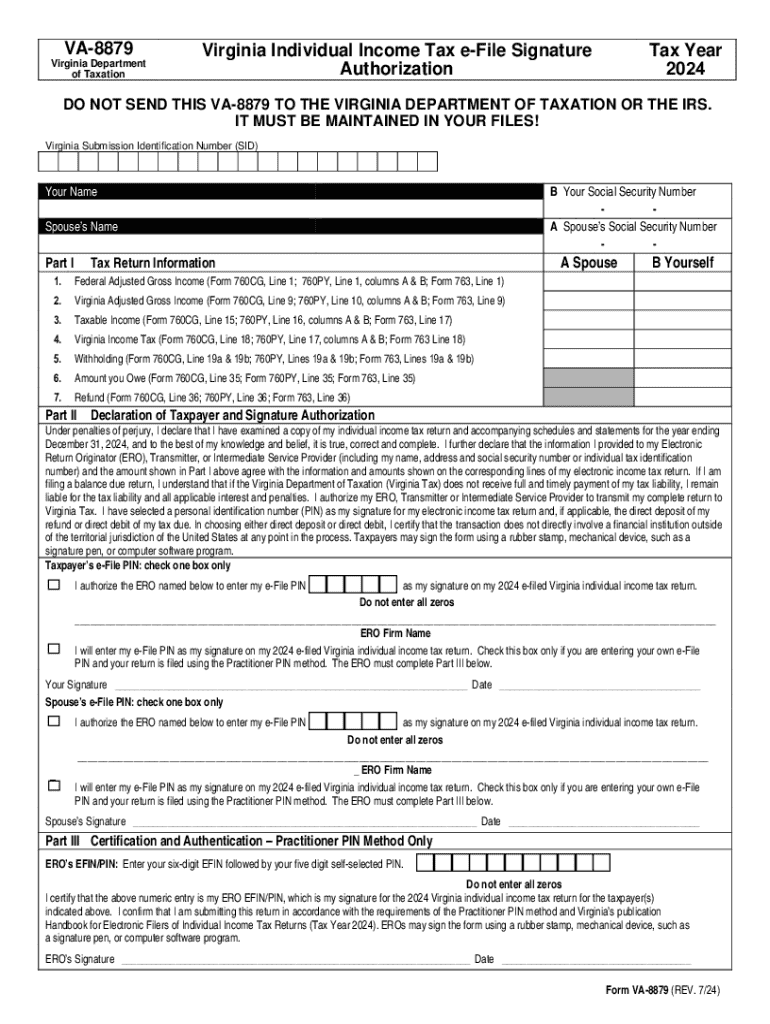

Definition & Meaning

The Virginia Individual Income Tax Declaration for Electronic Filing, often referred to as VA-8879, is a form that authorizes the electronic filing of individual income tax returns in Virginia. This document serves as a binding declaration of the taxpayer's consent to the electronic submission of their tax returns. It confirms the accuracy of the information provided in the tax return and permits the Electronic Return Originator (ERO) to input the taxpayer's personal identification number as a signature.

Steps to Complete the Virginia Individual Income Tax Declaration for Electronic Filing

-

Verify Personal Information: Ensure that your name, Social Security number, and contact details are accurately reflected on the form. This information should match the details on your tax return.

-

Review the Tax Return Summary: Check the figures on your tax return summary to confirm their accuracy. This step is crucial for verifying your income, deductions, and credits before authorizing the electronic filing.

-

Authorize the ERO: Provide consent for your ERO to enter your personal identification number (PIN) as your electronic signature. This consent is necessary for submitting your tax return electronically.

-

Sign and Date the Form: Sign the declaration and include the date. This action confirms your agreement with the information provided and your authorization for the electronic filing process.

-

Retain the Document: Keep a copy of the VA-8879 in your personal records. You are not required to submit it to the Virginia Department of Taxation or the IRS.

Who Typically Uses the Virginia Individual Income Tax Declaration for Electronic Filing

Typically used by individuals filing their state income taxes in Virginia, the VA-8879 form applies to a diverse range of taxpayers:

- Salaried Employees: Employees who receive W-2 forms and file standard state tax returns.

- Self-Employed Individuals: Individuals with 1099 forms who need to declare freelance or independent contractor income.

- Tax Professionals: Accountants or tax consultants submitting returns for clients as authorized EROs.

- Retirees: Individuals claiming pensions or retirement benefits needing to file state returns.

Key Elements of the Virginia Individual Income Tax Declaration for Electronic Filing

- Taxpayer Information: Comprehensive details, including name and Social Security number, must be included.

- Tax Return Summary: Summarized data regarding income, deductions, and tax liabilities.

- PIN Authorization: Specific consent permitting the use of a PIN as an electronic signature by the ERO.

- Signature and Date: The taxpayer must sign and date the form to validate the declaration.

- Record Retention: Guidelines for maintaining a copy of the completed form for personal records.

Legal Use of the Virginia Individual Income Tax Declaration for Electronic Filing

The VA-8879 form is legally binding and adheres to both federal and state regulations concerning electronic tax submissions. By completing the form, taxpayers attest to the authenticity and accuracy of their electronic tax return submissions, and it fulfills legal requirements as per the Electronic Signatures in Global and National Commerce (ESIGN) Act.

Filing Deadlines / Important Dates

- Virginia State Deadline: State income tax returns, along with the VA-8879 form, are generally due by May 1st of each year unless an extension has been granted.

- Federal Alignment: While the VA-8879 is specific to Virginia, it typically aligns with federal deadlines for acknowledgment and preparatory purposes.

Required Documents

To effectively complete the VA-8879, taxpayers should have the following on hand:

- W-2 or 1099 Forms: To verify income details.

- Previous Year’s Tax Return: Useful for cross-referencing income, deductions, and credits.

- Social Security Details: For correct taxpayer identification.

- State-Specific Deductions and Credits Documentation: To ensure all applicable benefits are claimed.

Examples of Using the Virginia Individual Income Tax Declaration for Electronic Filing

- Jane Doe, a full-time employee, uses VA-8879 to authorize her accountant to submit her Virginia state taxes electronically, ensuring her tax refund is processed quickly and efficiently.

- John Smith, a freelance designer, completes the form to validate his electronic tax filing and PIN usage, facilitating hassle-free confirmation of his state return’s accuracy and timely submission.