential, maintaining the privacy of involved parties while fulfilling legal reporting requirements.

How to Obtain the Realty Transfer Certificate - Sanders County

Obtaining the certificate involves a straightforward process:

- Visit Local County Offices: The form can be picked up in person from Sanders County's clerk or recorder's office.

- Access Online Resources: Some counties offer downloadable forms on their official websites for convenience.

- Consult a Real Estate Professional: Real estate agents often supply these forms during property transactions.

State-Specific Rules for the Realty Transfer Certificate - Sanders County

In Montana, certain state-specific rules govern the use of the Realty Transfer Certificate:

- Mandatory Filing: All property transactions require a completed Realty Transfer Certificate for the county records.

- Confidentiality Assured: The information provided in this document is kept confidential and used solely for tax purposes.

- Water Rights Disclosure: Explicit disclosure of water rights is mandated for all transactions, given the importance of water resources in Montana.

Required Documents

To successfully complete and file the Realty Transfer Certificate, have the following documents ready:

- Proof of Property Ownership: For verification of property ownership and details.

- Legal Identification: Valid identification such as a driver’s license or state-issued ID for all parties involved.

- Water Rights Documentation: If applicable, documents proving water rights connected to the property.

- Sales Contract: The original or a copy outlining the agreed terms of sale.

Examples of Using the Realty Transfer Certificate - Sanders County

Consider these practical scenarios:

- Residential Home Sale: Used by a homeowner selling their property, to officially record the change in ownership.

- Family Gift Transaction: Employed when property is transferred as part of a family gifting process to document it legally.

- Commercial Property Sale: Utilized in the sale of commercial properties to ensure accurate documentation for tax purposes.

Through these examples, the tailored use of the Realty Transfer Certificate becomes apparent, showing its versatility in various property transaction types.