Definition & Meaning

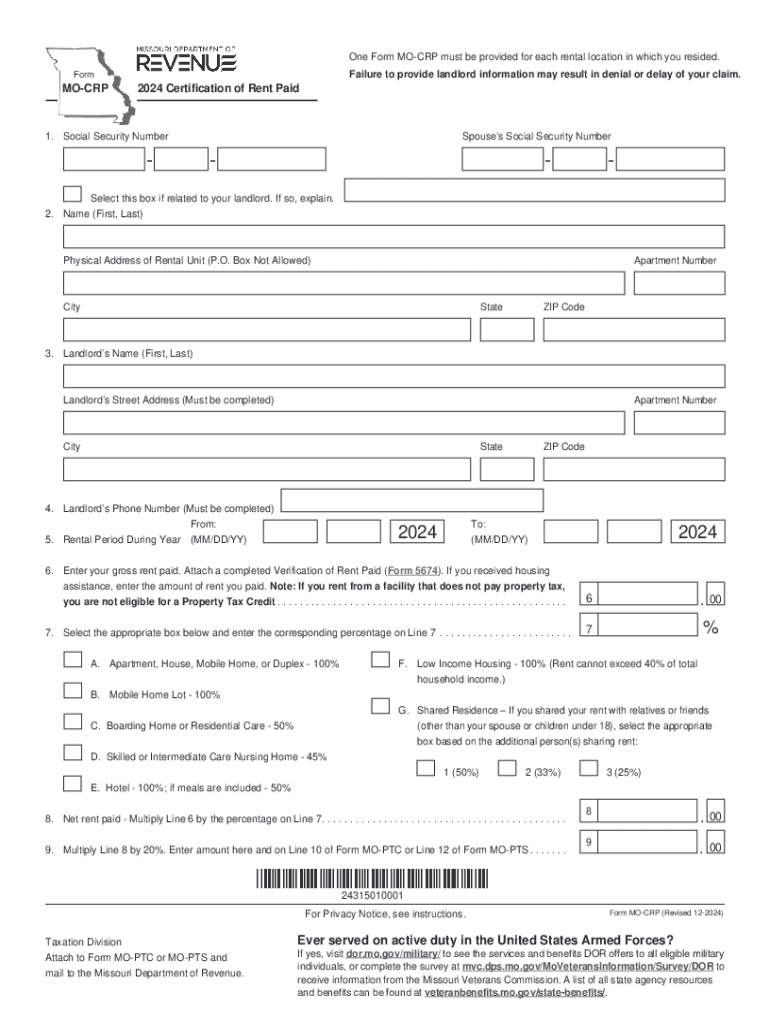

The Missouri Rent Rebate 2019 Form, also recognized as Form MO-CRP, is a crucial document used for the Certification of Rent Paid. Designed to aid Missouri residents, particularly renters, this form allows individuals to claim rent rebates based on the gross rent paid in the year 2019. It serves a dual purpose of collecting necessary personal and rental information while facilitating the eligibility assessment for property tax credits. The form's objective is to provide financial relief to renters who qualify based on specific criteria set forth by the state.

How to Use the Missouri Rent Rebate 2019 Form

To effectively use the Missouri Rent Rebate 2019 Form, individuals must meticulously fill out various sections that capture essential details. Begin by providing personal information such as your name, address, and Social Security number. Next, input details about your landlord, ensuring accuracy for correspondence purposes. The form also requires information about the rental period covered, which should align precisely with the year 2019. Carefully follow the instructions to calculate eligible net rent, which is crucial for determining any potential tax credits. Finally, review the completed form for any errors before submission to avoid processing delays.

Steps to Complete the Missouri Rent Rebate 2019 Form

- Gather Required Information: Collect all relevant personal and landlord information, including rental agreements or payment receipts.

- Start with Personal Details: Enter your full name, Social Security number, and current address.

- Provide Landlord Information: Detail the landlord's name, contact information, and rental property address.

- Enter Rental Period and Amount: Specify the period you resided at the rental property in 2019 and the total rent paid.

- Calculate Gross and Net Rent: Utilize the provided instructions to accurately calculate these amounts.

- Verify and Sign: Double-check all entries for accuracy and sign the form to affirm the correctness of the provided details.

- Submit the Form: Depending on the submission options, prepare to file the form online or via mail as per the specified instructions.

Eligibility Criteria

Eligibility for the Missouri Rent Rebate 2019 Form is contingent upon several factors:

- Residency: Applicants must have rented residential property in Missouri during the entire or part of the year 2019.

- Income Limits: There are income thresholds that determine qualification, which vary based on individual or household financial circumstances.

- Age/Disability: Certain exemptions or conditions apply for senior citizens or individuals with disabilities, influencing eligibility.

- Documentation: Complete documentation of rent paid, typically validated via receipts or lease agreements, must be available to support the claim.

Required Documents

When preparing to submit the Missouri Rent Rebate 2019 Form, ensure you have the following documents ready:

- Proof of Rent Paid: Rental agreements, receipts, or a statement from the landlord confirming rent payment amounts.

- Proof of Identity: Valid identification documents like a driver’s license or state ID.

- Social Security Card: For verification purposes.

- Previous Year’s Tax Returns: Which may be necessary for cross-referencing income and other tax-related information.

- Disability Documentation: If applying under special conditions due to disability.

Form Submission Methods

The Missouri Rent Rebate 2019 Form can be submitted through several channels:

- Online: Accessible through secure platforms such as DocHub, allowing for digital completions and electronic submissions.

- Mail: Traditional postal services can be used to send the filled form to the designated Missouri Department of Revenue address.

- In-Person: Some local offices may accept forms directly, where staff can assist with any questions or concerns during submission.

State-Specific Rules for the Missouri Rent Rebate 2019 Form

The execution and utility of the Missouri Rent Rebate 2019 Form are governed by state-specific rules that applicants must adhere to:

- Deadline Compliance: Know the filing deadline to ensure timely submission and avoid penalties.

- State-Specific Calculations: Calculation methods for rent rebates are defined by Missouri state laws, requiring adherence to official instructions.

- Mandatory Field Completion: Every required field must be completed to prevent the form's rejection due to insufficient data.

Important Terms Related to Missouri Rent Rebate 2019 Form

Understanding relevant terminology is crucial for completing the Missouri Rent Rebate 2019 Form accurately:

- Gross Rent: Total rent paid before any subsidies or adjustments.

- Net Rent: Rent amount after subtracting any applicable deductions or adjustments as specified by the state regulations.

- Rebate: A partial refund provided to qualified renters, diminishing the financial burden of rental expenses.

- Eligibility Thresholds: Income and residency criteria that applicants must meet to qualify for a rent rebate.